Типы оградительных сооружений в морском порту: По расположению оградительных сооружений в плане различают волноломы, обе оконечности...

Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

Типы оградительных сооружений в морском порту: По расположению оградительных сооружений в плане различают волноломы, обе оконечности...

Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

Топ:

Определение места расположения распределительного центра: Фирма реализует продукцию на рынках сбыта и имеет постоянных поставщиков в разных регионах. Увеличение объема продаж...

Характеристика АТП и сварочно-жестяницкого участка: Транспорт в настоящее время является одной из важнейших отраслей народного хозяйства...

Выпускная квалификационная работа: Основная часть ВКР, как правило, состоит из двух-трех глав, каждая из которых, в свою очередь...

Интересное:

Аура как энергетическое поле: многослойную ауру человека можно представить себе подобным...

Подходы к решению темы фильма: Существует три основных типа исторического фильма, имеющих между собой много общего...

Искусственное повышение поверхности территории: Варианты искусственного повышения поверхности территории необходимо выбирать на основе анализа следующих характеристик защищаемой территории...

Дисциплины:

|

из

5.00

|

Заказать работу |

Содержание книги

Поиск на нашем сайте

|

|

|

|

Preference Shares - Shares in a company which give their holders an entitlement to a fixed dividend but which do not usually carry voting rights. The important difference between preference and ordinary shares are:

The dividend on ordinary shares is uncertain and variable (high when the company does well, poor or non-existent when it does badly). Preference shareholders get a fixed dividend which, if not paid, usually accrues until it can be.

Each ordinary share usually carries a vote. Preference shares do not usually carry a vote unless dividends fall into arrears.

In the event of a winding up, preference shares are usually repayable at par value, and rank above the claims of ordinary shareholders (but behind bank and trade creditors).

Preference shares may be issued with the right of conversion into ordinary shares. These are called convertibles.

Ordinary Shares - Ordinary shares represent the ownership of a limited company. Companies are incorporated with an authorised share capital Ð for instance 1,000 ordinary £1 shares. They do not have to issue all the authorised shares, but can issue as many as they like up to the authorised number. Once issued the shares can be traded either privately or on an exchange if the company has listed them. The price at which they trade will have nothing to do with the par value, but will be determined by market forces. Shares usually come with a right to vote at the companys Annual General Meeting, and an entitlement to a share of dividends declared. They are, however, unsecured, meaning that shareholders are last in the queue if a company goes into liquidation. Known as common stock in the US.

PRACTICAL LESSONS № 12. Exercises № 1. Translate the text:

STOCKS AND SHARES 2. Buying and selling shares. (text №1)

After newly issued shares have been sold (usually by investment banks) for the first time - this is called the primary market - they can be repeatedly traded at the stock exchange on which the company is listed, on what is called the secondary market.Major stock exchanges, such as New York and London, have a lot of requirements about publishing financial information for shareholders. Most companies use over-the-counter (OTC) markets, such as NASDAQ in New York and the Alternative Investment Market (AIM) in London, which have fewer regulations.

Exercises № 2. Translate the text (text №2).The nominal value of a share - the price written on it - is rarely the same as its market price - the price it is currently being traded at on the stock exchange. This can change every minute during trading hours, because it depends on supply and demand - how many sellers and buyers there are. Some stock exchanges have computerized automatic trading systems that match up buyers and sellers. Other markets have market makers: traders in stocks who quote bid (buying) and offer (selling) prices. The spread or difference between these prices is their profit or mark-up. Most customers place their buying and selling orders with a stockbroker: someone who trades with the market makers.

|

|

Exercises № 3. Work with the glossary.

A stockbroker is a regulated professional individual, usually associated with a brokerage firm or broker-dealer, who buys and sells stocks and other securities for both retail and institutional clients, through a stock exchange or over the counter, in return for a fee or commission.

Shareholder -A person or entity that owns shares in a corporation.

Shareholders' Equity -The difference between a company's total assets and total liabilities. Sometimes call net worth or book value, shareholders equity represents the shareholders' ownership of the company. See Price/Book ratio.

Stock -A share in the ownership of a company, representing a proportionate claim to the company's earnings and assets.

Stockholders' Equity -See Shareholder's Equity.

Stock Power -A power of attorney a person the right to transfer ownership of a stock in behalf of the owner.

Stock Splits -The exchange of existing shares for more newly issued shares from the same corporation. Splits do not increase or decrease the capitalization of the company, shareholders equity is simply redistribute over more shares, making the price of each individual share cheaper.

PRACTICAL LESSONS № 13.

|

|

|

Своеобразие русской архитектуры: Основной материал – дерево – быстрота постройки, но недолговечность и необходимость деления...

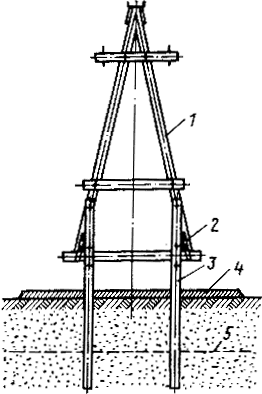

Особенности сооружения опор в сложных условиях: Сооружение ВЛ в районах с суровыми климатическими и тяжелыми геологическими условиями...

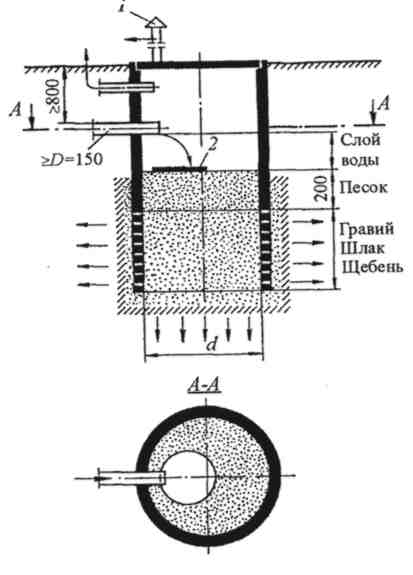

Индивидуальные очистные сооружения: К классу индивидуальных очистных сооружений относят сооружения, пропускная способность которых...

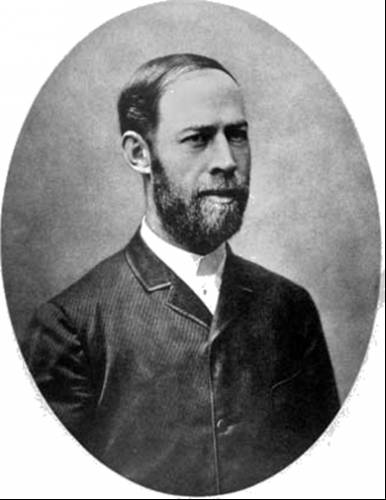

История создания датчика движения: Первый прибор для обнаружения движения был изобретен немецким физиком Генрихом Герцем...

© cyberpedia.su 2017-2024 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!