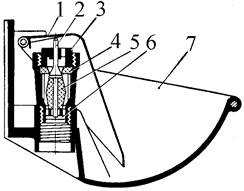

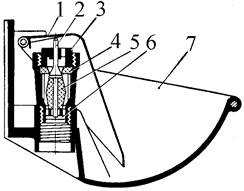

Индивидуальные и групповые автопоилки: для животных. Схемы и конструкции...

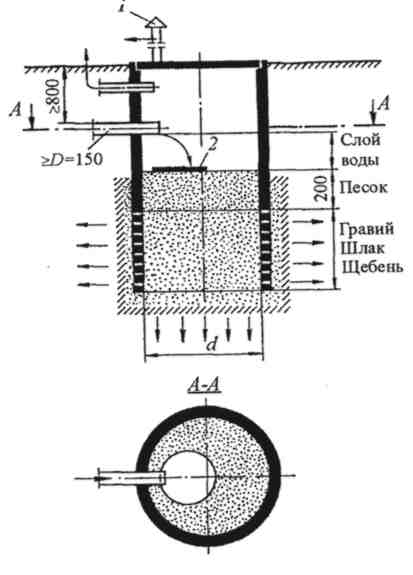

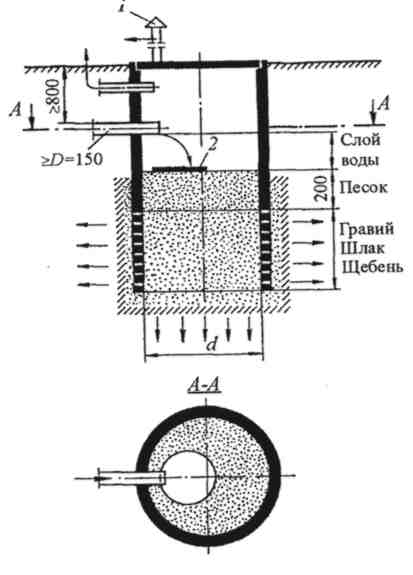

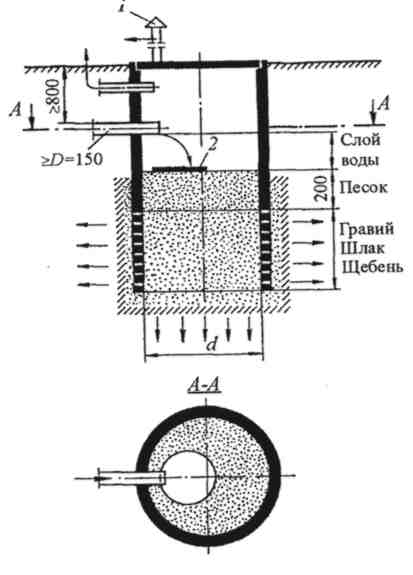

Индивидуальные очистные сооружения: К классу индивидуальных очистных сооружений относят сооружения, пропускная способность которых...

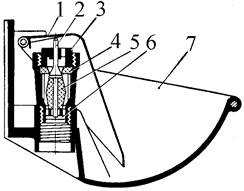

Индивидуальные и групповые автопоилки: для животных. Схемы и конструкции...

Индивидуальные очистные сооружения: К классу индивидуальных очистных сооружений относят сооружения, пропускная способность которых...

Топ:

Проблема типологии научных революций: Глобальные научные революции и типы научной рациональности...

Комплексной системы оценки состояния охраны труда на производственном объекте (КСОТ-П): Цели и задачи Комплексной системы оценки состояния охраны труда и определению факторов рисков по охране труда...

Выпускная квалификационная работа: Основная часть ВКР, как правило, состоит из двух-трех глав, каждая из которых, в свою очередь...

Интересное:

Средства для ингаляционного наркоза: Наркоз наступает в результате вдыхания (ингаляции) средств, которое осуществляют или с помощью маски...

Отражение на счетах бухгалтерского учета процесса приобретения: Процесс заготовления представляет систему экономических событий, включающих приобретение организацией у поставщиков сырья...

Принципы управления денежными потоками: одним из методов контроля за состоянием денежной наличности является...

Дисциплины:

|

из

5.00

|

Заказать работу |

Содержание книги

Поиск на нашем сайте

|

|

|

|

Some of the inefficiency in the use of capital is believed to be due to more basic troubles.

Some farmers may not be capable of using additional capital profitably. Others may not be interested in having a more productive farm business. Their aims in life provide strong enough disincentives to farm expansion. In such cases additional capital is not necessary.

Still another reason for the inefficient use of capital has been found to be associated with the life cycle of the farm family. Traditionally, farms had to be financed by every generation. The young man to start farming had to begin with rather small operation. His business was supposed to grow as he was able to reinvest his returns and borrow additional funds. Often the demands of his family for living expenditures were too high to make any profitable investment in his business. After his children had grown up, it became possible for his farm to approach an optimum size. It continued to grow for a period, but decline was inevitable due to increasing age of the operator.

Much attention has been given to the problem of transferring farms from one generation to the next. Often there existed several heirs, which resulted in fragmenting efficient farm businesses. Even if the land was passed to the son, he had to acquire the necessary capital in order to buy livestock and provide for the living of his family. As a result, no considerable investment in farm business was made. In other cases the young farmer spent several years buying out other heirs.

There is a great difference among farms in solving the transfer problem. The fact remains, however, that at any time, some farms are on their way up and some on the way down. Economists believe capital productivity in agriculture to depend on this fact.

II. Выберите правильный вариант ответа на вопросы к тексту.

1. What is one of the main reasons for inefficient capital investment in farming?

a) low living expenditures

b) life cycle of the farm family

c) farm expansion

2. What age do farmers usually reach an optimum size of their business?

| a) 20 | b) 25 – 30 | c) 45 – 50 |

3. How can heirs solve the farm transfer problem?

a) by purchasing the livestock

b) by buying out other heirs

c) by sharing the land

III. Закончите предложения по содержанию прочитанного текста.

4. Some farmers are not capable of ________.

a) using additional capital profitably

b) running the company

c) forecasting the weather

5. Traditionally farms had to be financed by the _________.

| a) state | b) brokers | c) family |

6. To start farming, the young man had to begin with ________.

| a) rather small investment | b) rather small operation | c) rather big operation |

7. The decline in the farm output is inevitable due to _________.

a) good weather conditions

b) the absence of heirs

c) the old age of the farmer

|

|

8. Firstly, the farmer had to acquire the necessary capital to buy _________.

| a) livestock | b) shares | c) bonds |

IV. Подберите эквивалент к данному русскому слову.

9. капиталовложение

| a) reinvest | b) investment | c) investor |

10. одолженный

| a) borrow | b) borrowing | c) borrowed |

11. прибыльный

| a) profitable | b) profitably | c) profitability |

12. неэффективность

| a) inefficient | b) efficiency | c) inefficiency |

13. отсутствие стимула

| a) incentive | b) insect | c) disincentive |

14. трата

| a)expend | b) expenditure | c) expendable |

15. расширение

| a) expansion | b) expander | c) expensive |

V. Выберите русское предложение, наиболее точно передающее содержание предъявленного.

16. The inefficiency in the use of capital is believed to be due to more basic troubles.

a) Некоторые считают, что неэффективное использование капитала вызвано более вескими причинами.

b) Полагают, что неэффективность использования капитала обусловлена более существенными трудностями.

c) Есть уверенность в том, что неэффективность использования капитала связана с некоторыми затруднениями.

17. This business was supposed to grow as the farmer was able to reinvest his returns and borrow additional funds.

a) Расширение бизнеса предполагалось при условии, когда фермер мог повторно вложить в дело деньги, полученные с дохода, и занять дополнительные суммы.

b) Предполагалось, что бизнес расширялся, когда фермер мог вложить в него деньги, полученные с прибыли, и взять ссуды под высокий процент.

с) Признаком расширения бизнеса являлась возможность кредитования фермера и повторного капиталовложения.

18. Often there existed several heirs, which resulted in fragmenting efficient farm businesses.

a) Фрагментация фермерского хозяйства была обусловлена наличием наследников.

b) Почти всегда появление наследников приводит к разделу фермерского хозяйства.

с) Часто наличие нескольких наследников приводило к дроблению эффективных фермерских хозяйств.

VI. Выберите английское предложение, наиболее точно передающие содержание предъявленного.

19. The young man to start farming had to begin with rather small operation.

a) The young man had to run a small farm as soon as he became the owner.

b) To start farming, the young man had to work a little.

c) As soon as he started farming, the young man couldn’t expand his business because of high living expenditures.

20. The fact remains, however, that any time some farms are on their way up and some are on their way down.

|

|

a) It has been proved that some farms are the richest, some are the poorest.

b) The life proves that sometimes farming might bring not only success and profits, but also losses.

c) The fact is that some farms are located on the top of the hill, some down the hill.

21. There is a great difference among farms in solving transfer problems.

a) Inheritance is the most complicated problem in finding out the farm heir.

b) Farmers try to solve the problem of farm inheritance differently.

c) There is a great difference among farms in experience transfer.

VII. Выберите правильную видовременную форму глагола.

22. No investments _________ in farming last year.

| a) made | b) have been made | c) were made |

23. The government usually _________ funds to provide public programs.

| a) sets up | b) is setting up | c) set up |

24. The plant __________ the production of agricultural machines now.

| a) expands | b) is expanding | c) is expanded |

25. He ___________ money yet.

| a) hasn’t borrowed | b) borrowed | c) didn’t borrow |

26. For many years wheat __________ by farmers.

| a) grew | b) has been grown | c) is grown |

VIII. Заполните пропуски модальными глаголами или их эквивалентами.

27. Next year the manufacturer __________ to reinvest his returns in production.

| a) will be able | b) can | c) must |

28. Last year the farmer __________ to work hard to buy the livestock.

| a) should | b) could | c) had |

29. The owners ___________ pay much attention to the problems of inheritance.

| a) mustn’t | b) should | c) may |

30. The fact is that some farmers __________ use additional capital profitably.

| a) were not able | b) can’t | c) mustn’t |

31. The partner to the contract __________ change the terms stated.

| a) mustn’t | b) needs | c) can’t |

IX. Заполните пропуски прилагательными в нужной форме.

32. This company has achieved __________ results in production than the competitive one.

| a) the best | b) better | c) goodest |

33. Farming should be __________ with new agricultural machines.

| a) less efficient | b) most efficient | c) more efficient |

34. Since the operator’s age greatly increased, the probability of decline in the farm output was ________.

| a) less inevitable | b) more inevitable | c) inevitable |

X. Переведите текст письменно.

The word “economy” is the word we hear or read almost every day. For example, we may be told that “the world economy is in deadlock”, or “European economy is making little progress out of recession”, or “the UK economy is beginning to recover”, or “Scottish economy has held up relatively well during the recent recession”.

But what is meant by “economy”? What is economy? What happens under different economic conditions? How does economy work?

Economy means a system for management, use and control of money, goods and other resources of a country, community or household. The economy comprises millions of people and thousands of firms as well as the government and local authorities. All of them take decisions about prices and wages, what to buy, sell, produce, export, import and many other matters. All these organizations and the decisions taken play a prominent part in creating the business environment in which firms exist and operate.

Контрольная работа №1

по английскому языку для студентов экономических специальностей

по английскому языку для студентов экономических специальностей

заочного отделения

I семестр

Вариант 2

I. Прочитайте и переведите текст (устно).

MIXED ECONOMY

There are three types of management in economies. Economy may be almost totally planned, as it was in the Soviet Union. Economy may be almost totally unplanned, as it is in the USA. Or economy may be a combination of planning and freedom of operation. Examples of the latter are Japan and South Korea.

|

|

In a planned economy the government decides what goods are to be produced and how they are to be marketed. Governments set all the priorities, and the producers are to follow the directions given to them.

In a partially planned economy such as Japanese, the government often encourages industry and helps it with subsidies. The government also makes investments and regulates trade.

The United States is an example of an unplanned economy. But it has a lot of government intervention in economic activity. As the economy of the United States grew, and as the government and its importance increased, the government policy at every level acquired greater importance for the economy.

But the economy of the United States may be called unplanned because the government does not regulate what will be produced and how it will be marketed. These decisions are left to the producers. Even the great amount of government regulation that has emerged since the Great Depression has not turned the economy of the United States into a planned economy.

The name of the American economic system is capitalism. Another name for it is the free market economy.

II. Выберите правильный вариант ответа на вопросы к тексту.

1. Who makes all the decisions about production and consumption in a planned economy?

| a) the government | b) producers | c) managers |

2. Which type does the economy of Japan belong to?

| a) planned economy | b) unplanned economy | c) partially planned economy |

3. How are the resources allocated in the United States of America?

a) entirely through the markets

b) by central planning

c) with a large dose of government intervention

III. Закончите предложения по содержанию прочитанного текста.

4. Economy may be a combination of planning and freedom of operation ________.

a) as it used to be in the Soviet Union

b) as it is in Japan and South Korea

c) as it is in the United States

5. The government of the USA ________.

a) encourages industry and helps it with subsidies

b) decides what goods are to be produced

c) does not regulate what will be produced

6. The producers of a country with a planned economy _________.

a) follow the directions of the government

b) promote goods without any government restrictions

c) decide how the goods are to be marketed

7. A free market economy ________.

a) relies entirely on command

b) has no government intervention

c) is a system of centralized planning

8. Government regulations and restrictions __________.

a) are the same in every country

b) are of no importance in any country

c) differ greatly from country to country

IV. Подберите эквивалент к данному русскому слову или словосочетанию.

9. способы управления

| a) managerial skills | b) types of management | c) management duties |

10. субсидия

| a) subsidy | b) subsidiary | c) subsidize |

11. продавать на рынке

| a) marketing | b) market | c) marketer |

12. экономика

| a) economic | b) economist | c) economy |

13. вкладывать, инвестировать

| a) make investments | b) do investments | c) put investments |

14. управление торговлей

| a) trade regulation | b) regular trade | c) regulate trade |

15. принимать решение

a) decision

b) make a decision

c) be decisive about something

V. Выберите русское предложение, наиболее точно передающее содержание предъявленного.

|

|

16. Governments set all the priorities, and the producers are to follow the directions given to them.

a) Правительства устанавливают приоритет, а производители следуют в заданном им направлении.

b) Правительства устанавливают порядок очередности выполнения задач, а производители обязаны выполнять данные им указания.

c) Правительства устанавливают срочность выполнения задач и выдают последующие инструкции для производителей.

17. As the economy of the United States grew, and as the government and its importance increased, the government policy at every level acquired greater importance for the economy.

a) Экономический рост США и увеличение государственного аппарата в значительной степени определили пути экономического развития страны.

b) Экономический рост Соединенных Штатов придал большую значимость государственной политике на каждом уровне экономического развития.

c) По мере развития экономики Соединенных Штатов и возрастания роли правительства, государственная политика приобрела большую значимость для каждого уровня экономической системы.

18. Even the great amount of government regulation that has emerged since the Great Depression has not turned the economy of the United States into a planned economy.

a) Даже значительная доля правительственного регулирования со времен “Великой Депрессии” не заставила США свернуть с выбранного пути развития.

b) Даже значительное участие правительства в процессе экономического регулирования со времен “Великой Депрессии” не привело экономику Соединенных Штатов к централизованному планированию.

c) Значительное правительственное вмешательство со времен “Великой Депрессии” превратило экономику США в планированную.

VI. Выберите английское предложение, наиболее точно передающее содержание предъявленного.

19. In a planned economy the government decides what goods are to be produced and how they are to be marketed.

a) In a mixed economy the government and market are both of importance.

b) In a planned economy the government allows great individual economic freedom.

c) In a command economy the government regulates production and consumption of goods.

20. An economy may be a combination of planning and freedom of operation.

a) An economy may be a system without any government intervention.

b) Some economic systems may be a sample of the mixed economy, where some industries are owned by the state and others by individuals, who are free to run business.

c) In a mixed economy the government has the power to choose the ways of production and consumption.

21. The decisions are left to the producer in an unplanned economy.

a) If the economy is unplanned, it is the owner but not the government who has the right to decide what will be produced and how it will be distributed.

b) In an unplanned economy the government has the right to regulate production.

c) In an unplanned economy both the government and the manufacturer control production and levels of consumption.

VII. Выберите правильную видовременную форму глагола.

22. Inflation _________ by the rise in prices within a certain period of time.

| a) characterizes | b) characterized | c) is characterized |

23. The number of countries with market economy _______ since the Soviet Union collapsed.

| a) increase | b) increased | c) has increased |

24. The government often ___________ industry and helps it with subsidies.

| a) encourage | b) encourages | c) is encouraged |

25. Some economists suppose the world population ________ 12-13 billion by 2020.

| a) will reach | b) will have reached | c) will have been reached |

26. The famous English economist Alfred Marshall _______ his “Principles of Economics” in 1890.

|

|

| a) wrote | b) will write | c) has written |

VII. Заполните пропуски модальными глаголами или их эквивалентами.

27. Sometimes the government ________ to impose trade barriers to protect domestic producers.

| a) must | b) should | c) has |

28. Students studying economics _________ expect higher earnings than those of students studying philosophy.

| a) can | b) are able | c) are allowed |

29. In a free market economy the individuals ______ to produce goods and services without any government restrictions.

| a) must | b) are allowed | c) may |

30. The enterprise ________ to make high profits if it is managed well.

| a) is able | b) is allowed | c) might |

31. The government _______ not ignore the high unemployment rate.

| a) is | b) has | c) must |

IX. Заполните пропуски прилагательными в нужной форме.

32. The euro rate was ______ than the US dollar rate in 2002.

| a) more high | b) higher | c) the highest |

33. There is much ______ government regulation in present-day Russia than in the former Soviet Union.

| a) less | b) little | c) the least |

34. In this supermarket you can find goods of _______ quality.

| a)more good | b) the most good | c) the best |

X. Переведите текст (письменно).

Economics is a scientific study of the system by which the country’s wealth is made and used. There are various forms of government restrictions and regulations in economies.

Planned or command economy is a system, where the government makes all decisions on what, how and for whom to produce.

Economy in which there is no government intervention is called free market economy. Production and consumption are coordinated through prices.

Mixed economy lies between these two main types where the market and the government are both of importance. Modern economies in the West are mixed and rely mainly on the market, but the general tendency is to keep the government regulation at quite a high level.

The optimal level of the government control remains a problem which is of interest for most economists.

Контрольная работа №1

по английскому языку для студентов экономических специальностей

по английскому языку для студентов экономических специальностей

заочного отделения

I семестр

Вариант 3

I. Прочитайте и переведите текст (устно).

FISCAL POLICY

Fiscal policy is an instrument of demand management, which is used to influence the level of economic activity in an economy through the control of taxation and government expenditure.

The government can use a number of taxation measures to control aggregate demand or spending: direct taxes on individuals (income tax) and companies (corporation tax) can be increased if spending has to be reduced, for example, to control inflation. Spending can also be reduced by increasing indirect taxes: an increase in the VAT (value added tax) on all products or excise duties on particular products such as petrol and cigarettes will result in lower purchasing power.

The government can change its own expenditure to affect spending levels as well: a cut in purchases of products or capital investment by the government can reduce total spending in the economy.

If the government is to increase spending, it creates a budget deficit, reducing taxation and increasing its expenditure.

A decrease in government spending and an increase in taxes (a withdrawal from the circular flow of national income) reduces aggregate demand to avoid inflation. By contrast, an increase in government spending and / or decrease in taxes – an injection into the circular flow of national income stimulates aggregate demand and creates additional jobs to avoid unemployment.

In practice, however, the effectiveness of fiscal policy can be reduced by a number of problems. Taxation rate changes, particularly changes in income tax, take time to make; considerable proportions of government expenditure on, for example, schools, roads, hospitals and defence cannot easily be changed without lengthy political lobbying.

II. Выберите правильный вариант ответа на вопросы к тексту.

1. What is theeffect of reduced aggregate demand in an economy?

| a) decreasing inflation | b) increasing inflation | c) avoiding inflation |

2. How can aggregate demand be reduced?

a) by an increase in taxes

b) by a decrease in government spending

c) by both a decrease in government spending and an increase in taxes

3. How does higher aggregate demand affect government spending?

a) there is an increase in taxes

b) there is a decrease in taxes and an increase in government spending

c) there is a decrease in government spending

III. Закончите предложения по содержанию прочитанного текста.

4. The government can impose a number of taxation measures_________.

a) to increase aggregate demand

b) to decrease aggregate demand or spending

c) to create a budget deficit

5. Spending can also be cut ___________.

a) by raising indirect taxes

b) by decreasing indirect taxes

c) without changing indirect taxes

6. An increase in the value added tax on products will result in__________.

a) unchanged purchasing power

b) higher purchasing power

c) lower purchasing power

7. An injection into the circular flow of national income brings about additional jobs_________.

a) to increase unemployment

b) to prevent unemployment

c) to reduce unemployment

8. Large proportion of government expenditure on defence cannot easily be altered without _______.

| a) voting | b) referendum | c) political lobbying |

IV. Подберите эквивалент к данному русскому слову или словосочетанию.

9. налогообложение

| a)tax | b) taxation | c) tax rate |

10. совокупный спрос

| a) aggregate demand | b) consumer demand | c) primary demand |

11. акцизные сборы

| a)customs duties | b) excise duties | c)registration duties |

12. покупательная способность

| a) earning power | b) water power | c) purchasing power |

13. приводить к чему-либо

| a) result in something | b)follow something | c) avoid something |

14. уменьшать налоги

| a) decrease taxes | b) impose taxes | c) subtract taxes |

15. увеличивать расходы

| a) cut spending | b) increase spending | c)multiply spending |

V. Выберите русское предложение, наиболее точно передающее содержание предъявленного.

16. The government can change its own expenditures to affect spending levels as well: a cut in purchases of products or capital investment by the government can reduce total spending in economy.

а) Правительство может увеличить свои собственные расходы, влияя таким образом на потребительский уровень.

b) Правительство может также изменить расходы, чтобы повлиять на уровень потребления, так как уменьшение объема закупок или правительственных инвестиций может привести к сокращению всеобщего потребления в народном хозяйстве.

c) Сокращение закупок продуктов и капитального инвестирования заставляет государство изменять расходы, которые, в свою очередь, изменяли бы потребительский уровень.

17. By contrast, an increase in government spending and / or decrease in taxes – an injection into the circular flow of national income stimulates aggregate demand and creates additional jobs to avoid unemployment.

a) По контрасту, рост правительственных трат и уменьшение налогов (инъекция в циркуляцию национального дохода) является стимулом для создания дополнительных вакансий.

b) И, наоборот, увеличение правительственных расходов и уменьшение налогов (инжекции в кругооборот национального дохода) стимулирует агрегатные потребности и создает дополнительные специальности, чтобы избежать безработицы.

с) Напротив, увеличение правительственных расходов и / или снижение налогов (денежное вливание в оборот национального дохода) стимулирует совокупный спрос и создает дополнительные рабочие места, что, в свою очередь, позволяет избежать безработицы.

18. Fiscal policy is an instrument of demand management, which is used to influence the level of economic activity in an economy through the control of taxation and government expenditure.

a) Фискальная политика является инструментом управления спросом, используемым для оказания влияния на уровень экономической активности, посредством контроля за системой налогообложения и правительственными расходами.

b) Фискальная политика является средством политического лоббирования в экономике, используемым для влияния на уровень экономической деятельности правительственных ведомств.

с) Фискальная полиция является инструментом управления спросом, средством контроля в системе налогообложения корпоративного бизнеса.

VI. Выберите английское предложение, наиболее точно передающее содержание предъявленного.

19. An increase in the VAT on all products or excise duties on particular products such as petrol or cigarettes will result in lower purchasing power.

a) If the value added tax on certain products such as petrol and cigarettes rise, it will lead to the fall of spending power.

b) An increase in the value added tax on most goods or excise duties on some goods such as petrol and cigarettes is the result of lower purchasing power.

c) A drop in taxes on definite products (e.g. petrol and cigarettes) will lead to lower purchasing power.

20. The government can change its own expenditure to affect spending levels as well.

a) The government is allowed to spend a lot of money.

b) The government must fix its expenses to influence purchasing power.

c) The government is able to review its own expenses to alter the level of consumption.

21. A cut in purchases of products or capital investment by the government can reduce total spending in economy.

a) A decrease in quality of products and capital investment can make the government review total spending in economy.

b) Either a decrease in purchases of products or capital investment by the government might result in lower purchasing power in economy.

c) Only a drop in goods purchased by the government can dramatically change total spending in economy.

VII. Выберите правильную видовременную форму глагола.

22. Fiscal policy _________ to influence the level of economic activity.

| a) uses | b)used | c) is used |

23. Spending can ____________ by increasing taxes.

| a) to reduce | b)be reduced | c) to be reduced |

24. Nowadays taxation rate changes (e.g. income tax changes) _________ time to make.

| a) are taking | b) take | c) are taken |

25. An increase in government spending _________ aggregate demand.

| a) is stimulated | b) stimulates | c) has been stimulated |

26. The government ________ considerably ______ its expenditure over last two years.

| a) is changed | b) to be changed | c) has changed |

VIII. Заполните пропуски модальными глаголами или их эквивалентами.

27. The government _________ use a number of taxation measures to subsidize the social sector.

| a) can | b) has | c) ought |

28. If the government _________ to increase spending, it creates a budget deficit.

| a) should | b) must | c) is |

29. The rise in the VAT on all goods or excise duties on particular products _____ to lead to lower purchasing power.

| a) might | b) is able | c)should |

30. A fall in government spending _________ reduce aggregate demand.

| a) must | b) ought | c) is able |

31. A dramatic increase in government spending _______ to stimulate aggregate demand.

| a) could | b) has | c) must |

IX. Заполните пропуски прилагательными в нужной форме.

32. An increase in the VAT will lead to ________ spending power.

| a) low | b)lower | c) the lowest |

33. An improvement in government spending creates ___________ jobs.

| a) additional | b) more additional | c) the most additional |

34. A significant proportion of government expenditure has been reviewed after the ________ crisis in the country’s history.

| a) worse | b) worst | c) baddest |

X. Переведите текст (письменно).

The central purpose of the tax system in any country is to distribute the cost of financing government activities as fairly as possible among the population. However, fair distribution of taxes is considered to be one that imposes taxes on people in accordance with their ability to pay, as measured by social acceptable index of economic capacity. The personal income tax is the only significant component of the tax system which has at least the potential of being completely “fair”, in the sense that taxes paid by different individuals can be explicitly related to their society determined ability to contribute to the financing of government activity. Only the personal income tax takes explicitly into account those personal characteristics of the taxpayer which are considered the most relevant to his ability to pay.

The essential role of the personal income tax system is thus to treat different people equitably, as equity is defined in the society in question. The ideal is to tax those with the same capacity to pay at the same rate, while levying heavier taxes on those with greater capacity than on those with less capacity.

Контрольная работа №1

по английскому языку для студентов экономических специальностей

по английскому языку для студентов экономических специальностей

заочного отделения

I семестр

Вариант 4

I. Прочитайте и переведите текст (устно).

|

|

|

Историки об Елизавете Петровне: Елизавета попала между двумя встречными культурными течениями, воспитывалась среди новых европейских веяний и преданий...

Индивидуальные и групповые автопоилки: для животных. Схемы и конструкции...

Индивидуальные очистные сооружения: К классу индивидуальных очистных сооружений относят сооружения, пропускная способность которых...

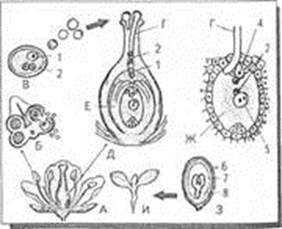

Двойное оплодотворение у цветковых растений: Оплодотворение - это процесс слияния мужской и женской половых клеток с образованием зиготы...

© cyberpedia.su 2017-2024 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!