Общие условия выбора системы дренажа: Система дренажа выбирается в зависимости от характера защищаемого...

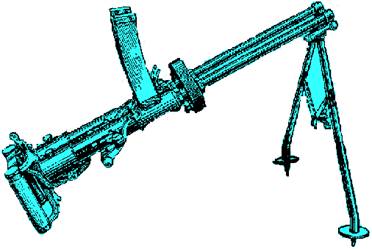

История развития пистолетов-пулеметов: Предпосылкой для возникновения пистолетов-пулеметов послужила давняя тенденция тяготения винтовок...

Общие условия выбора системы дренажа: Система дренажа выбирается в зависимости от характера защищаемого...

История развития пистолетов-пулеметов: Предпосылкой для возникновения пистолетов-пулеметов послужила давняя тенденция тяготения винтовок...

Топ:

Особенности труда и отдыха в условиях низких температур: К работам при низких температурах на открытом воздухе и в не отапливаемых помещениях допускаются лица не моложе 18 лет, прошедшие...

Техника безопасности при работе на пароконвектомате: К обслуживанию пароконвектомата допускаются лица, прошедшие технический минимум по эксплуатации оборудования...

Интересное:

Уполаживание и террасирование склонов: Если глубина оврага более 5 м необходимо устройство берм. Варианты использования оврагов для градостроительных целей...

Что нужно делать при лейкемии: Прежде всего, необходимо выяснить, не страдаете ли вы каким-либо душевным недугом...

Подходы к решению темы фильма: Существует три основных типа исторического фильма, имеющих между собой много общего...

Дисциплины:

|

из

5.00

|

Заказать работу |

|

|

|

|

Real investment refers to the purchase of tangible assets such as land, houses, precious metals, buildings, and equipment. Financial investment, on the other hand, refers to the purchase of "paper" assets, which are collectively called securities. Among these assets are bonds, common stocks, preferred stocks, convertible securities, mutual funds, and short-term money market instruments. While the major emphasis of this book is on financial investments, tangible assets and home ownership as an investment are also analyzed.

INVESTMENT PLANNING

Investment planning begins with the establishment of objectives by the investor, based on personal financial needs, preferences, and constraints. A strategy can then be formulated and a portfolio (or group) of assets can be selected. The first step, then, is to examine some of the elements that determine investment objectives. Investors should ask themselves several questions:

• How much money do I need to live on now?

How much do I need for the fundamental security of life, property, and casualty insurance?

The answers to these questions tell the individual how much income remains that can be used for investing.

• How much in assets do I have available for investment purposes?

Certain types of investments require a substantial amount of cash, such as $100,000 certificates of deposit (CDs) from commercial banks. The more funds one has to invest, the greater the number of options. Nevertheless, even individuals of relatively modest means still have many investment opportunities.

• What are my liquidity requirements?

Liquidity refers to the ability to convert an asset into cash rapidly and with no loss in value of principal. Examples of liquid assets include money market instruments and accounts and a number of types of savings accounts. Individuals require liquid assets in order to pay for anticipated expenditures in the very near future. A down payment for a new car, a vacation, or other major expenses would be financed with such assets. Liquid assets are also needed for unanticipated events, such as emergencies or special purchase opportunities. If one is planning to purchase stocks, real assets, or make some other investment soon, an appropriate level of liquid assets should be available.

• What is my current tax status and how do I expect it to change in the future?

Investors are concerned with after-tax rates of return in deciding which assets to purchase. Those who are in a high tax bracket may prefer securities whose income is exempt from federal taxation even if other securities pay a higher interest rate before taxes. Many investors open Individual Retirement Accounts (IRAs) or establish other tax deferred investment plans. In an IRA account the investor, if qualified, gets tax deductions for contributions, and taxes are not assessed until the future when withdrawals are made. Each individual must decide whether the net benefits of a tax-advantaged investment outweigh the net benefits from alternative investment strategies.

|

|

• What is the purpose of my investment?

The answer to this question involves determining how much income is needed, and when. For example, retirees generally require a safe, steady income from their investments. They tend to hold a high proportion of their assets in Treasury securities or other safe income-producing investments. Younger people who are working are more inclined to invest in stocks that pay little or no dividends but offer the prospect of substantial capital gains.

• What is my tolerance for risk?

Investment opportunities differ in risk and expected return. The notion of investment risk involves the uncertainty of future outcomes, and investors must decide how much such risk they can live with. Investment risk is measured by the volatility or unpredictability of returns. For example, consider three different types of investments: common stocks, corporate bonds, and Treasury bills. In the sixty-year period from 1926 through 1985, common stocks were the most volatile. Bond returns historically have been less so, and Treasury bills have fluctuated the least of the three. Over that same period, the average annual return from common stocks was approximately 12 percent, more than double that of the two alternatives. Thus, in making decisions, investors must recognize that there is a trade-off between expected return and risk.

Even though there is no guarantee that the future will repeat the past, an investor's knowledge of the historical record is important in planning an investment timetable, and in attempting to determine one's tolerance of risk. In the end, only the investor can answer the question of how much risk is acceptable. Some people are perfectly comfortable taking the higher risk of investing in the stock market; others who do so can't sleep at night.

Securities Markets

We can examine securities transactions from several perspectives from the points of view of dealers, brokers, investment bankers, and other participants in securities markets. In this chapter we will also examine characteristics of the markets and some important investment strategies.

|

|

|

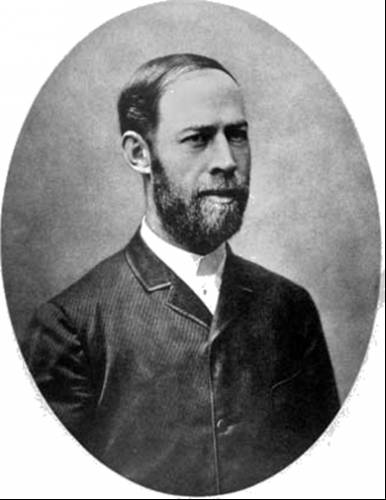

История создания датчика движения: Первый прибор для обнаружения движения был изобретен немецким физиком Генрихом Герцем...

Типы оградительных сооружений в морском порту: По расположению оградительных сооружений в плане различают волноломы, обе оконечности...

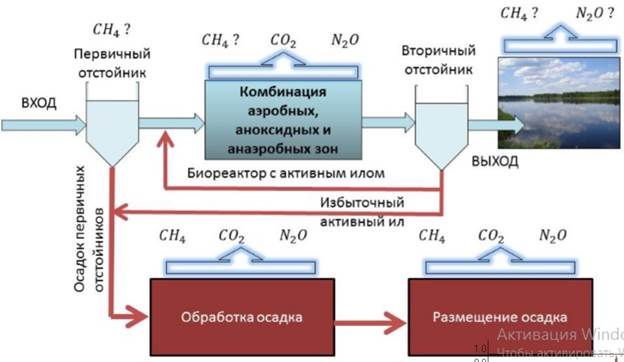

Эмиссия газов от очистных сооружений канализации: В последние годы внимание мирового сообщества сосредоточено на экологических проблемах...

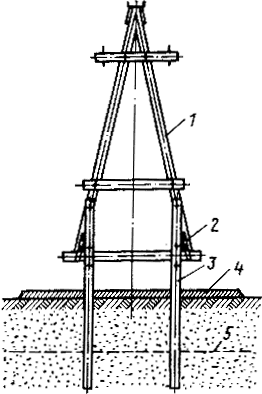

Особенности сооружения опор в сложных условиях: Сооружение ВЛ в районах с суровыми климатическими и тяжелыми геологическими условиями...

© cyberpedia.su 2017-2024 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!