Индивидуальные и групповые автопоилки: для животных. Схемы и конструкции...

История создания датчика движения: Первый прибор для обнаружения движения был изобретен немецким физиком Генрихом Герцем...

Индивидуальные и групповые автопоилки: для животных. Схемы и конструкции...

История создания датчика движения: Первый прибор для обнаружения движения был изобретен немецким физиком Генрихом Герцем...

Топ:

Методика измерений сопротивления растеканию тока анодного заземления: Анодный заземлитель (анод) – проводник, погруженный в электролитическую среду (грунт, раствор электролита) и подключенный к положительному...

Определение места расположения распределительного центра: Фирма реализует продукцию на рынках сбыта и имеет постоянных поставщиков в разных регионах. Увеличение объема продаж...

Организация стока поверхностных вод: Наибольшее количество влаги на земном шаре испаряется с поверхности морей и океанов...

Интересное:

Инженерная защита территорий, зданий и сооружений от опасных геологических процессов: Изучение оползневых явлений, оценка устойчивости склонов и проектирование противооползневых сооружений — актуальнейшие задачи, стоящие перед отечественными...

Мероприятия для защиты от морозного пучения грунтов: Инженерная защита от морозного (криогенного) пучения грунтов необходима для легких малоэтажных зданий и других сооружений...

Наиболее распространенные виды рака: Раковая опухоль — это самостоятельное новообразование, которое может возникнуть и от повышенного давления...

Дисциплины:

|

из

5.00

|

Заказать работу |

|

|

|

|

Основная структура бухгалтерских счетов

With the very smallest type of organization, it would possibly be sufficient to have the book-keeping records written in just one book. This we would call the ledger (бухгалтерский регистр). As the organization grew the amount of book-keeping entries needed would outgrow the limitations of the use of one ledger only.

This problem could be solved in several ways. One method would be to have more than one ledger, but the accounts contained in each ledger would be chosen simply by chance. There would be no set method for deciding which account should go into which ledger. This would not be very efficient, as it would be difficult to remember which accounts were in each ledger.

Another method would be to divide the ledger up into different books and each book would be for a specific purpose or function. The functions could be:

(a) One book just for customers’ personal accounts. We could call this Sales Ledger (регистр продаж).

(b) Another book just for suppliers’ personal accounts. We could call this the Purchases Ledger or Bought Ledger (регистр закупок).

(c) A book concerned with the receiving and payment out of money both by cash and check. This would be a Cash Book (кассовая книга).

(d) The remaining accounts would be contained in a ledger which we could call a General (главный) Ledger, an alternative name being a Nominal Ledger (номинальный регистр).

These ledgers all contain accounts and are part of double entry. If more than one person becomes involved in book-keeping, the fact that the ledger has been divided into different books would make their job easier. The book-keeping to be done would be split between the people concerned, each book-keeper having charge of one or more books.

The General Ledger would be used quite a lot, because it would contain the sales account, purchases account, returns inwards and returns outwards accounts, as well as all the other accounts for assets, expenses, income, etc.

When the General Ledger becomes overloaded, we could deal with this problem by taking a lot of the detailed work out of it. Most entries in it would have been credit sales, credit purchases and returns inwards and returns outwards. We can therefore start four new books, for credit transactions only. One book will be for credit sales (the Sales Journal) (журнал учета продаж), one for credit purchases (the Purchases Journal) (журнал учета закупок) and one each for Returns Inwards (the Returns Inwards Journal) (журнал возврата нам) and Returns Outwards (the Returns Outwards Journal) (журнал возврата поставщикам).

When a credit sale is made it will be entered in the customer’s personal account in the Sales Ledger exactly the same way as before. However, instead of entering the sale in the sales account on the General Ledger, we would enter it in the Sales Journal. At regular intervals, usually once a month, the total of the Sales Journal would be transferred to the credit of the Sales Account in the General Ledger.

|

|

What this means is that even if there were 1,000 credit sales in the month, only one entry, the total of the Sales Journal, would need entering in the General Ledger. This saves the General Ledger from being overloaded with detail.

Similarly credit purchases are entered in the suppliers’ account and listed in a Purchases Journal. The total is then entered, at regular intervals, in the debit side of the Purchases Account.

Returns inwards are entered in the customer’s personal accounts, and are listed in the Returns Inwards Journal. The total is then transferred to the debit of the Returns Inwards Account.

Returns outwards are entered in the supplier’s personal accounts, and are listed in the Returns Outwards Journal. The total is then transferred to the credit of the Returns Outwards Account.

Text #8

Controls

Виды контроля

Internal check (Внутренний контроль)

When sales invoices are being made out (после оформления счетов-фактур продаж) they should be scrutinized very carefully. A system is usually set up so that each stage of the preparation of the invoice is checked by someone other than the person whose job is to send out the invoice. If this was not done then it would be possible for someone inside a firm to send out an invoice, as an instance, at a price less than the true price. Any difference could then be split between that person and the outside firm. If an invoice should have been sent to Ivor Twister & Co for $2,000, but the invoice clerk made it out deliberately for $200, then, if there was no cross-check (в случае отсутствия двойного контроля), the difference of $1,800 could be split between the invoice clerk and Ivor Twister & Co.

Similarly outside firms could send invoices for goods which were never received by the firm. This might be in collaboration with an employee within the firm, but there are firms sending false invoices which rely on the firms receiving them being inefficient and paying for items never received. There have been firms sending invoices for such items as advertisements which have never been published. The cashier of the firm receiving the invoice, if the firm is an inefficient one, might possibly think that someone in the firm had authorized the advertisements and would pay the bill.

Besides these are of course genuine errors (естественные ошибки), and these should also be detected. A system is therefore set up whereby (таким образом, чтобы) the invoices have to be subject to scrutiny, at each stage, by someone other than the person who sends out the invoices or is responsible for paying them. Incoming (входящие) invoices will be stamped with a rubber stamp with spaces for each stage of the check. For instance, one person will have authority to certify that the goods were properly ordered, another that the goods were delivered in good order, another that the prices are correct, that the calculations are correct, and so on. Naturally in a small firm, simply because the office staff might be quite small, this cross-check may be in the hands of only one person other than the person who will pay it. A similar sort of check will be made in respect of sales invoices being sent out.

|

|

Statements (отчеты)

At the end of each month a statement should be sent to each debtor who owes money on the last day of the month. The statement is really a copy of the account for the last month, showing the amount owing (величина задолженности) at the start of the month, then the totals of each of the sales invoices sent to him in that month, the credit notes (кредитовые авизо) sent to him in the month for the goods returned, the cash and checks received from the debtor, and finally the amount owing at the end of the month.

The debtor will use this to see if the accounts in his accounting records agree with his account in our records. Put simply, if in our books he is shown as owing $798 then, depending on items in transit (в зависимости от содержания сделки) between us, his books should show us as a creditor for $798. The statement also acts as a reminder to the debtor that he owes us money and will show the date by which he should make payment.

Credit control (кредитный контроль)

Any organization which sells goods on credit should ensure that a tight control is kept on the amount owing from individual debtors. Failure to do so could mean that the amount of debtors increases past the point which the organization can afford to finance, also there is much higher possibility of bad debts (безнадежные долги) occurring if close control is not kept.

For each debtor a credit limit should be set. This will depend partly on the past record of dealings with the debtor, whether or not the relationship has been a good one, with the debtor always paying his account on time or not. The size of the debtor firm and the nature of its financial backing (финансовые гарантии) will also help determine what would be a safe credit limit to set. For instance, you might set a credit limit of only $250 for a fairly new and untried customer, but this could be as much as, say, $20,000 for a large well-known international firm with large financial resources. In the business world most business people are optimistic by nature, and they usually feel that they can manage to pay off debts much easier than is the case. Therefore it is a wise policy to err on the side of caution. On the other hand this should be tempered down (уравновешиваться) by the fact that if you are too cautious you will probably not do much business, so a sensible middle course is the answer.

Therefore the debtor should know the length of the term of credit, i.e. how many days or weeks or months he has in which to pay the bill. He should also know that you will not supply goods to him if the amount that he owes you exceeds a stated amount.

Text #9

Value Added Tax

Налог на добавленную стоимость

Value Added Tax, which will be shown hereafter in its abbreviated form as VAT, is charged in the United Kingdom on both the supply of goods and of services by persons and firms who are taxable. Some goods and services are not liable to VAT. Examples of this are food and postal charges (почтовые сборы). The rates at which VAT are levied have changed from time to time. Some goods have also attracted a different rate of VAT from the normal rate. Instances of this in the past have been motor cars and electric goods which have varied from the rates levied on most other goods.

The Government department which deals with VAT in the United Kingdom is the Customs and Excise department (Таможенно-Акцизное Управление).

Taxable firms (фирмы, облагаемые налогом)

Imagine that firm A takes raw materials that it has grown and processes them and then wants to sell them. If VAT did not exist it would sell them for $100, but VAT of 10 percent must be added, so it sells them to firm B for $100 + VAT$10 = $110. Firm A must now pay the figure of $10VAT to tax authorities. Firm B having bought for $110 alters the product slightly and then resells to firm C for $140 + 10 per cent VAT$14 = $154. Firm B now gives the tax authorities a check for the amount added less the amount it had paid to firm A for VAT$10, so that the check payable to the tax authorities by firm B is $4. Firm C is a retailer who then sells the goods for $200 to which it must add VAT 10 per cent $20 = $220 selling price to the customer. Firm C then remits $20 - $14 = $6 to the tax authorities.

|

|

It can be seen that the full amount of VAT tax has fallen on the ultimate customer who bought the goods from the retail shop, and that he suffered a tax (подвергается налогу) of $20. The machinery of collection (механизм сбора) was however geared to (связан с) the value added to each stage of the progress of the goods from manufacture to retailing, i.e. firm A handed over $10, firm B $4 and firm C $6, making $20 in all.

Exempted firms (освобожденные фирмы)

If a firm is exempted then this means that it does not have to add the VAT tax on to the price at which it sells its products or services. On the other hand it will not get a refund of the amount it has paid itself of the goods and services which it has bought and on which it has paid VAT tax. Thus such a firm may buy goods for $100 + VAT tax $10 = $110. When it sells them it may sell at $130, there being no need to add VAT tax at all. It will not however get a refund of the $10 VAT tax it had itself paid on those goods.

Instances of firms being exempted are insurance companies, which do not charge VAT on the amount of insurance premiums payable by their customers, and banks, which do not add VAT on to their bank charges (банковские комиссионные платежи). Small firms with a turnover of less than a certain amount (the limit is changed upwards from time to time) do not have to register for VAT if they don’t want to, and they would not therefore charge VAT on their goods and services. On the other hand many of these small firms could register if they wished, but they would then have to keep full VAT records in addition to charging out VAT. It is simply an attempt by the UK Government to avoid crippling (исключить трудности для) very small businesses with unnecessary record-keeping that gives most small businesses this right to opt out of charging (уклоняться от уплаты) VAT.

Zero rated firms (фирмы с нулевой ставкой)

They do not add VAT tax to the final selling price of their product or services. They do however obtain a refund of all VAT tax paid by them on goods and services. This means that if one of the firms buys goods for $200 + VAT tax $20 = $220, and later sells them for $300 it will not have to add VAT on to the selling price of $300. It will however be able to claim a refund of the $20 VAT tax paid when the goods were purchased. It is this latter element that distinguishes it from an exempted firm. A zero rated firm is therefore in a better position than an exempted firm. Illustrations of these firms are food, publishing and the new construction of buildings.

Text 10

|

|

|

Индивидуальные и групповые автопоилки: для животных. Схемы и конструкции...

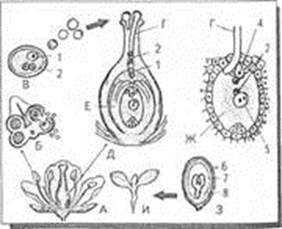

Двойное оплодотворение у цветковых растений: Оплодотворение - это процесс слияния мужской и женской половых клеток с образованием зиготы...

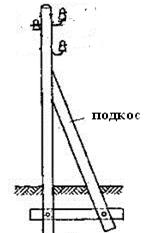

Опора деревянной одностоечной и способы укрепление угловых опор: Опоры ВЛ - конструкции, предназначенные для поддерживания проводов на необходимой высоте над землей, водой...

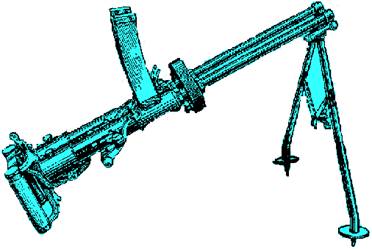

История развития пистолетов-пулеметов: Предпосылкой для возникновения пистолетов-пулеметов послужила давняя тенденция тяготения винтовок...

© cyberpedia.su 2017-2024 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!