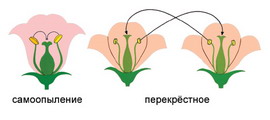

Индивидуальные и групповые автопоилки: для животных. Схемы и конструкции...

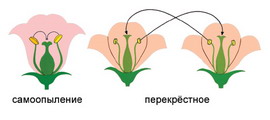

Семя – орган полового размножения и расселения растений: наружи у семян имеется плотный покров – кожура...

Индивидуальные и групповые автопоилки: для животных. Схемы и конструкции...

Семя – орган полового размножения и расселения растений: наружи у семян имеется плотный покров – кожура...

Топ:

Генеалогическое древо Султанов Османской империи: Османские правители, вначале, будучи еще бейлербеями Анатолии, женились на дочерях византийских императоров...

Эволюция кровеносной системы позвоночных животных: Биологическая эволюция – необратимый процесс исторического развития живой природы...

Когда производится ограждение поезда, остановившегося на перегоне: Во всех случаях немедленно должно быть ограждено место препятствия для движения поездов на смежном пути двухпутного...

Интересное:

Искусственное повышение поверхности территории: Варианты искусственного повышения поверхности территории необходимо выбирать на основе анализа следующих характеристик защищаемой территории...

Распространение рака на другие отдаленные от желудка органы: Характерных симптомов рака желудка не существует. Выраженные симптомы появляются, когда опухоль...

Берегоукрепление оползневых склонов: На прибрежных склонах основной причиной развития оползневых процессов является подмыв водами рек естественных склонов...

Дисциплины:

|

из

5.00

|

Заказать работу |

Содержание книги

Поиск на нашем сайте

|

|

|

|

Types of financial markets (by object)

The financial markets can be divided into different subtypes:

1. Capital markets which consist of:

· Stock markets, which provide financing through the issuance of shares or common stock, and enable the subsequent trading thereof.

· Bond markets, which provide financing through the issuance of Bonds, and enable the subsequent trading thereof.

The capital markets consist of primary markets and secondary markets.

2. Commodity markets, which facilitate the trading of commodities.

3. Money markets, which provide short term debt financing and investment.

4. Derivatives markets, which provide instruments for the management of financial risk (futures, options).

5. Insurance markets, which facilitate the redistribution of various risks.

6. Foreign exchange markets, which facilitate the trading of foreign exchange.

Structure of the financial market: Capital market (primary and secondary) and Money market.

Subjects Distinction

· Operating sectors: represented by the businessmen, state, home facilities(economy)

· The intermediaries: banks, insurance companies, funds

(In various conditions each of them can appear as in a role of the creditor, and borrower.)

Infrastructure of the financial market – it is a collection of organizational–legal forms, answering for movement (traffic) of objects of the financial market, collection of institutes, systems, services, firms serving the financial markets and ensuring it normal operation.

Basic elements of an infrastructure of the financial market:

· Exchanges (share, currency), their organizational made out mediating,

· Auctions, as the form organizational unexchangeобмена,

· The credit system and business banks,

· The system of insurance,

· Advertising agencies and mass media,

· The consulting companies,

· Auditor corporations,

· Trade unions working on hiring,

· Information technologies,

· Normative - legal base.

2. Notion, functions, types of financial intermediaries. Financial intermediaries in Russia.

Financial intermediaries are financial institutions and entities which mediate between market participants and financial markets. Institutions such as banks, mutual funds and securities dealers and mortgage firms are examples of financial intermediaries.

Financial intermediaries exist in order to allocate and channel capital more efficiently.

They perform 6 functions in the economy:

1. Asset Transformation, which consists of Diversification, Evaluation and Repackaging.

Diversification is spreading the investment over several stocks to reduce unsystematic risk of an asset. Unsystematic risk we understand the risk connect with the concrete stock. Systematic risk, which is the risk of the economy as a whole cannot be reduced. Diversify investment = to buy the stocks of several firms. You may not have sufficient funds to buy the stocks of many firms. Financial intermediaries like mutual funds provide this service. They sell shares of the mutual fund to small investors and use the money collected to buy the stocks of a large number of firms. Because you own shares of the mutual fund you indirectly derive the benefit of diversification.

Evaluation is the service of expertise and research of stocks provided by intermediaries in order to help investors decide and compensate their lack of expertise and time to research assets.

The borrowing firm usually does not have the information necessary to gather such small deposits; therefore financial intermediaries like banks and mutual funds, pension funds step in and provide the capital which they collected in small amounts from individual investors. Therefore the financial intermediaries have repackaged several small amounts into a big lump sum amount.

2. Production of a medium of exchange. Financial intermediaries create new securities that act as a new asset which serves as a medium of exchange between lenders and borrowers.

3. Act as a conduit between lenders and borrowers.

4. Reduction of Information Asymmetry: Lenders face additional risk as they do not know the whole information about the borrower. Therefore, lenders try to gather as much information on the borrower’s business as possible. Financial intermediaries reduce Asymmetry of information by gathering and selling it to private investors and at the same time protect the leakage of proprietary information of firms.

5. Reduction of Agency Costs: Financial Intermediary may take the responsibility over monitoring of the processes inside the company and controlling of agency costs, which may be caused by the conflict of interest between shareholders and the managers. As managers should improve shareholders’ wealth but tend to improve their own welfare, by using advantages of their positions, such as private jets, etc. as they spend shareholders’ money.

6. Reduction of Transaction Costs: As investors have to rebalance their portfolio to minimize risks and maximize profits, they will face a lot of transactions to make and each of them would incur commissions and other transaction costs. Therefore, if investors would confide their portfolios to intermediaries, they will benefit on economies of scale, as intermediaries save money on large number of transactions and amounts transmitted.

FinancialIntermediariesinRussia: Список видов деятельности в бизнес-справочнике прочего финансового посредничества России: Финансовый лизинг, Предоставление кредита, Предоставление потребительского кредита, Предоставление займов промышленности, etc.

3. Money and capital markets: functions, instruments, indicators.

Money market is the Market for short-term financial instruments with maturity less than one year.

Money market enables participants to borrow or lend liquid assets and therefore meet needs for cash or investment of cash.

Functions of money market:

1. To provide a means whereby economic unitscan quickly adjust through cash positions. For all economic units (business, households financialinstitutions or governments) the timing of cash inflows is rarely perfectly synchronized orpredictable in the short run.Thus, if a unithas access to facilities for short-term lending and borrowing at low transaction costs, then, giventhe same general pattern of cash inflows and outflows, it can operate with a lower average stockof cash. Organized money markets provide obvious advantages to many units such as banks andlarge companies who deal in large sums.

2. Interest rates on money market instruments serve as reference rates for pricing all debtinstruments;

3. Governments or central banks use money market instruments as tools at monetary policy;

4. Short-term interbank markets, finance longer-term lending when financial intermediariestransform maturities.

The participants of the money market are:

the treasury, government securities dealers, commercial banks, non-financial corporations

Money-market instruments:

Treasury bills, Federal funds – funds that are immediately available for lending and borrowing among financial institutions,

Repurchase agreements – agreement between a buyer and a seller to in a sale of a security to reserve the transaction in the future at a specified date and price, Negotiable certificates of deposits – financial instrument issued by a bank documenting a deposit, with principle and interest repayable to a bearer at a specified future date., Commercial papers – unsecured promissory note, issued by corporations, with an original maturity of 270 days and less.

Money market instruments possess qualities which make them useful for wholesale trade:

Liquidity – the ability of the asset to be converted into cash relatively easy and without significant loss in price in the process

Default risk – the risk of non-payment of the principle or interest – it should be minimal for an asset to be considered an investment opportunity for liquidity excess.

Capital market is a market for relatively long-term (with maturity over 1 year) financial instruments, such as bonds and stocks. There is a primary and secondary market.

Functions of capital markets: Corporations secure their financing through capital markets by selling long-term claims on their firms, whether in the form of bonds (liabilities) or stock (equity). Governments go to capital markets for operating funds and capital projects. Households use them mainly for residential mortgage financing.

Capital market will include such components as the stock market, commodities exchanges, the bond market, and just about any physical or virtual facility or medium where debt and equity securities can be bought or sold.

The capital market is an ideal environment for the creation of strategies that can result in raising long-term funds for bond issues or even mortgages.

Types of exchange rate

· Nominal exchange rates are established on currency financial markets called "forex markets", which are similar to stock exchange markets. Real exchange rates are nominal rate corrected by inflation measures.

· Bilateral exchange rates clearly relate to two countries' currencies. Multilateral exchange rates are computed in order to judge the general dynamics of a country's currency toward the rest of the world.

· Some countries impose the existence of more than one exchange rate, depending on the type and the subjects of the transaction. In many countries, beside the official exchange rate, the black market offers foreign currency at another, usually much higher, rate.

Factors of exchange rates

Fixed exchange rates are chosen by central banks and they may turn out to be more or less accepted by financial markets.

Changes in floating will be influenced by three broad categories of determinants:

· Trade balance: Exports, imports and their difference (the trade balance) influence the demand of currency aimed at real transactions. A rising trade surplus will increase the demand for country's currency by foreigners, so that the national currency will appreciate.

· Interest rate (cost of capital): Higher interest rates attract capital from abroad and the currency should appreciate. Decisive would be the difference between domestic and foreign interest rates, thus a reduction in interest rates abroad would have the same effects.

· Inflation rate: high inflation should be accompanied by depreciation (high prices, lower export, and lower demand for currency).

· Demand for exported products

· The business environment: positive indications (in terms of government policy, competitive advantages, market size, etc) increase the demand of the currency, as more and more entities want to invest there.

· Political Factors: All exchange rates are susceptible to political instability and anticipations about the new ruling party.

7. Foreign exchange regulation: purposes and instruments.

The foreign exchange market is the market on which foreign currencies are bought and sold. The Foreign Exchange market, also referred to as the "Forex" or "FX" that market is the largest financial market in the world. FOREX is global decentralized market which virtually operates around the clock. It facilitates the transfer of purchasing power denominated in different currencies. The foreign exchange market is not a physical place/location; rather it is an informal arrangement between large commercial banks and foreign exchange brokers for buying and selling foreign currencies.

Despite the importance of this market foreign exchange remains a largely unregulated business. Although foreign exchange has traditionally been regarded as the exclusive domain of the biggest banks and corporations, recent trends made it important for foreign exchange be regulated.

Transactions in the foreign exchange market can be broadly classified into two types – commercial and speculative. A commercial transaction: is one that is backed by an economic activity, such as payment for an import. A speculative transaction: undertaken purely to make a profit from currency moves. Speculative transactions greatly exceed commercial transactions. Commercial transactions accounted for only 13% of daily total forex volume in 2012.

While regulation in forex markets was virtually non-existent in earlier years, the rapid growth of forex trading among retail investors has led to increasing scrutiny and regulation by bodies such as the Commodity Futures Trading Commission (CFTC).Some of the foreign exchange markets are regulated by governmental and independent supervisory bodies.

For a retail FOREX trader, the biggest risk of non-regulation is that of illegal activity or outright fraud. The objective of regulation is to ensure fair and ethical business behavior. In their turn all foreign exchange brokers and signal sellers have to operate in strict compliance with the rules and standards laid down by the Forex regulators, otherwise their activity is regarded as unlawful.

· Brokers must be registered and licensed in the country where their operations are based, which ensures quality control standards are met.

· Brokers are subject to recurrent audits, reviews and evaluations which force them to maintain the industry standards.

· Foreign exchange brokers must keep a sufficient amount of funds to be able to execute and complete foreign exchange contracts concluded by their clients and also to return clients’ funds intact in case of bankruptcy.

Major principles of forex regulation in Russia:

1. Priority of economic measures in the process of forex market regulations

2. Government should not interfere into the forex market without special need

3. The unity of internal and external currency policy

4. The unity of systems of currency regulations and its control

5. Government must defend the rights of participants of the forex market

Governmentrevenue

Government revenue comes primarily from taxes but includes all amounts of money received from sources outside the government entity. Large governments usually have an agency or department responsible for collecting government revenue from companies and individuals

Taxes -A tax is a financial charge or other levy imposed on an individual or a legal entity by a state or a functional equivalent of a state (for example, tribes, secessionist movements or revolutionary movements). Taxes could also be imposed by a subnational entity. Taxes consist of direct tax or indirect tax, and may be paid in money or as corvée labor

Debt -Governments, like any other legal entity, can take out loans, issue bonds and make financial investments. Government debt is moneyowed by any level of government; either central government, federal government, municipal government or local government.

As the government represents the people, government debt can be seen as an indirect debt of the taxpayers. Government debt can be categorized as internal debt, owed to lenders within the country, and external debt, owed to foreign lenders.

Seigniorage -is the net revenue derived from the issuing of currency. It arises from the difference between the face value of a coin or bank note and the cost of producing, distributing and eventually retiring it from circulation. Seigniorage is an important source of revenue for some national banks.

Public goods

The free rider problem

Бюджетный процесс

В соответствии с Бюджетным кодексом, правительство России вносит на рассмотрение Государственной Думы проект федерального бюджета на очередной финансовый год не позднее 26 августа. Федеральный бюджет разрабатывается в соответствии с положениями ежегодного Бюджетного послания Президента РФ.

Федеральный бюджет рассматривается Госдумой в трёх чтениях (внесены изменения в Кодекс). В первом чтении принимаются основные параметры бюджета.

После принятия федерального бюджета Госдумой он утверждается Советом Федерации и подписывается Президентом РФ.

This division of state funds is because different levels of government have different functions and objectives. Federal functions are more broad ones, for example: Protection of the rights and freedom of citizens; economic, social, cultural and national development; maintenance of national defense system and army; production of public goods; international activities, whereas functions of Subjects of RF have more local character.

The budget reflects what amount of financial resources is necessary for the State and therefore defines the tax policy in the country.

The budget set particular directions of spending budget funds, distributing of the national income and GDP.

The budget fulfils regulative role for economy and has following functions:

· Redistribution of GDP

· State regulation and stimulation of economy

· Budgetary sphere financial maintenance and realization of social policy

· Control over formation and use of the centralized monetary funds.

Revenues of the budget - resources acting in the gratuitous and irrevocable order for the state. Formation of revenues is connected with compulsory withdrawal of parts of GDP created during a social production in favor of the state. Non-tax revenues are formed as a result of economic activities of the state.

There are 5 groups of revenue sources:

1. Tax revenues

2. Non-tax revenues

3. Gratuitous transfers from budges of other levels

4. Revenues from financial activities

5. Revenues from entrepreneurial activities

To fulfill the function of the state the government spends money. There are 2 types of expenditures: current and capital.

· Current - provides current functioning of bodies of the government, local self-management, budgetary establishments, rendering of the state support to other budgets and branches of economy in the form of grants of subventions, grants..

· Capital - connected with realization of investments, the organizations, establishments. Construction, reconstruction, purchase of the equipment. Capital charges lead to creation of new property.

Expenditures provide realization of social and economic policy. The priorities of these policy is provided by corresponding distribution of funds.

15. International financial organizations: role, activities.

IMF – International Monetary Fund – responsible stability of ex-rates.

IBRD – International Bank of Construction and Development – financing of projects using financial instruments.

EBRD – European Bank for Reconstruction and Development – creation of common transportation nets, small businesses, medium business.

BIS – Bank for International Settlements (BASEL) – Creates Standards – for development of an overall market economy.

IMF - The International Monetary Fund was created in 1945 in Bretton Woods to help promote the health of the world economy. Headquartered in Washington DC, it is governed by and accountable to the governments of the 185 countries.

Responsibilities:

• promoting international monetary cooperation;

• facilitating the expansion and balanced growth of international trade;

• promoting exchange stability;

• assisting in the establishment of a multilateral system of payments; and

• making its resources available (under adequate safeguards) to members experiencing balance of payments difficulties.

IMF is responsible for ensuring the stability of the international monetary and financial system—the system of international payments and exchange rates among national currencies that enables trade to take place between countries. The Fund seeks to promote economic stability and prevent crises; to help resolve crises when they do occur; and to promote growth and alleviate poverty. It employs three main functions —surveillance, technical assistance, and lending—to meet these objectives.

Main Sources of financing:

• Quotas. Quota subscriptions generate most of the IMF's financial resources. Each member country of the IMF is assigned a quota, based broadly on its relative size in the world economy.

• Gold holdings. The IMF's gold holdings are worth about $103 billion as of end-March 2008 – 3rd largest holder.

• Lending and borrowing

IBRD - Founded in 1944 to help Europe recover from World War II, IBRD is one of five institutions that make up the World Bank Group. It works with middle-income and creditworthy poorer countries to promote job-creating growth, reduce poverty. 185 member countries. Work closely with IMF and other international institutions.

• supports long-term human and social development needs that private creditors do not finance;

• provides financial support (in the form of grants) in normal and crisis periods, which is when poor people are most adversely affected;

• uses the leverage of financing to promote key policy and institutional reforms (such as safety net or anticorruption reforms);

• creates a favorable investment climate

EBRD - The European Bank for Reconstruction and Development was established in 1991. Today the EBRD uses the tools of investment to help build market economies and democracies in countries from central Europe to central Asia. It is owned by 61 countries and two intergovernmental institutions. it invests mainly in private enterprises, usually together with commercial partners. It provides project financing for banks, industries and businesses, both new ventures and investments in existing companies.

Through its investments, the EBRD promotes

• Structural and sectoral reforms

• Competition, privatization and entrepreneurship

• Stronger financial institutions and legal systems

• Infrastructure development needed to support the private sector

• Adoption of strong corporate governance, including environmental sensitivity

BIS is an international organization which fosters international monetary and financial cooperation and serves as a bank for central banks. Established on 17 May 1930, the BIS is the world's oldest international financial organization. Its customers are central banks and international organizations. The BIS acts as:

• a forum to promote discussion and policy analysis among central banks and within the international financial community

• a centre for economic and monetary research

• a prime counterparty for central banks in their financial transactions

• agent or trustee in connection with international financial operations

16. Forms of state and municipal borrowings.

Government Debt Securities:

· Treasury Bills - are treasury securities having a maturity period of one year or less and sold in the primary market by auction at a discount from face value. Upon maturity the face value will be paid to the holder.

· Government Bonds - are debt securities issued by the government, having a maturity period of one year or longer. The primarily objectives are to finance the budget deficit in each fiscal year or when the expenditures exceed the revenue, to support social and economic development and to restructure public debt. Interest payments of government bonds are made at regular intervals throughout the life of the bonds, normally twice a year. Upon maturity, the principal of face value will be paid along with the last interest payment.

· Government Savings Bonds - are debt securities sold, as an investment or savings alternative, to individuals and non-profit institutions such as foundations, the Thai Red Cross Society, and the National Council on Social Welfare of Thailand.

Municipal bond (or muni) is a bond issued by a state, city or other local government, or their agencies. Potential issuers of municipal bonds include cities, counties, redevelopment agencies, school districts, publicly owned airports and seaports, and any other governmental entity (or group of governments) below the state level. Municipal bonds may be general obligations of the issuer or secured by specified revenues. Interest income received by holders of municipal bonds is often exempt from the federal income tax and from the income tax of the state in which they are issued, although municipal bonds issued for certain purposes may not be tax exempt.Bonds bear interest at either a fixed or variable rate of interest.

TYPES:

• General obligation bonds promise to repay based on the full faith and credit of the issuer; these bonds are typically considered the most secure type of municipal bond, and therefore carry the lowest interest rate.

• Revenue bonds promise repayment from a specified stream of future income, such as income generated by a water utility from payments by customers.

• Assessment bonds promise repayment based on property tax assessments of properties located within the issuer's boundaries.

17. Inter-budgetary relations in the Russian Federation.

Межбюджетные отношения — это отношения между органами государственной власти РФ, субъектов РФ и местного самоуправления. Они строятся на следующих принципах:

· сбалансированность интересов всех участников межбюджетных отношений;

· самостоятельность бюджетов всех уровней;

· объективное перераспределение средств между бюджетами для выравнивания уровня бюджетной обеспеченности регионов и муниципальных образований;

· единство бюджетной системы;

· равенство всех бюджетов РФ.

Межбюджетные отношения регулируются. Бюджетное регулирование — это процесс распределения доходов и перераспределения средств между бюджетами разных уровней в целях выравнивания доходной части бюджетов, осуществляемый с учетом государственных минимальных социальных стандартов.

Бюджетный кодекс РФ четко разграничил доходы и расходы по бюджетам различных уровней.

Доходы бюджетов можно разделить на две группы:

• собственные доходы бюджетов — доходы, закрепленные на постоянной основе полностью или частично за соответствующими бюджетами;

• регулирующие доход — федеральные и региональные налоги и платежи, по которым устанавливаются нормативы отчислений в процентах в бюджеты субъектов РФ или местные бюджеты на очередной финансовый год.

Одним из методов бюджетного регулирования является оказание прямой финансовой помощи из вышестоящего бюджета нижестоящему. Формы оказания прямой финансовой поддержки: субвенции, дотации, субсидии, кредиты, ссуды.

Субвенция — фиксированный объем государственных средств, выделяемых на безвозмездной и безвозвратной основе для целевого финансирования расходов бюджетов. Субвенция имеет две особенности. Во-первых, она используется в течение оговоренного срока, при просрочке субвенция подлежит возврату предоставившему ее органу. Во-вторых, ее используют для выполнения конкретных целей.

Дотация выдается, когда регулирующих доходов недостаточно для покрытия текущих расходов.

Субсидия — бюджетные средства, предоставляемые бюджету другого уровня, физическому или юридическому лицу.

Бюджетный кредит — форма финансирования бюджетных расходов, которая предусматривает предоставление средств юридическим лицам на возвратной и возмездной основе.

Бюджетная ссуда — бюджетные средства, предоставляемые другому бюджету на возвратной, безвозмездной или возмездной основе на срок не более 6 месяцев в пределах финансового года.

В 1994 г. в России был введен новый механизм межбюджетных отношений. Был создан Федеральный фонд поддержки регионов (ФФПР) за счет отчислений части НДС, поступающей в федеральный бюджет. Регионы получают из этого фонда трансферты. Регионы делились на три группы, с выделением нуждающихся и особо нуждающихся регионов.

1 8. Derivative financial instruments.

Futures = standardized contracts (what assers, quantity, etc) => traded on stock exchange

Forwards = non-standardized future contract

SWAP = exchange of 2 possible cash flows

Options = (CALL, PUT). US Option – at any moment, European Option – at a particular date.

A derivative instrument (or simply derivative) is a financial instrument which derives its value from the value of some other financial instrument or variable.Derivatives can be based on different types of assets such as commodities, equities (stocks), bonds, interest rates, exchange rates, or indexes (such as a stock market index, consumer price index, etc.) Performance of these indices can determine both the amount and the timing of the pay-offs.

The main use of derivative contracts is to reduce risk for one party or for both parties entering a derivative contract. Derivatives are an efficient and universal means of risk-minimization and effective resource allocation. They help to reduce practically all kinds of financial risk s:

However, the practice shows that they are also widely used for speculative trading. Speculators may trade with other speculators as well as with hedgers. In most financial derivatives markets, the value of speculative trading is far higher than the value of hedge trading used for risk minimization purposes.

Deposits

To carry out their extensive lending and investing operations, banks draw on a wide variety of deposit and nondeposit sources of funds. The bulk of commercial bank funds— about three fourths of the total—comes from deposits. There are three main types of deposits. Demand deposits, more commonly known as checking accounts, are the principal means of making payments because they are safer than cash and widely accepted. Savings deposits generally are in small dollar amounts; they bear a relatively low interest rate but may be withdrawn by the depositor with no notice. Time deposits carry a fixed maturity and offer the highest interest rates a bank can pay. Time deposits may be divided into nonnegotiable certificates of deposit (CDs), which are usually small, consumer-type accounts, and negotiable CDs that may be traded in the open market in million-dollar amounts and are purchased mainly by corporations.

Moreover, the cost of attracting customer funds has been further increased in recent years by the tendency of bankers to expand their services in an effort to offer their customers "one-stop" financial convenience. Thus, to retain old deposits and attract new ones, many banks have developed or are working through franchise agreements to offer (1) security brokerage services so that customers can purchase stocks and bonds and pay by charging their deposit accounts; (2) insurance counters to make life, health, and property-casualty insurance coverage available (usually through joint ventures with cooperating nonbank firms); (3) networking agreements with other banks so that customers can access their deposit accounts while traveling; (4) account relocation services and real estate brokerage of homes and other properties for customers who move; (5) financial and tax counseling centers to aid customers with important personal and business decisions; and (6) merchant banking services that aid major corporations with mergers and long-term financing requirements. Bankers are also pushing Congress and the regulatory agencies-for broad permission to offer investment banking services—purchasing corporate securities issued by their business customers and reselling them to investors. These new services may have opened up new markets for banks, but they have also created new complexities for bank management and demanded greater efficiency and more effective marketing techniques.

Currency Risk

Conducting business internationally forces companies to become familiar with the currency exchange rates. Companies choosing to operate business locations on foreign soil typically use foreign currency when purchasing materials and hiring workers at the local facility. Start-up capital may come from the company's domestic operations prior to the company exchanges it for foreign currency. If the U.S. dollar is stronger than the value of the foreign currency, it will require more foreign currency to equal the value in U.S. dollars. Conversely, if the U.S. dollar is weaker than the foreign currency, gaining an equal-value currency exchange will require more dollars. Exchange rates may affect profits made in a foreign country when companies transfer foreign currency to their U.S. headquarters.

Political Risk

U.S. companies might hesitate when conducting business internationally since foreign countries may be less stable politically and economically. Situations such as political unrest, military coups, dictatorships and anti-business groups can create difficult banking environments in foreign countries. These political issues can make forecasting difficult because U.S. companies tend to lack familiarity with violent political upheaval. Business-friendly countries might create unfavourable banking conditions or institute tougher banking regulations to restrict foreign companies from dominating their local business market.

Accounting Risk

U.S. companies are required to follow Generally Accepted Accounting Principle (GAAP) when recording and reporting financial information from business activities located outside the United States. Publicly held companies face close scrutiny by regulators because companies may use foreign business operations to hide profits or losses. While these abuses might improve a company's domestic financial statements, external audits will uncover these discrepancies and report the improprieties to outside stakeholders. International banks may also be required to disclose which U.S. companies use their banking and investing services. Foreign countries usually require the reporting of financial information according to international financial accounting standards. These requirements mean U.S. companies must convert their GAAP-prepared statements to international standards or keep a separate international accounting ledger for their foreign operations. Either situation creates a lengthy and expensive process for the company's accounting process.

Types of Loans

· Secured

A secured loan is a loan in which the borrower pledges some asset (e.g. a car or property) as collateral for the loan.

A mortgage loan is a very common type of debt instrument, used by many individuals to purchase housing.

· Unsecured

Unsecured loans are monetary loans that are not secured against the borrowers assets.

ü personal loans, bank overdrafts, corporate bonds

One of the forms of credit is personal loans. The purpose of this credit is to grant the money or the goods to the people with agreement to pay them back in some particular period of time.

Loans

The principal business of commercial hanks is to make loans to qualified borrowers. Loans are among the highest yielding assets a bank can add to its portfolio, and they provide the largest portion of operating revenue.

Historically, commercial banks have preferred to make short-term loans to businesses, principally to support purchases of inventory.

Probably the most dynamic area in bank lending today is home equity loans. Home equity loans can be used to finance a college education or to pay down other debts, or they can be used for a variety of needs not related to housing.

Loans.

Business loans.

Banks regard such loans as high-priority items. More than half of all demand deposits in commercial banks are held by firms.Other types of loans which are quite important quantitatively include real estate loans and loans to individuals. Real estate loans consist of long-term mortgages on residential properties, farms, and business properties. Banks employ several arrangements to grant loans to individuals, commonly known as consumer loans. Banks may lend directly to consumers.

Other types of loans granted by banks include loans to financial institutions, loans to dealers, brokers, and individuals to purchase and/or carry securities, loans to farmers.

Assets

Current assets

inventories, accounts receivable,cash and cash equivalents

Long-term assets

1. property, plant and equipment

2. investment property, such as real estate held for investment purposes

3. intangible assets

4. financial assets (excluding investments accounted for using the equity method, accounts receivables, and cash and cash equivalents)

6. biological assets, which are living plants or animals. Bearer biological assets are plants or animals which bear agricultural produce for harvest, such as apple trees grown to produce apples and sheep raised to produce wool.

Liabilities

1. accounts payable

2. provisions for warranties or court decisions

3. financial liabilities (excluding provisions and accounts payable), such as promissory notes and corporate bonds

4. liabilities and assets for current tax

5. deferred tax liabilities and deferred tax assets

6. minority interest in equity

7. issued capital and reserves attributable to equity holders of the parent company

Equity

The net assets shown by the balance sheet equals the third part of the balance sheet, which is known as the shareholders' equity.

1. numbers of shares authorised, issued and fully paid, and issued but not fully paid

2. par value of shares

3. reconciliation of shares outstanding at the beginning and the end of the period

4. description of rights, preferences, and restrictions of shares

5. treasury shares, including shares held by subsidiaries and associates

6. shares reserved for issuance under options and contracts

7. a description of the nature and purpose of each reserve within owners' equity

38. Financial planning process. Budgeting.

Corporate financial planning (FP) - it is a process, in which a firm:

o Formulates a set of consistent business and financial objectives;

o Identifies where management would like to have the firm in the future;

o Projects the financial impact of alternative operating strategies with respect to different financial policies (capital structure policy, dividend policy, etc);

o Evaluates these impacts and decides which financial policies to adopt and what sort of long-term and short-term financing program to pursue; and

o Prepares contingency plans in addition to basic financial strategies in case future events differ from those now expected.

FP involves analyzing the interactions among the capital investment, capital structure, dividend, liquidity, financing, and liability management options available to the firm.

FP helps a firm evaluate anticipated returns and risks and determine a reasonable set of strategies, which are embodied in its financial plan.

FP typically consists of two phases. First, the firm prepares a long-term financial plan. Most companies have a long-term planning period of between 3 and 5 years. Second, the firm also prepares a more detailed short-term financial plan. Companies update their financial plan annually.

The principal components of an effective corporate financial plan include:

o A clear statement of the corporation’s strategic, operating and financial objectives;

o A clear statement of the business and economic assumptions, on which the plan is based;

o A description of basic business strategies that will be applied;

o An outline of the planned capital expenditure programs, divisions and product lines, expansion, acquisitions, replacement of existing equipment, etc.);

o An outline of the planned financing programs, (i.e. preferred stock, common stock, long-term debt)

FP to a large extent involves forecasting. Forecasting concentrates on the expected outcome. Forecasts related to FP: sales forecasts, forecasts of fixed and variable costs.

Budgeting is an integral part of a company’s financial management and planning. Budget represents a specific quantitative goal that is set as an objective for a company or department, reflecting a management plan for business growth and development.

Budget period is the time frame, for which the budgets are being compiled, and during which they are being adjusted.

Budgets perform three basic functions for the company. First, they indicate the amount and timing of the firm’s needs for future financing. Second, they provide the basis for taking corrective action in case when budgeted figures do not match actual or realized figures. Third, budgets provide benchmarks that can be used to evaluate the performance of people responsible for carrying out those plans and, in turn, controlling their actions.

Budgets should be focused not only on figures, but also on actions and company’s strategies. Budgets are composed with the help of special modes (consumption model, price model) and of course to a large extend rely on the firm’s forecasts. Nowadays budgets are created with the help of special software packages.

Modigliani-Miller theorem

If there were no tax advantages for issuing debt, and equity could be freely issued, Miller and Modigliani showed that the value of a leveraged firm and the value of an unleveraged firm should be the same.

40. Profit and profitability: definition, methods of calculation.

Profit - A financial benefit that is realized when the amount of revenue gained from a business activity exceeds the expenses, costs and taxes needed to sustain the activity.

Profitability – expected or average ratio of revenue to cost for a particular investment or trading system

The profitability ratios include: operating profit margin, net profit margin, return on assets and return on equity.

1. Return on Equity. It is the most fundamental indication of a company's ability to increase its earnings per share. It measures the return an investor receives on the capital that has been invested in the business. Shareholder equity is equal to total assets minus total liabilities. It’s what the shareholders “own”.

ROE % = Net Income/ Sharesholder’s equity

The ROE allows quickly determine if a company will generate assets or just continue to seek investment dollars to maintain operations.

2. Return on assets measures a company’s earnings in relation to all of the resources it had at its disposal (the shareholders’ capital plus short and long-term borrowed funds). Thus, it is the most stringent and excessive test of return to shareholders. If a company has no debt, it the return on assets and return on equity figures will be the same.

There are two acceptable ways to calculate return on assets.

ROA % = Net Income/ Total Assets

Note: Some investors add interest expense back into net income when performing this calculation because they'd like to use operating returns before cost of borrowing.

3. Profit Margin = (Operating Profit/ Sales)*100

It shows what % or how many pence of profit is on average generated for each $ of Sales.

The expected value of this ratio will differ quite considerably for different types of businesses. A high volume business, such as a retailer, will tend to operate on low margins that make the assets involved work very hard. By contrast a low business, such as a contractor will tend to require much greater margins.

Profit Margin % = (Profit before Taxation plus Interest Payable/ Sales)*100

Any action that will improve the profit margin % should improve the ROA %

If in comparing results with previous years or another company the profit margin % is found to be considerably lower it can be further analyzed with a view to identifying likely problem areas:

o % growth in sales

o Product mix from various activities

o Market mix for profit and sales by division and geographical area

o Expansion of activities by merger or acquisition

o Changes in selling prices (usually only available from management accounts and not from published accounts

o Change in costs

41. Cash Flow. Methods of its estimation. Cash Flows management at the company.

Cash Flow - A revenue or expense stream that changes a cash account over a given period. Cash inflows usually arise from one of three activities - financing, operations or investing - although this also occurs as a result of donations or gifts in the case of personal finance. Cash outflows result from expenses or investments. This holds true for both business and personal finance.

The concept of cash flow is one of the central elements of financial analysis, planning, and resource allocation decisions. Cash flows are important because the financial health of а firm depends on its ability to generate sufficient amounts of cash to pay its creditors, employees, suppliers, and owners. Only cash can be spent.

The value of common stock, bonds, and preferred stock is based upon the present value of the cash flows that these securities are expected to provide to investors. Similarly, the value to а firm of а capital expenditure is equal to the present value of the cash flows that the capital expenditure is expected to produce for the firm. In addition, cash flows are central to the prosperity and survival of а firm. Therefore, it is important for managers to pay close attention to the projected cash flows associated with investment and firm expansion strategies.

For financial analysis purposes, two important definitions of cash flows are used. The two most common cash flow definitions are after-tax operating cash flow and free cash flow.

AFTER-ТАХ OPERATING CASH FLOW. The after-tax operating cash flow concept is

used primarily when estimating cash flows for capital investment analysis purposes. After-tax operating cash flow (CF) is defined as operating cash flows before tax minus tax payments.

After Tax Operating CF = (Cash Revenues-Operating Expenses)x(1-Тax Rate)+Depreciation

FREE САSH FLOW. Free Cash Flow recognizes that part of the funds generated by an ongoing enterprise must be set aside for reinvestment in the firm. Therefore, these funds are not available for distribution to the firm's owners.

FCF can be computed as:

Free Cash Flow = After-tax CF — Interest x(1 — Тax Rate) — DividendPreferred— В — Changes in WC — CapEx

Free Cash Flow = EBIT(1-T)- CapEx -WC + Depreciation

FCF represents the portion of а firm's total cash flow available to service additional debt, to make dividend payments to common stockholders, and to invest in other projects.

Hybrid Financing.Companies may raise funds by issuing financial instruments with debt and equity features. Such instruments are called hybrid instruments or quasi-debt. There are two types of quasi-debt: convertible bonds and preferred shares; they pay fixed dividend but do not confer voting or management right on the owner. Holders of convertible bonds may convert such bonds into equity in accordance to the bond agreement. For instance, a holder of Company A's bonds might convert such bonds into shares if the stock has increased substantially in value after a period of time.

43. Methods of companies’ capital attraction from international financial market.

Capital, in the financial sense, is the money which gives the business the power to buy goods to be used in the production of other goods or the offering of a service.

There are several sources of capital:

Long Term - usually above 7 years

- Share Capital - the portion of a company's equity that has been obtained (or will be obtained) by trading stock to a shareholder for cash or an equivalent item of capital value.

- Mortgage - a loan secured by real property through the use of a mortgage note which evidences the existence of the loan and the obligation of that realty through the granting of a mortgage which secures the loan

- Retained Profit - the portion of net income which is retained by the corporation rather than distributed to its owners as dividends

- Venture Capital - financial capital provided to early-stage, high-potential, high risk, growth startup companies

- Project Finance - the long term financing of infrastructure and industrial projects based upon the projected cash flows of the project rather than the balance sheets of the project sponsors. Usually, a project financing structure involves a number of equity investors, known as sponsors, as well as a syndicate of banks or other lending institutions that provide loans to the operation

- Medium Term - usually between 2 and 7 years

- Term Loans

- Leasing - a process by which a firm can obtain the use of a certain fixed assets for which it must pay a series of contractual, periodic, tax deductible payments

- Short Term - usually under 2 years

- Bank Overdraft - occurs when money is withdrawn from a bank account and the available balance goes below zero. If there is a prior agreement with the account provider for an overdraft, and the amount overdrawn is within the authorized overdraft limit, then interest is normally charged at the agreed rate. If the negative balance exceeds the agreed terms, then additional fees may be charged and higher interest rates may apply

- Trade Credit

- Deferred Expenses - an asset used to enable cash paid out to a counterpart for goods or services to be received in a later accounting period

- Factoring - a financial transaction whereby a business sells its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount.

But the most popular among Russian companies are:

Eurobondsissue (term>1y). Еврооблига́ция — облигация, выпущенная в валюте, являющейся иностранной для эмитента, размещаемая с помощью международного синдиката андеррайтеров среди зарубежных инвесторов, для которых данная валюта также является иностранной.

Заёмщиками, выпускающими еврооблигации, могут выступать правительства, корпорации, международные организации, заинтересованные в получении денежных средств на длительный срок — от 1 года до 40 лет (в основном, от 3 до 30 лет). Еврооблигации размещаются инвестиционными банками, основными их покупателями являются институциональные инвесторы — страховые и пенсионные фонды, инвестиционные компании.

сумме без удержания налога у источника доходов в отличие от обычных облигаций.

IPO via foreign bank

is the first sale of stock by a company to the public. It can be used by either small or large companies to raise expansion capital and become publicly traded enterprises. Many companies that undertake an IPO also request the assistance of an investment banking firm acting in the capacity of an underwriter to help them correctly assess the value of their shares, that is, the share price.

IPO включает в себя следующие этапы:

• Предварительный этап — на данном этапе эмитент критически анализирует своё финансово-хозяйственное положение, организационную структуру и структуру активов, информационную (в том числе, финансовую) прозрачность, практику корпоративного управления etc

· Подготовительный этап

- Подбирается команда участников IPO

- Принимаются формальные решения органами эмитента, соблюдаются формальные процедуры

- Создается Инвестиционный меморандум — документ, содержащий информацию, необходимую инвесторам для принятия решения

- Запускается рекламная кампания

· Основной этап — во время основного этапа происходит собственно сбор заявок на приобретение предлагаемых ценных бумаг, прайсинг — определение цены (если она не была заранее определена), удовлетворение заявок (аллокация) и подведение итогов публичного размещения (обращения).

· Завершающий этап (aftermarket) — начало обращения ценных бумаг и, в свете него, окончательная оценка успешности состоявшегося IPO.

Commercial Papers (term <1y) (вексель) is an unsecured promissory note with a fixed maturity of 1 to 270 days. Commercial paper is a money-market security issued (sold) by large corporations to get money to meet short term debt obligations (for example, payroll), and is only backed by an issuing bank or corporation's promise to pay the face amount on the maturity date specified on the note. Since it is not backed by collateral, only firms with excellent credit ratings from a recognized rating agency will be able to sell their commercial paper at a reasonable price. Commercial paper is usually sold at adiscount from face value, and carries higher interest repayment rates than bonds. Typically, the longer the maturity on a note, the higher the interest rate the issuing institution must pay. Interest rates fluctuate with market conditions, but are typically lower than banks' rates

Corporate credit policy.

Accounts Receivable and actions with it.

1) calls

2) letters

3) lawsuits

4) visits

5) changes to limits of particular debtors

6) factoring + loan sale (переуступкадолгов)

7) AR and AP ratio managing

8) Bad debts

9) Collection, lawsuits (continued)

The first step is to find out what your options are.

This way you can choose the sources of corporate credit that can benefit your business the best.

- Credit cards in the business name

- Lines of credit

- Corporate loans

Corporate credit is important for any type of business. It is a way to separate business transactions from personal ones. Even small sized businesses need to have some type of corporate credit in place. The first step is to find out what your options are. This way you can choose the sources of corporate credit that can benefit your business the best.

The easiest form of corporate credit to get is credit cards in the business name. Never get those offered where you are personally liable for them. Just like with a personal credit card though, you will have to take the time to compare offers. You want those corporate credit cards that offer you a low interest rate and that don't have any annual fee associated with them. You also want a decent amount of credit to be able to access when you need it.

Lines of credit are a good type of corporate credit. They offer you a set amount of money that you can access when you need it. This is less time consuming than having to go to the bank each time you need to access money for something. It puts power in your hands so you can make important decisions because you already know you have the funding to take care of it.

It takes longer to get a loan for corporate credit than these other forms but you will have access to more funding. Corporate credit loans are often applied for to cover a particular expense. The lender is going to look at the financial records for your business. They are also going to look at the credit that you have for it and the payment history.Corporate loans always are attached to collateral as they are considered to be secured debts. Make sure you are willing to take that risk for your business. O

|

|

|

Состав сооружений: решетки и песколовки: Решетки – это первое устройство в схеме очистных сооружений. Они представляют...

Папиллярные узоры пальцев рук - маркер спортивных способностей: дерматоглифические признаки формируются на 3-5 месяце беременности, не изменяются в течение жизни...

Таксономические единицы (категории) растений: Каждая система классификации состоит из определённых соподчиненных друг другу...

Своеобразие русской архитектуры: Основной материал – дерево – быстрота постройки, но недолговечность и необходимость деления...

© cyberpedia.su 2017-2026 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!