The creation of the Chicago Board Options Exchange (CBOE) in April of 1973 changed the whole picture of the options market and trading in the United States. The innovations introduced by the CBOE made trading in options as easy as trading in stocks. Investors and speculators responded with great enthusiasm. Now options are traded not only on the CBOE but also on the American Exchange, the Philadelphia Exchange, the Midwest Exchange, and the Pacific Exchange. Options traded on exchanges now account for more than 90 percent of the total volume.

The innovations introduced by the CBOE are the following:

1. Standardization of maturity dates. Under the present practice of exchanges, the expiration months are in three-month cycles. Some options expire in January, April, July, and October, while others expire in February, May, August, and November.

2. Standardization of exercise price (or striking price). The exercise price is the price per share at which the holder of the option may purchase the underlying stock upon exercise. Standardization of exercise price is accomplished in the following manner. When trading is introduced in a new expiration month, the exercise price is fixed at a dollar per share figure approximating the market price of the underlying stock. For example, if the market price of XYZ stock is 21 when trading is initiated in XYZ October options, the exercise price would ordinarily be set at 20; if the market price of the underlying stock were 48, the exercise price would ordinarily be set at 50; and if the market price were 107, the exercise price would ordinarily be set at 110. For stocks with prices below $ 200, the interval between exercise prices is usually $ 5 (for some stocks the interval can be $ 2.50). For stocks with prices over $ 200, the interval between exercise prices is $ 10.

3. Range of striking prices. New options are introduced from time to time after substantial price movements on underlying stocks. When significant price movements take place in an underlying stock, additional options with exercise prices reflecting such price movements may be opened for trading. For example, if stock option was first introduced at a striking price of $ 50, and the stock rises to $ 67, a new option will probably be offered at a striking price of $ 70.

4. Central marketplace. CBOE provides a central marketplace for continuous trading in call and put options, both new and old, issued by the Chicago Board.

5. Adjustments to exercise price. Unlike options traded in the over-the-counter market, no adjustment is made by the CBOE to reflect the declaration or payment of ordinary cash dividends as defined in the rules of the exchange. However, in the case of other distributions (stock dividend, stock split, or recapitalization), either the exercise price of options with respect to such stock is reduced by the value per share of the distributed property, or such options are equitably adjusted to include the equivalent property which a holder of the underlying stock would be entitled to receive.

6. Assignment of responsibility. The Options Clearing Corporation is the primary issuer and obliger on every option issued on the CBOE. Ordinarily, whenever a Chicago Board Option is issued to a buyer, there must exist a writer (seller) of this option. However, the holder of an option does not look to any particular writer (seller) for performance; instead, the clearing corporation bears full responsibility for honoring all the options issued on the CBOE.

7. Certificateless trading. Ordinarily no option certificates are issued by the Clearing Corporation to evidence the issuance of Chicago Board Options. Rather, the clearing corporation maintains a daily record of options issued in each account of its clearing members, and each clearing member is required to maintain a continuous record of his respective customers' position in Chicago Board Options. The ownership of Chicago Board Options is evidenced by the confirmations and periodic statements that customers receive from their brokers.

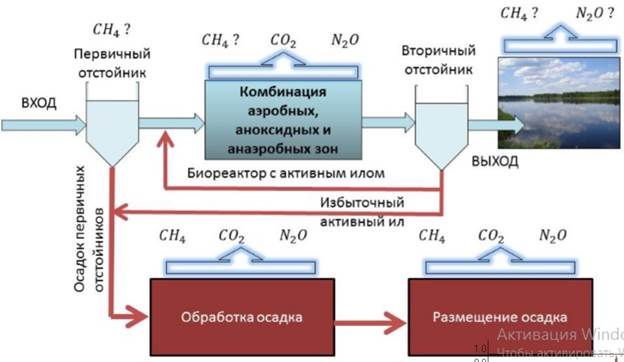

ECOLOGY AND ENVIRONMENT

Since ancient times Nature has served Man being the source of his life. For thousands of years people lived in harmony with environment and it seemed to them that natural riches were unlimited. But with the development of civilization man's interference in nature began to increase.

In the 20th century with the rapid growth of science and technology human achievements in conquering nature became so great that man's economic activities began to produce an increasingly negative effect on the biosphere.

Large cities with thousands of smoky industrial enterprises appear all over the world today. The by-products of their activity pollute the air we breath, the water we drink, the land we grow grain and vegetables. Every year world industry pollutes the atmosphere with about 1000 million tons of dust and other harmful substances. Many cities suffer from smog. Vast forests are cut and burnt in fire. Their disappearance upsets the oxygen balance. As a result some rare species of animals, birds, fish and plants disappear forever, a number of rivers and lakes dry up.

Environmental pollution has become a significant obstacle to economic growth. The discharge of dust and gas into the atmosphere returns to the Earth in the form of "acid rain" and affects crops, the quality of forests, the amount offish. To this we can add the rise of chemicals, radioactivity, noise and other types of pollution.

Economic, social, technological and biological processes have become so interdependent that modem production must be seen as a complex economic system. It is wrong to see economy and ecology as diametrically opposed such an approach inevitably leads to one extreme or the other.

The most horrible ecological disaster befell Belarus and its people as a result of the Chernobyl tragedy in April 1986. About 18 per cent of the territory of Belarus were polluted with radioactive substances. A great damage has been done to the republic's agriculture, forests and people's health. The consequences of this explosion at the atomic power station are tragic for the Belorussian nation.

Environmental protection is a universal concern, that is why serious measures to create a system of ecological security should be taken.

Some progress has already been made in this direction. As many as 159 countries - members of the UNO - have set up environmental protection agencies. To discuss questions of ecologically poor regions including the Aral Sea, the South Urals, Kuzbass, Donbass, Semipalatinsk and Chernobyl. The international environmental research center has been set up on Lake Baikal. The international organization Greenpeace is also doing much to preserve the environment.

But these are only the initial steps and they must be carried forward to protect nature to save life on the planet not only for the sake of the present but also for the future generation.