Индивидуальные и групповые автопоилки: для животных. Схемы и конструкции...

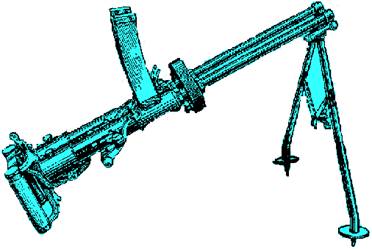

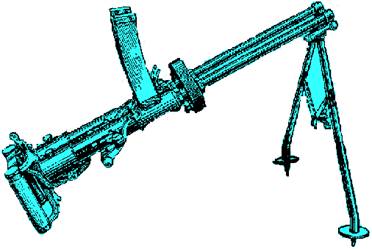

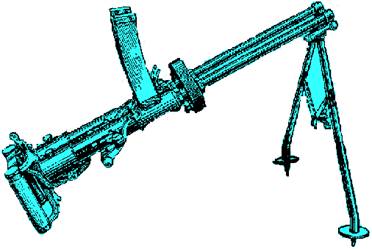

История развития пистолетов-пулеметов: Предпосылкой для возникновения пистолетов-пулеметов послужила давняя тенденция тяготения винтовок...

Индивидуальные и групповые автопоилки: для животных. Схемы и конструкции...

История развития пистолетов-пулеметов: Предпосылкой для возникновения пистолетов-пулеметов послужила давняя тенденция тяготения винтовок...

Топ:

Теоретическая значимость работы: Описание теоретической значимости (ценности) результатов исследования должно присутствовать во введении...

Отражение на счетах бухгалтерского учета процесса приобретения: Процесс заготовления представляет систему экономических событий, включающих приобретение организацией у поставщиков сырья...

Устройство и оснащение процедурного кабинета: Решающая роль в обеспечении правильного лечения пациентов отводится процедурной медсестре...

Интересное:

Инженерная защита территорий, зданий и сооружений от опасных геологических процессов: Изучение оползневых явлений, оценка устойчивости склонов и проектирование противооползневых сооружений — актуальнейшие задачи, стоящие перед отечественными...

Наиболее распространенные виды рака: Раковая опухоль — это самостоятельное новообразование, которое может возникнуть и от повышенного давления...

Финансовый рынок и его значение в управлении денежными потоками на современном этапе: любому предприятию для расширения производства и увеличения прибыли нужны...

Дисциплины:

|

из

5.00

|

Заказать работу |

|

|

|

|

Governments determine the legal framework that sets the basic rules for the ownership of property and the operation of markets. If the legal framework outlaws private ownership of businesses, the economy is socialist; if businesses are owned by individuals and operated for private profit, the economy is capitalist.[1] Even in the most capitalist economies, there are limits to the rights of ownership. Not everyone can own a gun, for instance. Nor are people entirely free to use their property as they please; it is usually illegal to build a factory on land in a residential area.

In addition, governments at all levels regulate economic behaviour, setting detailed rules for the operation of businesses. Regulations include planning permission (how land can be used and where businesses can locate), health and safety regulations, and attempts to prevent some types of business, such as the sale of heroin. Some regulations apply to all businesses; examples include laws against fraud and laws that prohibit competitors from agreeing to fix prices. Some regulations apply only to certain industries, such as requirements that barbers and doctors have appropriate training.

Buy and Sell Goods and Services

Governments buy and produce many goods and services, such as defence, education, parks, and roads, which they provide to firms and households. Most of these goods, such defence and education, are provided to users free of direct charge. Some, such as local bus rides and government publications, are paid for directly by the user.

Governments, like private firms, must decide what to buy and what to produce themselves. For instance, governments typically buy computers but write the programs they need to operate them. In order to do this, governments must act as buyers in the markets for the services of computer programmers.

Governments also produce and sell goods. In some countries, the phone company is government-owned; in most countries, the government owns and operates urban transport such as buses and the underground.

Make Transfer Payments

Governments also make transfer payments, such as social security and unemployment benefits, to individuals. Transfer payments are payments for which no current direct economic service is provided in return. A fireman's salary is not a transfer payment; a social security cheque is, as are unemployment benefits and interest payments on government borrowing.

Government spending is the sum of government purchases of goods and services and transfer payments. Table 3-1 gives a breakdown of government and welfare activity for several countries.

The scale of government activity is much bigger in a country like Sweden than in a country such as the United States.

Table 3-1. Government activity as a percentage of national income in the mid-1980s.

| UK | USA | GERMANY | SWEDEN | |

| Goods and services bought | 24.1 | 19.9 | 21.2 | 30.4 |

| Debt interest | 3.5 | 2.5 | 2.2 | 3.1 |

| Other transfer payments | 19.2 | 14.5 | 20,6 | 30.3 |

| Total spending | 468 | 36.9 | 44.0 | 63.8 |

| Tax revenue | 44.1 | 336 | 42.9 | 60.0 |

| Deficit | 2.7 | 3.3 | 1.1 | 3.8 |

| Source: OECD National Accounts |

Impose Taxes

|

|

Governments pay for the goods they buy and for the transfer payments they make by levying taxes or by borrowing. Taxes raised at national level, such as income tax or VAT, are usually supplemented by local taxes assessed on property values or household size.

Spending, Taxes, and Deficits Table 3-2 shows that the scale of government activity has risen over a long period. For much of this time, governments have been reluctant to meet this extra cost in full by raising taxes. They have run budget deficits financed by borrowing. Budget deficits add to the government's debt. Table 3-3 shows how government debt has changed over the 1980s. Only in the UK has the debt-income ratio fallen during the 1980s.

Table 3-2. Government spending, as percentage of national income.

| 1880 | 1929 | 1960 | 1985 | |

| Japan | 19 | 18 | 33 | |

| USA | 8 | 10 | 28 | 37 |

| Germany | 10 | 31 | 32 | 47 |

| UK | 10 | 24 | 32 | 48 |

| France | 15 | 19 | 35 | 52 |

| Sweden | 6 | 8 | 31 | 65 |

| Source World Bank. World Development Report. 1908 |

Table 3-3. Government debt as a percentage of national income, 1980-89.

| 1980 | 1989 | |

| USA | 37.9 | 51.2 |

| Japan | 52.0 | 65.1 |

| Germany | 32.5 | 43.8 |

| France | 37.3 | 43.8 |

| Italy | 58.5 | 96.7 |

| UK | 54.6 | 40.1 |

| Sweden | 44.8 | 53.0 |

| Netherlands | 45.9 | 82.5 |

| Ireland | 78.0 | 132.2 |

In countries like Italy and Ireland it has now grown to very high levels indeed. In later chapters we shall address several questions. Will government spending continue to increase? Should it? Can government debt be allowed to increase indefinitely?

|

|

|

Своеобразие русской архитектуры: Основной материал – дерево – быстрота постройки, но недолговечность и необходимость деления...

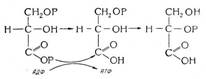

Биохимия спиртового брожения: Основу технологии получения пива составляет спиртовое брожение, - при котором сахар превращается...

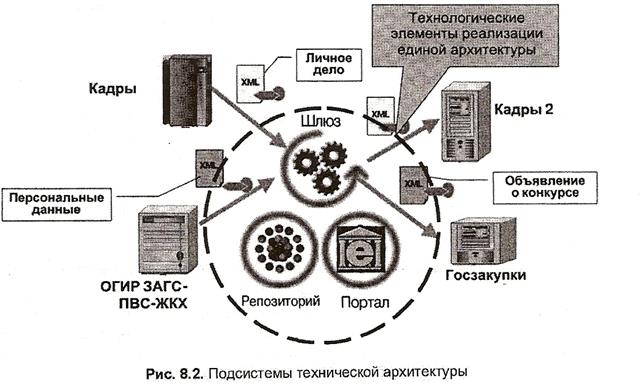

Архитектура электронного правительства: Единая архитектура – это методологический подход при создании системы управления государства, который строится...

История развития пистолетов-пулеметов: Предпосылкой для возникновения пистолетов-пулеметов послужила давняя тенденция тяготения винтовок...

© cyberpedia.su 2017-2024 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!