Семя – орган полового размножения и расселения растений: наружи у семян имеется плотный покров – кожура...

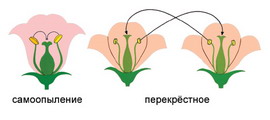

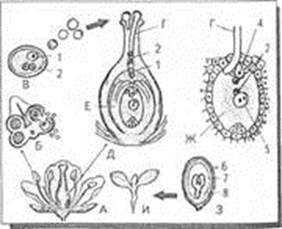

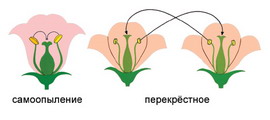

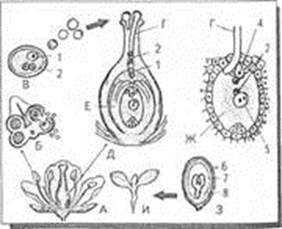

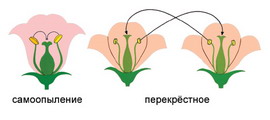

Двойное оплодотворение у цветковых растений: Оплодотворение - это процесс слияния мужской и женской половых клеток с образованием зиготы...

Семя – орган полового размножения и расселения растений: наружи у семян имеется плотный покров – кожура...

Двойное оплодотворение у цветковых растений: Оплодотворение - это процесс слияния мужской и женской половых клеток с образованием зиготы...

Топ:

Марксистская теория происхождения государства: По мнению Маркса и Энгельса, в основе развития общества, происходящих в нем изменений лежит...

Интересное:

Средства для ингаляционного наркоза: Наркоз наступает в результате вдыхания (ингаляции) средств, которое осуществляют или с помощью маски...

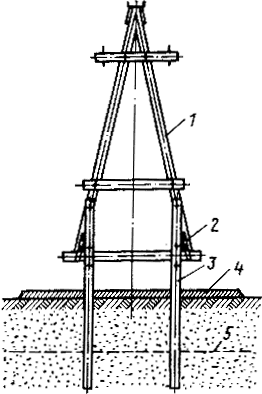

Берегоукрепление оползневых склонов: На прибрежных склонах основной причиной развития оползневых процессов является подмыв водами рек естественных склонов...

Инженерная защита территорий, зданий и сооружений от опасных геологических процессов: Изучение оползневых явлений, оценка устойчивости склонов и проектирование противооползневых сооружений — актуальнейшие задачи, стоящие перед отечественными...

Дисциплины:

|

из

5.00

|

Заказать работу |

Содержание книги

Поиск на нашем сайте

|

|

|

|

Many supposed natural monopolies are the subject of various types of regulation. As described above, under conditions of natural monopoly the market is best served when one firm supplies total market demand. Public interest theory claims to provide an explanation for government intervention in what may be considered a market imperfection. The need to avoid duplication of facilities, particularly fixed costs, would serve as a justification for traditional entry regulation. Consider in this respect the restructuring of the telecom industry in the United States that broke up the Bell system to AT&T, while forbidding Regional Bell Operating Systems to enter the lines of business assigned to AT&T in order to prevent destructive competition.perfect competition prices of goods equal marginal cost, as firms engage in a competitive bidding process. Under conditions of monopoly, the profit - maximizing behavior of the incumbent firm will lead to a higher price charged to consumers and a lower output. It enables the seller to capture much of the value that would otherwise be attained by consumers. Monopoly pricing thus results in a wealth transfer from consumers of a product to the seller. At the higher price, at which the monopolist tries to maximize profits, a group of potential consumers will be excluded as they will not be able to afford the product at the higher (artificially set) price. Thus, monopoly leads to the classic case of the occurrence of dead weight losses: the part of the consumer surplus that the monopolist cannot appropriate but consumers lose.as a result of the monopoly pricing scheme, these consumers may be forced to consume more costly substitutes or less useful products, although society’s resources would be better used producing more of the good provided by the monopoly firm. Furthermore, the argument goes that by limiting output the monopolist underutilizes productive resources.argument of the negative consequences of monopoly on economic welfare has been the subject of heavy debate. This article will not venture into the broad discussion of welfare economics, monopoly and distributive justice (for an introduction, see Tullock, 1967; Rahl, 1967; for case studies on the consequences of monopoly pricing and welfare, Albon, 1988). We can, however, focus on a few of the arguments concerning the case of natural monopoly which challenge the relevance of the alleged allocative inefficiency. The classic opposition to monopoly rents as opposed to everyday rent-seeking by the common man is that monopoly rents are the result of an artificial scarcity rather than a natural scarcity (Schap, 1985).question arises whether the same really can be said about an unregulated natural monopolist. Early on, Posner (1969) rightly noted that market power in the latter case stems from cost and demand characteristics of the market, not from unfair or restrictive practices.condition of natural monopoly raises the question whether internal efficiency, cost minimization by the firm, is achieved under natural monopoly. Does a monopoly firm put its resources to the best possible use within the existing state of technology?antitrust economists have used the term ‘X-Inefficiency’ to indicate the internal wastes that occur when a firm acquires monopoly power and is no longer pressured by strong competitors to keep its costs at the competitive minimum. Often-cited legendary examples are US Steel, General Motors, Sears, IBM and American Airlines. These giant firms, which once dominated their industries, are accused of falling victim to their own inefficiencies (Mueller, 1996). Empirical data suggest that the amount to be gained by increasing X-efficiency is significant (for a review, see Leibenstein, 1966)., in a competitive market firms have an incentive to reduce costs, in order to obtain higher profits by selling at the same price or a price between the old price and the new cost level. Although cost reduction might be shortlived in a competitive situation, as competitors reduce their production costs and adjust their prices to those of their direct competitors, the concern for survival provides a firm in such a market with a strong incentive to minimize costs (Dewey, 1959). If a firm fails to anticipate or match the cost reductions of its competitors, it might suddenly find itself in a market dominated by its competitors. Where there are no significant entry barriers the threat of potential competition will hold price down to cost. Otherwise other firms will enter the market at the same scale of production, sell at a slightly lower price and capture the whole market for as long as it is profitable., it could be argued a monopoly firm has an even stronger incentive to minimize costs in order to gain maximized profits. Since the threat of a counter reaction to its pricing schemes is absent, it does not face the risk that the consequential benefits will only be short-lived.developments have been the drive behind the transformation of certain natural monopoly markets to more competitive outcomes. Most notably, this is the case for the more recent changes in the telecommunications industry, where the enhancement and development of microwave and satellite technology has come to provide a strong substitute for the traditional cable networks. The value of technical development should not be underestimated. Technological progress often reduces production costs or creates new products and has been of enormous importance to economic welfare.classic argument goes that monopoly firms lack an efficient incentive to promote technical change and invest in expensive R&D programs. Allegedly, a monopoly firm would discourage progress. By virtue of its protected position it would not fear that a rival will promote products and production methods and would therefore not be driven to pioneering himself. Real-life observations regarding the introduction of new technology in monopoly firms seem to validate this criticism - witness the long life of equipment in telephone industries. This is often the case, regardless of whether the monopoly firm is conducted as a public or private monopoly (Dewey, 1959). Some empirical data suggests that small, profit-seeking firms are responsible for most major innovations (Scherer, 1984)., there are strong arguments that provide indications that contradict the traditional allegations concerning the case of under-innovation under monopoly.when assuming that a monopoly firm will not introduce new products unless the cost of the new product is less than the marginal cost of the old (as sunk costs are bygones), there is no reason the same could not be said about competitive firms (Fellner, 1951)., an important point has to be made. The fact that an industry is a monopoly does not mean than only one firm is pursuing research and development in its technology. Through the presence of external forces it is likely that the incumbent monopoly firm will feel the pressure to spend time and money on innovation, in order to safeguard its position (Posner, 1969). Certainly in an unregulated market, with free entry, successful research in the field of production methods could seriously threaten the position of natural monopoly firms. Although a natural monopolist is less concerned about survival, the possible threat of the introduction of new technology in substitute markets should provide monopoly firms with a strong incentive to anticipate such developments through R&D expenditure (this relates to the theory of contestable markets, see Section 8).the other end of the spectrum Schumpeter (1950) holds that there is a positive relation between innovation and market power. A monopoly firm would be a strong instead of a poor innovator. Superior access to capital, the ability to pool risks and economies of scale in the maintenance of R&D laboratories are likely to advance industrial technology.of social considerations, government may often feel the need to ensure the provision of certain products or services at a lower-than-cost price to some consumers. For instance, it is quite common that governments demand the provision of ‘universal services’ to consumers by telephone companies, the availability of minimum services at reasonable prices, even to small and distant communities where the small scale of operation may lead to very high costs, which often results in the occurrence of losses.

|

|

|

Историки об Елизавете Петровне: Елизавета попала между двумя встречными культурными течениями, воспитывалась среди новых европейских веяний и преданий...

Особенности сооружения опор в сложных условиях: Сооружение ВЛ в районах с суровыми климатическими и тяжелыми геологическими условиями...

Семя – орган полового размножения и расселения растений: наружи у семян имеется плотный покров – кожура...

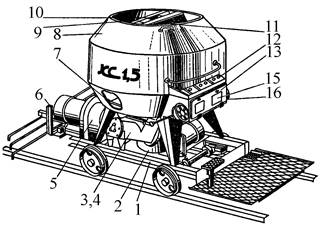

Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

© cyberpedia.su 2017-2025 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!