Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

Историки об Елизавете Петровне: Елизавета попала между двумя встречными культурными течениями, воспитывалась среди новых европейских веяний и преданий...

Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

Историки об Елизавете Петровне: Елизавета попала между двумя встречными культурными течениями, воспитывалась среди новых европейских веяний и преданий...

Топ:

Процедура выполнения команд. Рабочий цикл процессора: Функционирование процессора в основном состоит из повторяющихся рабочих циклов, каждый из которых соответствует...

Основы обеспечения единства измерений: Обеспечение единства измерений - деятельность метрологических служб, направленная на достижение...

Характеристика АТП и сварочно-жестяницкого участка: Транспорт в настоящее время является одной из важнейших отраслей народного...

Интересное:

Принципы управления денежными потоками: одним из методов контроля за состоянием денежной наличности является...

Мероприятия для защиты от морозного пучения грунтов: Инженерная защита от морозного (криогенного) пучения грунтов необходима для легких малоэтажных зданий и других сооружений...

Уполаживание и террасирование склонов: Если глубина оврага более 5 м необходимо устройство берм. Варианты использования оврагов для градостроительных целей...

Дисциплины:

|

из

5.00

|

Заказать работу |

Содержание книги

Поиск на нашем сайте

|

|

|

|

To transfer shares, to sell/buy stock, to make (good) profits, to sustain losses, to tap capital, to raise funds/ capital, to issue bonds, to pay an interest rate, to repay principal, to carry dividends, to forego the chance of, to recover equity, to borrow money, to benefit from, to give up the chance of, to declare dividends, to be entitled to.

1. Now you know the main kinds of securities. Explain the difference between common stock, preferred stock and bonds. What is their role in organisation of the corporation?

2. What shares of what enterprises of your town would you buy? Give your reasons.

3. Your business is going to raise funds by borrowing. What should you do for that? Would you like to be a securities dealer? What should you know to become a dealer?

UNIT V THE SECURITIES MARKET AND REGULATION

Glossary

сash наличные деньги

suffice быть достаточным, хватать

to retail продавать в розницу

at retail в розницу

at wholesale оптом

to issue выпускать

holding вклад, пакет (ценных бумаг)

lack of smth. недостаток, нехватка

to lack smth. испытывать недостаток

to encourage поощрять, поддерживать

pending рассматриваемый,

находящийся на обсуждении

to disclose освещать, раскрывать

claim иск, претензия

to underwrite гарантировать выкуп ценных бумаг

outstanding нереализованный,

выпущенный в обращение

remuneration вознаграждение

transaction сделка

Ex.1 Building your business vocabulary is very important. Some new business terms introduced in this unit are printed below, along with definitions. Please match each with its proper definition after reading the texts of this unit.

a) securities exchange

b) bear market

c) cash dividend

d) securities market

e) bull market

f) brokerage house

g) speculative trading

h) prospectus

1. The millions of people and organization that buy stocks and bonds and the securities intermediaries who bring buyers and sellers together.

2. A cash payment to shareholders.

3. A firm that buys and sells securities on behalf of its investor-clients.

4. An institution set up by brokers at a permanent location for buying and selling securities.

5. A summary of the securities registration statement that is filed with the SEC; it contains information about the firm’s operation and management, the purpose of the proposed issue, and anything else that would be helpful to potential buyers of securities

6. The buying and selling of securities in the hope of profiting from near term changes in their prices.

7. A stock market in which prices are falling, and there is pessimism among speculators.

8. A stock market in which prices are rising and there is much optimism.

Assignments to text 1:

1. Read the text and write down into your notebook the English equivalents for the Russian “потенциальный акционер/покупатель”.

2. Read the first paragraph and try to formulate the main idea, give the subtitle to it.

3. Read the second paragraph, and explain how the main idea of the first paragraph is developed.

4. Look through the 3rd paragraph and explain in what connection non-financial terms “retail” and “wholesale” are used.

5. Translate the text.

Text 1 Investment Banks

When a corporation is established by a small group of investors, the owners merely contribute cash or property to the newly chartered company in exchange for shares of stock. When funds are to be raised from a large number of people, however, this informal arrangement will no longer suffice. The people founding or promoting the corporation do not know who the would-be shareholders are. Nor can the prospective buyer of only a few shares of stock afford to spend time and money hunting for a company in which to invest. Bringing would-be investors and investment opportunity together is the job of the specialized financial institution called an investment bank.

Investment banks are what might be called "retailers" of corporate securities. They take blocks of stocks or bonds from the corporation "at wholesale" and break them into smaller holdings to sell "at retail" to the final owner. The investment bank collects a commission for performing this service. The same procedure is followed when an existing corporation issues new shares to increase its capital by expanding its ownership. Advertisements by investment banks announcing the availability of new issues of securities are often seen in the financial pages of newspapers.

Investment banks help small companies “go public”. That is, they help businesses that want to sell shares of stock to the public. The investment bank must decide whether it will underwrite the new public offering of stock. Underwriting means that the investment bank guarantees to purchase the stock. The investment bank then contacts various brokerage houses. Brokerage houses are firms that buy and sell securities on behalf of their investor-clients. They explain the offering to them. So, investment banks deal with both individuals and brokerage houses.

Thus, an investment bank is a financial institution that does not accept deposits from the general public but instead helps firms sell new issues of stocks and bonds. They also help firms to acquire other firms or to be acquired.

Assignments to text 2:

1. Look through the 1st paragraph and explain what the word combination “blue sky laws” means.

2. Read the second paragraph. Find the word "these" in it; indicate the nouns it stands for.

3. Read the text and prove by the facts that information has a high price.

4. Find and translate the paragraph in which the functions of SEC are described.

5. Read the text once more and say if the securities market is safe in the USA.

Text 2 Securities Regulation

State and federal laws in the USA regulate both the insurance and the trading of securities. At the state level there exist blue-sky laws. Blue-sky laws are state laws that force corporations to give potential investors certain facts about the securities. Their purpose is to prevent corporations from issuing worthless securities to unsuspecting investors (selling them “the blue sky”). At the federal level the Securities Act of 1933 protects the public from interstate sales of fraudulent securities.

The Securities and Exchange Commission. The buyer of a security invests his wealth to become one of the owners of the firm. Yet he is often remote from the actual operation of the company, and may lack the information necessary to make a sound judgement concerning the investment. Frequently all he knows about the company and its prospects is what the management or the investment banker tells him. Since these have special interest in encouraging him to buy the stock, he needs some assurance that he is being told everything he needs to know.

Making sure that perspective stockholders are fully informed is one of the duties of the Securities and Exchange Commission (SEC), a federal agency established by the Securities Exchange Act of 1934. Before a corporation can offer a new issue of securities for sale to the public, it must file a registration statement and a prospectus with the Commission. The registration statement must disclose such matters as “the names of the persons who participate in the management or control of the business; the security holdings and remuneration of such persons; the general character of the business, its capital structure, past history and earnings; underwriters' commissions; payment to promoters made within 2 years or intended to be made; the interests of directors, officers and principal stockholders in material transactions; pending or threatening legal proceedings; the purpose to which the proceeds of the offering are to be applied; and financial statements certified by independent accountants." The prospectus is part of the registration statement and embodies the more important of the required disclosures.

The SEC staff examines the registration statement and prospectus for accuracy and completeness. Unless it is found to be misleading, inaccurate, or incomplete, the registration becomes effective, and the security can be offered for sale.

Assignments to text 3:

1. Read the text.

2. Find the key sentences in every paragraph.

3. Find answers to the following questions.

· What is the function of a stock market?

· What are the main players in a stock market?

· What stock markets are described?

· What is the difference between the two types of the stock market?

4. Identify all the definitions in the text.

5. Find the sentences which explain regulations for stock exchanges.

Text 3 The Stock Market

A stock market consists of brokers, dealers, and organized exchanges whose function is to facilitate the transfer of securities from one private owner to another. The corporation itself is not a party to transactions in its securities on the stock market, nor are stock markets places where corporations raise capital. The function of the stock market is, rather, to provide the easy transferability of ownership that characterizes the corporate form of business organization.

There are two distinct types of stock market. (1) Securities that are less frequently traded are generally bought and sold through the facilities of the over-the-counter market. (2) The organized stock exchange is set up for the purchase and sale of a selected list of securities that are usually traded in large daily volume.

The Over-the-counter Market

Once a stock or bond has been issued, its owner is entitled to sell it to anybody else, at any time, at any price that can be agreed on. The transaction can be completed privately, but most people enlist the services of a specialized middleman. An over-the-counter dealer plays essentially the same role in the securities market that a used car dealer does in the used car market. He buys securities from individual owners for resale to others at slightly higher prices, getting his commission from the difference between the buying and the selling prices. Since over-the-counter dealers are organized into a National Association of Security Dealers, there is a nationwide competitive market. Most securities are unlisted. Quotations of security prices being paid (bid) and charged (asked) by dealers are published in the daily financial pages.

Organized Stock Exchanges

As in any other part of the economic system, greater specialization in securities trading is possible in more extensive markets. Securities that are bought and sold in large volume every day are traded through highly organized special markets called organized stock exchanges.

A stock exchange (or a securities exchange) is an institution set up by brokers at a permanent location for buying and selling securities. The securities bought and sold at these exchanges are called listed securities.

An organized stock exchange is an institution with a limited membership, whose members are permitted to trade securities with each other. Since only members are permitted to conduct business on the exchange, others who want to buy or sell in this way must employ members to act on their behalf.

Trading among members of each exchange is restricted to a special list of securities and the stocks and bonds of corporations not listed on the exchange cannot be bought or sold there. Each exchange has established rules governing which securities can be listed for trading. Among other requirements, securities are listed only if they are traded in sufficient volume to make it worthwhile. In addition, before a security can be listed, it must have been outstanding long enough to have «seasoned». Securities of young companies, for example, are not listed. Moreover, the listed corporation must agree to file certain reports with the SEC (Securities and Exchange Commission).

There is an organized stock exchange in almost every major U.S. city, but most of these are small and limit their lists largely to the securities of local firms. The securities of most large, nationally known corporations are traded on the two large New York exchanges: the New York Stock Exchange and the American Stock Exchange.

The New York Stock Exchange (NYSE) is the most important U.S. Securities exchange and one of the three largest exchanges in the world. The American Stock Exchange (AMEX) is also a national exchange, but it is smaller than NYSE.

Text 4 Learn How to Read a Stock Price Quotation

Stock and Bond prices – the prices of stocks and bonds on the securities exchange and the over-the-counter market are reported in many daily newspapers.

Stock Prices - several important kinds of information are presented in a stock quotation.

1. The stock quotation usually starts with the stock’s 52 week high and low.

2. The stock’s name is then presented in abbreviated form.

3. Next is shown the annual dividend and then the yield (interest rate) the stock is paying.

4. Next is the price earnings ratio and then the total number of shares traded.

5. The next two columns typically show the high and low price on the date shown and the closing price.

Bond Prices are expressed in terms of 100, although most bonds have a par value of $1000.

Stock and Bond prices Averages—lists show the average price of a group of stocks or bonds.

Assignment to text 5:

1. Read the text given in a jumbled order and put the paragraphs in the correct order.

2. How many logical parts can you distinguish?

3. Match the following headings with the parts:

· Don’t make a costly mistake!

· Why are the pyramid schemes dangerous?

· What is a pyramid scheme?

· How does the pyramid work?

Text 5 The Pyramid Scheme.

Don`t make a costly mistake!

- Thousands of Americans have lost millions of dollars participating in pyramid schemes. Many of the victims knew they were gambling (although they didn’t know the odds were rigged against them). Many others, however, thought they were playing for help in starting a small business of their own. These people were fooled by pyramid schemes disguised to look like legitimate businesses.

- In reality, however, the supply of participants is limited, and each new level of participants has less chance of recruiting others and a greater chance of losing money.

- Things you should know about pyramid schemes:

· There are losers. Pyramiding is based on simple mathematics: many losers pay a few winners.

· They are fraudulent. Participants in a pyramid scheme are, consciously or unconsciously, deceiving those they recruit.

· They are illegal.

- To join, you might have to pay anywhere from a small investment to thousands of dollars. For example, $1000 buys a position in one of the boxes on the bottom level. $500 of your money goes to the person in the box directly above you, and the other $500 goes to the person at the top of the pyramid, the promoter. If all the boxes on the chart fill up with participants, the promoter will collect $16000, and you and the others on the bottom level will each be $1000 poorer. When the promoter has been paid off, his box is removed and the second level becomes the top of payoff level. Only then do the two people on the second level begin to profit. To pay off these two, 32 empty boxes are added at the bottom, and the search for new participants continues.

- Of course, the pyramid may collapse long before you reach the top. In order for everyone in a pyramid scheme to profit, there would have to be a never-ending supply of new participants.

- Each time a level rises to the top, a new level must be added to the bottom, each one twice as large as the one before. If enough new participants join, you and the other 15 players in your level may make it to the top. However, in order for you to collect your payoffs, 512 people would have to be recruited, half of them losing $1000 each.

- The purpose of this discussion is to help you avoid falling victim to pyramid schemes, whether simple or disguised. Simple pyramid schemes are similar to chain letters, while disguised pyramids are like wolves in sheep’s clothing, hiding their true nature in order to fool potential investors and evade law enforces. What is a pyramid scheme?

- Pyramid schemes are illegal scams in which large numbers of people at the bottom of the pyramid pay money to a few people at the top. Each new participant pays for the chance to advance to the top and profit from payments of others who might join later.

Discussion:

These are some helpful word-combinations in addition to the glossary that you should translate, memorise, and use while discussing the texts:

to contribute cash, to raise funds, to spend time and money, to make a sound judgement, to collect a commission, to follow a procedure, to examine for accuracy, to take at wholesale, to sell at retail, to perform a service, to disclose information, to lack information, to offer for sale, to become effective, to contact brokerage house (broker), to complete a transaction.

1. Discuss the functions and the role of investment banks.

2. Explain what SEC is and its role in business.

3. Draw a line of comparison between the American securities market and the Russian one.

4. What do you think about the system of securities regulation in the USA and in Russia? Compare the systems.

5. Investigate securities scandals in the USA and Russia. Include in your report the background of each, how the business was organized, for how long the pyramid existed.

For your notes:

|

|

|

Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

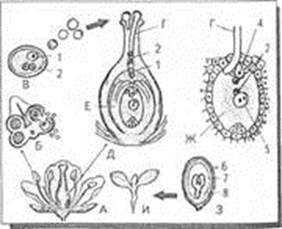

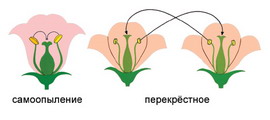

Двойное оплодотворение у цветковых растений: Оплодотворение - это процесс слияния мужской и женской половых клеток с образованием зиготы...

Семя – орган полового размножения и расселения растений: наружи у семян имеется плотный покров – кожура...

Автоматическое растормаживание колес: Тормозные устройства колес предназначены для уменьшения длины пробега и улучшения маневрирования ВС при...

© cyberpedia.su 2017-2026 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!