Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

Наброски и зарисовки растений, плодов, цветов: Освоить конструктивное построение структуры дерева через зарисовки отдельных деревьев, группы деревьев...

Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

Наброски и зарисовки растений, плодов, цветов: Освоить конструктивное построение структуры дерева через зарисовки отдельных деревьев, группы деревьев...

Топ:

Теоретическая значимость работы: Описание теоретической значимости (ценности) результатов исследования должно присутствовать во введении...

История развития методов оптимизации: теорема Куна-Таккера, метод Лагранжа, роль выпуклости в оптимизации...

Выпускная квалификационная работа: Основная часть ВКР, как правило, состоит из двух-трех глав, каждая из которых, в свою очередь...

Интересное:

Уполаживание и террасирование склонов: Если глубина оврага более 5 м необходимо устройство берм. Варианты использования оврагов для градостроительных целей...

Что нужно делать при лейкемии: Прежде всего, необходимо выяснить, не страдаете ли вы каким-либо душевным недугом...

Принципы управления денежными потоками: одним из методов контроля за состоянием денежной наличности является...

Дисциплины:

|

из

5.00

|

Заказать работу |

|

|

|

|

· Balance-of-Payments Position

The exchange rate for any foreign currency depends on a multitude of factors reflecting economic and financial conditions in the country issuing the currency. One of the most important factors is the status of a nation's balance-of-payments position. When a country experiences a deficit in its balance of payments, it becomes a net demander of foreign currencies and is forced to sell substantial amounts of its own currency to pay for imports of goods and services. Therefore, balance-of-payments deficits often lead to price depreciation of a nation's currency relative to the prices of other currencies. For example, during most of the 1970s, 1980s, and into the 1990s, when the United States was experiencing deep balance-of-payments deficits and owed substantial amounts abroad for imported oil, the value of the dollar fell.

· Speculation

Exchange rates also are profoundly affected by speculation over future currency values. Dealers and investors in foreign exchange monitor the currency markets daily, looking for profitable trading opportunities. A currency viewed as temporarily undervalued quickly brings forth buy orders, driving its price higher vis-a-vis other currencies. A currency considered to be overvalued is greeted by a rash of sell orders, depressing its price. Today, the international financial system is so efficient and finely tuned that billions of dollars can flow across national boundaries in a matter of hours in response to speculative fever. These massive unregulated flows can wreak havoc with the plans of policymakers because currency trading affects interest rates and ultimately the entire economy.

· Domestic Economic and Political Conditions

The market for a national currency is, of course, influenced by domestic conditions. Wars, revolutions, the death of a political leader, inflation, recession, and labor strikes have all been observed to have adverse effects on the currency of a nation experiencing these problems. On the other hand, signs of rapid economic growth, improving government finances, rising stock and bond prices, and successful economic policies to control inflation and unemployment usually lead to a stronger currency in the exchange markets.

Inflation has a particularly potent impact on exchange rates, as do differences in real interest rates between nations. When one nation's inflation rate rises relative to others, its currency tends to fall in value. Similarly, a nation that reduces its inflation rate usually experiences a rise in the value of its currency. Moreover, countries with higher real interest rates generally experience an increase in the exchange value of their currencies, and countries with low real interest rates usually face relatively low currency prices.

· Government Intervention

It is known that each national government has its own system or policy of exchange-rate changes. Two of the most important are floating and fixed exchange-rate systems. In the floating system, a nation's monetary authorities, usually the central bank, do not attempt to prevent fundamental changes in the rate of exchange between its own currency and any other currency. In the fixed-rate system, a currency is kept fixed within a narrow range of values relative to some reference (or key) currency by governmental action.

|

|

National policymakers can influence exchange rates directly by buying or selling foreign currency in the market, and indirectly with policy actions that influence the volume of private transactions. A third method of influencing exchange rates is exchange control—i.e., direct control of foreign-exchange transactions.

Intervention of a central bank involves purchases or sales of the national money against a foreign money, most frequently the U.S. dollar. A central bank is obliged to prevent its currency from depreciating below its lower support limit. The central bank should buy its own currency from commercial banks operating in the exchange market and sell them dollars in exchange. These transactions are effectively an open-market sale using dollar demand deposits rather than domestic bonds. Such transactions reduce the central bank's domestic liabilities in the hands of the public. The ability of a foreign central bank to prevent its currency from depreciating depends upon its holdings of dollars, together with dollars that might be obtained by borrowing. Even if a national monetary authority has the foreign exchange necessary for intervention, its need to support its currency in the exchange market might be inconsistent with its efforts to undertake a more expansive monetary policy to achieve its domestic economic objectives.

Also I’d like to say a few words about currency sterilization. A decision by a central bank to intervene in the foreign currency markets will have both currency market and money supply effects unless an operation known as currency sterilization is carried out. Any increase in reserves and deposits that results from a central bank currency purchase can be "sterilized" by using monetary policy tools that absorb reserves. There is currently a great debate among economists as to whether sterilized central bank intervention can significantly affect exchange rates, in either the short term or the long term, with most research studies finding little impact on relative currency prices.

Conclusion

A market in national monies is a necessity in a world of national currencies; this market is the foreign-exchange market. The assets traded in this market are demand deposits denominated in the different currencies. Individuals who wish to buy goods or securities in a foreign country must first obtain that country's currency in the foreign-exchange market. If these individuals pay in their own currency, then the sellers of the goods or securities, use the foreign-exchange market to convert receipts into their own currency.

One from the most important participants of an exchange market is a business bank, which act as the intermediaries between the buyers and sellers. As already it is known they can execute a role speculators and arbitragers.

Most foreign-exchange transactions entail trades involving the U.S. dollar and individual foreign currencies. The exchange rate between any two foreign currencies can be inferred as the ratio of the price of the U.S. dollar in terms of each of their currencies.

The exchange rates are prices that equalize the demand and supply of foreign exchange. In recent years, exchange rates have moved sharply, more sharply than is suggested by the change in the relationship between domestic price level and foreign price level. Exchange rates do not accurately reflect the relationship between the domestic price level and foreign price levels. Rather, exchange rates change so that the anticipated rates of return from holding domestic securities and foreign securities are the same after adjustment for any anticipated change in the exchange rate.

|

|

The major factor influencing to the rate of exchange, is interference of government in the person of central bank in currency policy of the country. The value of a nation's currency in the international markets has long been a source of concern to governments around the world. National pride plays a significant role in this case because a strong currency, avidly sought by traders and investors in the international marketplace, implies the existence of a vigorous and well-managed economy at home. A strong and stable currency encourages investment in the home country, stimulating its economic development. Moreover, changes in currency values affect a nation's balance-of-payments position. A weak and declining currency makes foreign imports more expensive, lowering the standard of living at home. And a nation whose currency is not well regarded in the international marketplace will have difficulty selling its goods and services abroad, giving rise to unemployment at home. This explains why Russia made such strenuous efforts in the early 1990s to make the Russian ruble fully convertible into other global currencies, hoping that ruble convertibility will attract large-scale foreign investment.

Literature used

1. “Money, banking and the economy” T. Mayer, J.S. Duesenberry, R.Z. Aliber

W.W. Norton & company New York, London 1981

2. “Principles of international finance” Daniel R. Kane

Croom Helm 1988

3. “Money and banking” David R. Kamerschen

College Division South-western Publishing Co. 1992

4. “Money and capital markets: the financial system in a increasingly global economy” fifth edition Peter S. Rose

IRWIN 1994

Summary

A market in national monies is a necessity in a world of national currencies; this market is the foreign-exchange market. The assets traded in this market are demand deposits denominated in the different currencies. Individuals who wish to buy goods or securities in a foreign country must first obtain that country's currency in the foreign-exchange market. If these individuals pay in their own currency, then the sellers of the goods or securities, use the foreign-exchange market to convert receipts into their own currency.

One from the most important participants of an exchange market is a business bank, which act as the intermediaries between the buyers and sellers. As already it is known they can execute a role speculators and arbitragers.

The exchange rates are prices that equalize the demand and supply of foreign exchange. In recent years, exchange rates have moved sharply, more sharply than is suggested by the change in the relationship between domestic price level and foreign price level. Exchange rates do not accurately reflect the relationship between the domestic price level and foreign price levels. Rather, exchange rates change so that the anticipated rates of return from holding domestic securities and foreign securities are the same after adjustment for any anticipated change in the exchange rate.

. A strong and stable currency encourages investment in the home country, stimulating its economic development. Moreover, changes in currency values affect a nation's balance-of-payments position. A weak and declining currency makes foreign imports more expensive, lowering the standard of living at home. And a nation whose currency is not well regarded in the international marketplace will have difficulty selling its goods and services abroad, giving rise to unemployment at home. This explains why Russia made such strenuous efforts in the early 1990s to make the Russian ruble fully convertible into other global currencies, hoping that ruble convertibility will attract large-scale foreign investment.

|

|

Dictionary

| english | русский |

| foreign exchange | иностранная валюта |

| market | рынок |

| determining | определение |

| rates | нормы{разряды} |

| trade | торговля |

| payments | платежи |

| currency | валюта |

| domestic | внутренний |

| anticipated | ожидаемый |

| volume | объем{том} |

| involved | вовлеченный |

| explosion | взрыв |

| increasingly | все более и более |

| increase | увеличение |

| purpose | цель |

| negotiation | переговоры |

| participants | участники |

| accomplished | опытный |

| convertible | конвертируемый |

| inflation | инфляция |

| quantity | количество |

| liabilities | долги |

| influence | влияние |

| compose | составить |

| demand | требование{спрос} |

| reciprocals | аналоги |

| denominated | называемый |

| obtain | получить |

| customers | клиенты |

| deregulation | отмена госконтроля |

| mergers | слияния компаний |

| speculators | спекулянты |

| arbitragers | арбитраж |

| response | ответ |

| designates | определяет |

| substantial | существенный |

| distinguish | различить |

| accompanying | сопровождение |

| importer | импортер |

| deposit | депозит{залежь} |

| authorizes | разрешает |

| delivery | поставка |

| examining | исследование |

| resident | житель |

| determinant | детерминант |

| continually | непрерывно{все время} |

| investments | инвестиции |

| experiencing | преодоление |

| profoundly | глубоко |

| affected | затронутый |

| sterilization | стерилизация |

| monetary | денежно-кредитный |

| entail | повлечь за собой |

| strenuous | напряженный |

| convertibility | обратимость |

|

|

|

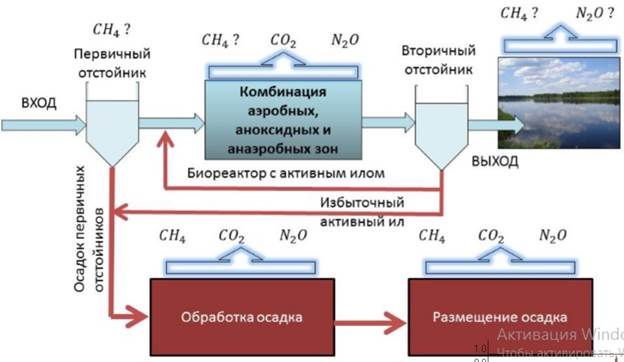

Эмиссия газов от очистных сооружений канализации: В последние годы внимание мирового сообщества сосредоточено на экологических проблемах...

Состав сооружений: решетки и песколовки: Решетки – это первое устройство в схеме очистных сооружений. Они представляют...

Общие условия выбора системы дренажа: Система дренажа выбирается в зависимости от характера защищаемого...

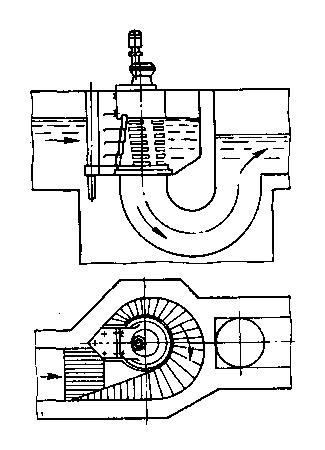

Автоматическое растормаживание колес: Тормозные устройства колес предназначены для уменьшения длины пробега и улучшения маневрирования ВС при...

© cyberpedia.su 2017-2024 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!