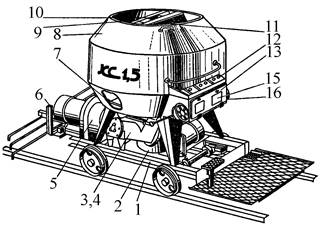

Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

Археология об основании Рима: Новые раскопки проясняют и такой острый дискуссионный вопрос, как дата самого возникновения Рима...

Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

Археология об основании Рима: Новые раскопки проясняют и такой острый дискуссионный вопрос, как дата самого возникновения Рима...

Топ:

Особенности труда и отдыха в условиях низких температур: К работам при низких температурах на открытом воздухе и в не отапливаемых помещениях допускаются лица не моложе 18 лет, прошедшие...

Устройство и оснащение процедурного кабинета: Решающая роль в обеспечении правильного лечения пациентов отводится процедурной медсестре...

Интересное:

Аура как энергетическое поле: многослойную ауру человека можно представить себе подобным...

Распространение рака на другие отдаленные от желудка органы: Характерных симптомов рака желудка не существует. Выраженные симптомы появляются, когда опухоль...

Влияние предпринимательской среды на эффективное функционирование предприятия: Предпринимательская среда – это совокупность внешних и внутренних факторов, оказывающих влияние на функционирование фирмы...

Дисциплины:

|

из

5.00

|

Заказать работу |

Содержание книги

Поиск на нашем сайте

|

|

|

|

Task 1. Read the following text. Then complete the chart using the information from the text. Speak about most tradable currencies using the chart.

U.S. Dollar (USD)

Central Bank: Federal Reserve (Fed)

The Almighty Dollar Created in 1913 by the Federal Reserve Act, the Federal Reserve System (also called the Fed) is the central banking body of the U.S. With the U.S. dollar being on the other side of approximately 90% of all currency transactions, the Fed's sway has a sweeping effect on the valuation of many currencies.

Sometimes referred to as the greenback, the U.S. dollar (USD) is the home denomination of the world's largest economy, the United States. As with any currency, the dollar is supported by economic fundamentals, including gross domestic product, and manufacturing and employment reports. However, the U.S. dollar is also widely influenced by the central bank and any announcements about interest rate policy. The U.S. dollar is a benchmark that trades against other major currencies, especially the euro, Japanese yen and British pound.

European Euro (EUR)

Central Bank: European Central Bank (ECB)

The Dollar's Nemesis In addition to having jurisdiction over monetary policy, the ECB also holds the right to issue banknotes as it sees fit. Similarly to the Federal Reserve, policy makers can interject at times of bank or system failures. The ECB differs from the Fed in an important area: instead of maximizing employment and maintaining stability of long-term interest rates, the ECB works towards a prime principle of price stability, with secondary commitments to general economic policies. As a result, policymakers will turn their focus to consumer inflation in making key interest rate decisions.

Japanese Yen (JPY)

Central Bank: Bank of Japan (BoJ)

Technically Complex, Fundamentally Simple Established as far back as 1882, the Bank of Japan serves as the central bank to the world's second largest economy. It governs monetary policy as well as currency issuance, money market operations and data/economic analysis. The main Monetary Policy Board tends to work toward economic stability, constantly exchanging views with the reigning administration, while simultaneously working toward its own independence and transparency.

British Pound (GBP)

Central Bank: Bank of England (BoE)

The Queen's Currency As the main governing body in the United Kingdom, the Bank of England serves as the monetary equivalent of the Federal Reserve System. In the same fashion, the governing body establishes a committee headed by the governor of the bank. Made up of nine members, the committee includes four external participants (appointed by the Chancellor of Exchequer), a chief economist, director of market operations, committee chief economist and two deputy governors.

Swiss Franc (CHF)

Central Bank: Swiss National Bank (SNB)

A Banker's Currency Different from all other major central banks, the Swiss National Bank is viewed as a governing body with private and public ownership. This belief stems from the fact that the Swiss National Bank is technically a corporation under special regulation. As a result, a little over half of the governing body is owned by the sovereign states of Switzerland. It is this arrangement that emphasizes the economic and financial stability policies dictated by the governing board of the SNB. Smaller than most governing bodies, monetary policy decisions are created by three major bank heads who meet on a quarterly basis.

|

|

Canadian Dollar (CAD)

Central Bank: Bank of Canada (BoC)

The Loonie Established by the Bank of Canada Act of 1934, the Bank of Canada serves as the central bank called upon to "focus on the goals of low and stable inflation, a safe and secure currency, financial stability and the efficient management of government funds and public debt." Acting independently, Canada's central bank draws similarities with the Swiss National Bank because it is sometimes treated as a corporation, with the Ministry of Finance directly holding shares. Despite the proximity of the government's interests, it is the responsibility of the governor to promote price stability at an arm's length from the current administration, while simultaneously considering the government's concerns. With an inflationary benchmark of 2-3%, the BoC has tended to remain a shade more hawkish rather than accommodative when it comes to any deviations in prices.

Australian/New Zealand Dollar (AUD/NZD)

Central Bank: Reserve Bank of Australia / Reserve Bank of New Zealand (RBA/RBNZ)

Always A Carry Favorite Offering one of the higher interest rates in the major global markets, the Reserve Bank of Australia has always upheld price stability and economic strength as cornerstones of its long-term plan. Headed by the governor, the bank's board is made up of six members-at-large, in addition to a deputy governor and a secretary of the Treasury. Together, they work toward to target inflation between 2-3%, while meeting nine times throughout the year. In similar fashion, the Reserve Bank of New Zealand looks to promote inflation targeting, hoping to maintain a foundation for prices.

South African Rand (ZAR)

Central Bank: South African Reserve Bank (SARB)

Emerging Opportunity Previously modeled on the United Kingdom's Bank of England, the South African Reserve Bank stands as the monetary authority when it comes to South Africa. Taking on major responsibilities similar to those of other central banks, the SARB is also known as a creditor in certain situations, a clearing bank and major custodian of gold. Above all else, the central bank is in charge of "the achievement and maintenance of price stability". This also includes intervention in the foreign exchange markets when the situation arises.

Interestingly enough, the South African Reserve Bank remains a wholly owned private entity with more than 600 shareholders that are regulated by owning less than 1% of the total number of outstanding shares. This is to ensure that the interests of the economy precede those of any private individual. To maintain this policy, the governor and 14-member board head the bank's activities and work toward monetary goals. The board meets six times a year.

Conclusion

As financial markets continue to evolve and grow globally, foreign exchange and currencies will play an increasingly large role in day-to-day transactions. As a result, whether a conversion for physical trade or a simple portfolio diversification play, currencies continue to offer more opportunities to both the retail and institutional investor.

|

|

| The central bank’s name | unofficial name of the currency | |

| 1. U.S. Dollar | ||

| 2. European Euro | ||

| 3. Japanese Yen | ||

| 4. British Pound | ||

| 5. Swiss Franc | ||

| 6.Canadian Dollar | ||

| 7. Australian/New Zealand Dollar | ||

| 8. South African Rand |

Unit 7. Check-up.

|

|

|

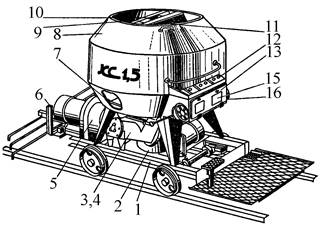

Общие условия выбора системы дренажа: Система дренажа выбирается в зависимости от характера защищаемого...

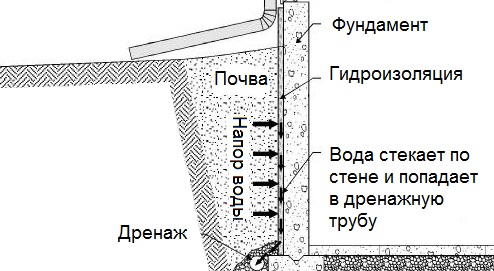

Состав сооружений: решетки и песколовки: Решетки – это первое устройство в схеме очистных сооружений. Они представляют...

Папиллярные узоры пальцев рук - маркер спортивных способностей: дерматоглифические признаки формируются на 3-5 месяце беременности, не изменяются в течение жизни...

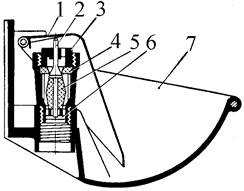

Индивидуальные и групповые автопоилки: для животных. Схемы и конструкции...

© cyberpedia.su 2017-2024 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!