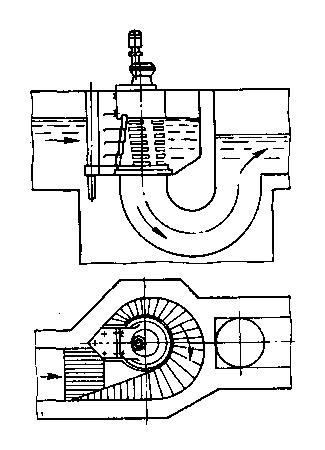

Состав сооружений: решетки и песколовки: Решетки – это первое устройство в схеме очистных сооружений. Они представляют...

Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

Состав сооружений: решетки и песколовки: Решетки – это первое устройство в схеме очистных сооружений. Они представляют...

Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

Топ:

Генеалогическое древо Султанов Османской империи: Османские правители, вначале, будучи еще бейлербеями Анатолии, женились на дочерях византийских императоров...

Проблема типологии научных революций: Глобальные научные революции и типы научной рациональности...

Интересное:

Уполаживание и террасирование склонов: Если глубина оврага более 5 м необходимо устройство берм. Варианты использования оврагов для градостроительных целей...

Искусственное повышение поверхности территории: Варианты искусственного повышения поверхности территории необходимо выбирать на основе анализа следующих характеристик защищаемой территории...

Влияние предпринимательской среды на эффективное функционирование предприятия: Предпринимательская среда – это совокупность внешних и внутренних факторов, оказывающих влияние на функционирование фирмы...

Дисциплины:

|

из

5.00

|

Заказать работу |

|

|

|

|

Speakers learn something every time they participate in a panel discussion. And every time something goes wrong, they tuck that information back in their heads to make sure it doesn't happen again.

è Using the quotes below as a springboard, organize a round-table discussion.

Hard Realities

“The recent experience of unemployment in eastern Europe and the states of the former Soviet Union has been diverse and prospects are mixed. Understanding the dynamics and nature of unemployment in these economies is essential for the developing policies that are consistent with furthering reform.” 1 Hard Realities

“The recent experience of unemployment in eastern Europe and the states of the former Soviet Union has been diverse and prospects are mixed. Understanding the dynamics and nature of unemployment in these economies is essential for the developing policies that are consistent with furthering reform.” 1

|

| Time to Rethink Privatization in Transition Economies “Privatization has won the day in transition countries … or has it? Where have privatization efforts — particularly those in central and Eastern Europe and the former Soviet Union — succeeded, where have they failed, and how can these countries best pursue further privatization?” 2 |

| A Decade of Transition An Overview of The Achievements And Challenges “Yet the challenges that remain are enormous. We are clearly far from the end of the road... Now, most countries can turn to the much more difficult and time-consuming task of implementing second-generation reforms.” He highlighted one specific task for the future: “enforcing the rule of law and fostering a culture that respects and, indeed, welcomes a framework of law, regulation, and codes of good practice.” 3 |

Transition and The Changing Role of Government

“Over the past decade, many centrally planned economies have set out to transform themselves into market economies. To be successful, they need to develop the necessary institutions and ensure a proper role for government.” 4 Transition and The Changing Role of Government

“Over the past decade, many centrally planned economies have set out to transform themselves into market economies. To be successful, they need to develop the necessary institutions and ensure a proper role for government.” 4

|

| From Centralized to Decentralized Governance “Decentralization can foster political stability and economic development — if transfers of resources and responsibilities are carefully coordinated and intergovernmental relationships are clearly defined.” 5 |

| Cleaning up “The global economy has made money laundering easier and less detectable.” “If you are in the business of trying to hide needles, you look for large haystacks.” 6 |

| The Russian Economy: Prospects and Retrospects “Over the course of time, we can see Russia increasingly taking its role as a major country in the international system, helping lead the IMF and helping develop the international system. Russia and the IMF would also cooperate to solve problems that we have in common, for example the difficulties of the Central Asian republics.” 7 |

References:

References:

1 Oliver Blanchard, Simon Commander, and Fabrizio Coricelli. F&D, December, 1994.

2 John Nellis. F&D, June, 1999.

3 Saleh M. Nsouli. F&D, June, 1999.

4 Vito Tanzi. F&D, June, 1999.

5 William Dillinger and Marianne Fay. F&D, December, 1999.

|

|

6 John William. Financial Times. September, 2001.

7 Stanley Fisher. F&D, June, 2001.

Part II

BUILDING A FINANCIAL SYSTEM:

Creative Writing

And Report Making

TEXT 1

Task 1. Skimming for main ideas

è Skim through Text 1 and identify the aspects under discussion.

Building a Financial System

arkets spur economic efficiency by allocating resources to their best uses, in response to supply and demand. A good system of financial markets and institutions is integral to this process, allocating savings to high-return investments. Worldwide experience confirms that countries with well-developed financial systems grow faster and more consistently than those with weaker systems and are better able to adjust to economic shocks. Transition implies vast reallocations of resources and ownership, a task at which effective financial systems could help enormously. Yet financial systems in transition economies start out in no fit state to help, with passive state-owned banks, often distressed, with limited capacity to assess credit risk, and an absence of financial regulation, key supporting institutions, and capital markets.

2. Reformers seeking to address these failings face a particularly thorny version of a common transition problem. The success of other market reforms depends on the health of the financial system; yet efforts to reform it cannot proceed independently of those other reforms, especially macroeconomic stabilization, enterprise reform, and the development of supporting legal institutions. Often transition countries respond to this dilemma with inaction, with the result that financial reforms lag behind.

3. The challenge for reformers is to find ways to help the financial system overcome the legacy of central planning, while at the same time sowing the seeds of a new system in which banks and other financial institutions will have to stand on their own two feet. The choice of approaches to banking reform brings this problem into stark relief. Should reformers use government funds to rehabilitate heavily overindebted state banks, and run the risk of their always coming to expect government bailouts? Or should reformers start afresh, encouraging the rapid entry of new banks and possibly the liquidation of old ones? Experience in transition economies to date provides evidence with which to assess both strategies and draw some tentative lessons for future reform. Whichever approach or combination of the two countries follow, one clear lesson is that governments have a vital role in promoting the development of a stable financial sector and regulating it over time. That role does not necessarily extend to the direct allocation of financial resources, even though governments in transition economies can face strong pressure to intervene, particularly in the rural sector. Another lesson is that developing a financial system takes time. Reform must seek ways to nurture a system of banks, nonbank intermediaries, and capital markets that will evolve not in response to government dictate but to the changing needs of the market.

© World Development Report

KEY WORDS AND WORD-COMBINATIONS

to spur economic efficiency

well-developed (effective) financial system

passive, distressed state-owned banks

health of financial system

to overcome the legacy of central planning

|

|

to rehabilitate heavily overindebted state banks

to expect government bailouts

to encourage the rapid entry of new banks

to promote the development of a stable financial sector

to nurture a system of banks

nonbank intermediaries

TEXT 2

Task 1. Scanning

è Scan the text to find information on two aspects:

1) two main tasks in approaching banking reforms;

2) two factors largely determining each country’s approach to banking reform.

Approaches to Banking Reform

Approaches to Banking Reform

ransition countries have two main tasks in approaching banking reform. The first is for each country to develop its central bank into an institution that independently formulates and conducts monetary policy. Evidence from transition economies confirms the worldwide finding that greater central bank independence, including the right not to finance the government and to set interest rates without government interference, is associated with lower inflation and more effective monetary policy. All transition economies have established basic instruments and procedures of monetary policy, although their effectiveness varies across countries, in part because interbank payments systems are often still poorly developed. Building them up is essential to creating a market-based financial system. Central banks have often also played a constructive role in formulating general macroeconomic and fiscal policies.

2. A much larger and more complicated task is to address the weaknesses of the commercial banks. Responding both to initial conditions and to developments early in transition, countries' approaches to banking reform have been based on either entry of new banks, rehabilitation of existing banks, or (usually) some combination of the two. Some countries, however, have yet to choose a consistent financial reform strategy. The new entry approach involves the entry of a relatively large number of new banks, the break up and privatization of state banks, and in some cases the liquidation of old banks. Estonia and Russia have both taken this path, although not always as a strictly deliberate policy choice. In many of the NIS, the confusion surrounding the break up of the Soviet Union created an environment in which many new banks emerged spontaneously. The alternative, rehabilitation approach, adopted by Hungary and Poland among others, stresses recapitalization of existing banks, together with extensive programs to develop them institutionally and to privatize them as soon as possible.

3. Two factors largely determine each country's approach to banking reform: the depth of the financial system (the ratio of financial liabilities to GDP) and the institutional legacy. During the late 1980s, financial depth was similar across the transition economies. But their different experiences with inflation—and the collapse in confidence in financial assets in the high-inflation countries have since caused an equally wide divergence. With inflation having wiped out bad loans and savings, leaving depositors with little confidence in the financial system, most NIS countries have little to lose by starting afresh. Countries in CEE started out with stronger institutional basis than did the NIS or the East Asian transition economies. This advantage, together with their deeper financial systems and generally better fiscal positions, led most CEE countries to opt for a more phased approach.

4. Financial reform with a stress on entry, including entry by foreign banks, can be a good approach for less advanced countries. Comparison of countries according to the institutional capacity of the better segment of their banks shows that, while the reformers with more entry generally had much worse starting conditions, some have now caught up with the other countries. Progress has been particularly rapid in Estonia and Russia, despite an unfavourable starting point. A period of relatively free entry can thus stimulate decentralized institutional building. But confidence can be undermined while the sector undergoes convulsive restructuring and as poor-quality banks spring up. Complementary policies are therefore needed to better screen new bank applicants, to weed out weak banks, and to improve the infrastructure for banking, including thorough enterprise and legal reform.

|

|

5. The rehabilitation approach has the advantage that it maintains a higher degree of confidence in the financial system and thus limits financial disintermediation (the tendency for financial transactions to bypass the banking system altogether). The downside is that it maintains a large role for existing state banks. Rehabilitation can also severely undermine banks' incentives to adopt prudent investment criteria, by fostering the expectation that, having bailed out troubled banks once, governments will do so again. In Hungary, for example, some banks have been recapitalized as many as five times. Thus, like the entry approach, a consistent rehabilitation policy requires a good many complementary reforms. These should focus on improving the interim governance of state banks, ensuring a strong commitment to privatization, and, perhaps, imposing certain restrictions on the state banks’ activities.

© World Development Report

Task 2. Building Vocabulary

1 è Before you read the text, study Key Words and Word-Combinations and give Russian equivalents for them.

KEY WORDS AND WORD-COMBINATIONS

to develop the central bank into an independent institution

to formulate and conduct monetary policy / fiscal policy

to set interest rates without government interference

to establish basic instruments and procedures of monetary policy

to develop (to build up) interbank payments systems

to create a market-based financial system

entry of new banks

rehabilitation of existing banks

to choose a consistent financial reform strategy

recapitalization of existing banks

break up and privatisation of state banks

to develop banks institutionally

depth of the financial system

institutional legacy

to undergo convulsive restructuring

to weed out weak banks

to improve the infrastructure for banking

to limit financial disintermediation

to adopt prudent investment criteria

2è The vocabulary exercises below will help you to master the key vocabulary. It will provide you with the required vocabulary to speak on the problems under consideration.

A. Find in the text English equivalents for the following word-combination.

Определять и осуществлять денежно-кредитную политику; создавать финансовый механизм рыночного типа; выбрать последовательную стратегию проведения финансовых реформ; разукрупнение и приватизация государственных банков; унаследованная институциональная структура; сделать центральный банк независимой структурой; создавать инструменты и механизмы денежно-кредитной политики; появление новых банков; закрывать нерентабельные банки; проводить осмотрительную инвестиционную политику; развивать институциональную структуру банков; препятствовать осуществлению финансовых операций вне рамок банковской системы; самостоятельно устанавливать процентные ставки; разрабатывать систему межбанковский расчетов; оздоровление существующих банков; улучшать инфраструктуру банковского сектора; уровень развития финансовой системы; рекапитализация существующих банков; претерпевать непоследовательную реструктуризацию.

|

|

B. Find the following English word-combinations in Text 2 and think of corresponding Russian equivalents.

Evidence from transition economies confirms; greater central bank independence is associated with lower inflation; to address the weaknesses of the commercial banks; responding both to initial conditions and developments early in transition; rehabilitation approach adopted by; the financial depth; the collapse in confidence in financial assets; high-inflation countries; with inflation having wiped out bad loans and savings; to opt for a more phased approach; financial reform with a stress on entry; comparison of countries according to the institutional capacity of their banks; to stimulate decentralized institution building; spring up of poor quality banks; complementary policies to better screen new bank applicants; the downside is that…; to improve the interim governance of state banks; a strong commitment to privatization.

Task 3. Discussing the content

1 è Using the examples given in the text comment on existing practices in implementing banking reforms.

2 è Having looked through the text in Box 1 continue your comparative analysis and speak on the effect of Russia’s banking system reforms.

BOX 1

Russia's Radical Banking Reform

1. Following the creation of a two-tier banking system in 1987, Russia's approach to banking reform rapidly — and partly unintentionally — diverged from that of other transition economies. In 1988 a new law permitted the creation of cooperative banks to serve the nascent private sector. Establishment of joint-stock banks became possible with the 1990 banking law, with licensing subject to only minimal requirements. Competition between a reformist Russian government and a more conservative Soviet government led to a separation of Russian banks from Soviet banks and, in Russia, to the break up of several state banks into independent regional banks. Together these events fueled an explosion in the number of Russian banks: from 5 in 1989 to 1,500 in 1992 and 2,500 in 1995.

2. Macroeconomic developments during this period created a competitive advantage for these new banks over the old state banks. Lack of fiscal and monetary control led to rampant inflation, and loan balances soon shrank to only a few weeks of production. This provided the new banks with an opportunity to gain market share quickly by providing higher-quality banking services to the newly emerging private sector. The voucher privatization program provided another new business opportunity, as many banks invested in enterprises directly or lent to other investors buying shares. As a result the share of the new banks in total banking system assets has risen sharply, to more than two-thirds as of early 1996, with the three remaining state banks holding the rest. Some of the larger new banks have rapidly become the country's leading commercial banks, with balance sheets of $1 billion to $3 billion. They move quickly into new business lines and financial products, and quite a few are the centre of emerging financial- industrial conglomerates.

3. The banking industry's main problems are the large number of poorly capitalized and badly managed banks and an associated severe lack of transparency. As stabilization has taken hold in Russia, the environment for banking has become more difficult. A third of Russia's banks reported losses in 1995, almost immediately after real interest rates turned positive. Although Russia has started to address its bad banks problem by withdrawing licenses and restricting operations, many troubled banks remain. The authorities will need to deal with these banks quickly, in many cases through liquidation, to restore confidence and prevent a major crisis, and to allow resources to be intermediated by the better banks instead.

4. Increased transparency is another must. Accounting and disclosure standards are still rudimentary, a well-developed auditing profession does not yet exist, and banking supervision remains embryonic. These limitations open the door to fraud and imprudent investment and undermine confidence in the financial system. To address this problem the Russian government, with assistance from the World Bank and the European Bank for Reconstruction and Development (EBRD), has introduced an international banking standards project. Some of the best banks have been selected to on-lend World Bank and EBRD funds to the private sector. In return, the banks must submit to annual audits by international accounting firms and adhere to prudential norms with respect to capital adequacy, portfolio diversification, asset and liability management, and so on. It is estimated that some twenty to forty banks will eventually participate in this bottom-up approach to banking reform.

|

|

© World Development Report

TEXT 3

Task 1. Skimming for main ideas

è The text headlined Where Government Should Lead … consists of five logical parts, each of which is clearly structured. Study the list of sub-headings covering the composition of the text, they are given in an arbitrary sequence. Skim through the text and relate each sub-heading to the corresponding part of the text:

a) Beware of recapitalizing banks

b) Develop effective supervision, screen new entry and improve disclosure

c) Establish at least a few reliable banks early on

d) Deal with problem banks quickly

Where Government Should Lead...

I. Introduction.

1. As we have seen, initial conditions are an important consideration in striking the balance between an entry and a rehabilitation approach to banking reform. Some countries may adopt a mixed strategy, limiting the activities of state banks while a new, private sector banking system develops in parallel. Whichever approach is followed, the crucial factor is the incentives it creates, and these depend significantly on government policies they pursue and how they are perceived. Experience to date yields several policy lessons.

II. __________________

2. Transition creates a difficult banking environment in which sizable loan losses are unavoidable, especially when real interest rates rise and firms have trouble servicing their loans. Unless governments act decisively, many transition economies can expect major financial crises to originate from troubled banks and from spillovers of problems at other financial intermediaries. Resolving financially distressed institutions requires three steps. First, financial flows to insolvent banks, whether from the government or from deposits attracted by high interest rates, must be stopped. Too often, troubled banks continue to receive normal or even preferential treatment. Second, management, often a primary source of the problem, must almost always be changed. Third, to reduce incentives for excessive risk taking, private shareholders should completely lose their stakes in liquidated or restructured banks. Depositors may also have to bear part of the losses. Countries that have moved decisively in this way have incurred lower costs and restored household confidence faster, even when households have suffered some losses, and have had fewer subsequent problem banks.

III. __________________

3. All transition countries need improved prudential regulation and supervision of commercial banks and other financial intermediaries, including financial-industrial groups and investment funds. Establishing such mechanisms demands a fully independent and market-oriented supervisory agency. Every transition economy now has a supervisory structure in place, either as a part of the central bank or as a self-standing body, and has issued laws and regulations aimed at improving the functioning of the financial system. Much less progress, however, has been made in translating these reforms into effective regulation and supervision. It takes time to train bank examiners and for them to acquire adequate experience; therefore supervision is likely to remain weak in many transition countries for an extended period and will not be able to prevent every banking failure. Supervisors should focus their limited resources on addressing problem banks and non-banks, screening entrants, and improving incentives for banks to adopt prudent practices.

4. Countries that allow relatively free entry of domestic banks have benefited from increased competition and fast institutional progress; for many, a period of market-driven consolidation of banks and closure of weak banks should reinforce this progress. But these countries also need to introduce high minimum capital requirements, checks on the suitability and integrity of owners and managers, and other formal guidelines to keep out applicants with poor prospects or fraudulent ventures. Even then, supervision will prevent only a few cases of fraud cause of many financial crises and supervisors may lack the political support to intervene. Many warning signals were ignored, for example, prior to the fraud-induced failures of some large banks in the Baltics. Banks also need incentives to act prudently in the absence of adequate supervision. Greater transparency, through better disclosure of bank balance sheets and profitability, will help by allowing depositors, other investors, and bank supervisors to better assess banks' quality. In most transition economies accounting and information disclosure standards for banks and other enterprises are far below those in market economies. Supervisors and international agencies need to set mandatory standards, especially on improved classification of nonperforming loans and more realistic provisioning for losses, and require annual audits.

IV. __________________

5. Large numbers of nonperforming loans and undercapitalized banks can undermine macroeconomic stability, lead to high interest rates, and forestall a decentralized, case-by-case restructuring of enterprises. Some observers have argued for early, comprehensive loan forgiveness to make a clean break with the past. Canceling the nonperforming debt of state enterprises to state banks has no impact on either national or government wealth, or on bank profits or fiscal revenues) but it raises a serious danger that money-losing firms will fail to restructure once freed from the burden of servicing their old loans, and it sends a perverse signal to other borrowers. No country has simply forgiven debts across the board, and in those that forgave debt on a large scale (such as Bulgaria and Romania) unprofitable enterprises continued to borrow rather than adjust. Forgiveness also creates no incentives for banks to develop skills in debt workout and recovery.

6. A decentralized, case-by-case approach, such as that adopted in Hungary and Poland, can be more useful. Banks are held accountable for their problem loans and must take the lead in resolving them. As part of the operational restructuring of individual enterprises and firms, banks can limit new loans and restructure old ones. The strategy works, however, only if banks and the enterprises concerned are properly governed and managed and if banks have enough capital to recognize and make provisions against problem loans. This may mean increasing their capital. As noted above, recapitalizing banks by injecting cash or bonds, taking over bad loans, and providing other forms of fiscal support has been an important component of a rehabilitation strategy. But recapitalization is a wise use of tax payers' money only if it quickly restores the health of the financial system and improves the prospects for bank privatization. Experience elsewhere with recapitalization is mixed. Banks often continue their bad lending policies, resources are frequently squandered or used fraudulently, and recapitalizations often are repeated again and again. Argentina, Chile, and the United States have all undertaken repeated recapitalizations of their banking systems. Recapitalization poses particularly large risks in transition countries. The adverse incentives it gives to already poorly governed state banks tend to be exacerbated by the fact that their privatization – a necessary complement to the rehabilitation approaches has proved difficult, making the endpoint unclear.

7. Instead of relying on recapitalizations and other forms of government support, policies should promote self-help for banks to encourage them to build up their capital base. Relative to their large volumes of bad loans, banks in most transition economies make smaller provisions for loan losses than is usual in high- and middle-income countries. Almost all the transition economies tax banks heavily, both through profit taxes and indirectly through high reserve requirements, which yield little interest. In some countries, banks are still saddled with quasi-fiscal responsibilities, which deplete their capital. In China, for example, the profitability of state banks is depressed in part because interest rates on loans to enterprises are kept below household deposit rates, and the credit plan dictates a large part of their lending. To allow banks to grow out of their bad debt problems, governments need to pay higher interest rates on required reserves, eliminate quasi-fiscal demands on banks, raise or liberalize lending interest rates, and encourage banks to make more realistic provisions for loan losses.

V. __________________

8. A combination of low confidence in the financial sector and sizable unofficial economies has meant that cash represents a large share of the money stock in CEE and the NIS, even compared with other countries with poor payments systems. To restore confidence, governments should aim to certify a few reliable institutions and try to protect the payments system from bank failures, entry by foreign banks is one quick way to increase the quality of banking. But in almost all transition countries regulation or other barriers have impeded foreign entry. Another approach, adopted in a number of CEE countries and NIS, is to single out a few select banks for financial and technical assistance. This approach signals to enterprises and households which banks may be most deserving of their trust. Still another route, most relevant for the NIS, is to establish “safe” banks in the meantime, possibly built on the national savings banks. These banks would primarily collect household deposits and be allowed to invest only in safe assets such as government obligations or engage in limited interbank lending. Their presence can help restore households' confidence in the banking system and allow authorities to remove, or at least reduce, the (implicit) deposit insurance now provided to state banks and sometimes to other financial institutions.

9. The measures just described would be more useful and far less costly than large-scale formal deposit insurance. Deposit insurance is often proposed for two reasons: to contain the risk of an individual bank's failure spreading through the payments system to other banks, and to increase households' confidence. Experience suggests, however, that deposit insurance is not essential to contain the contagions effects of bank failure. Especially where banking supervision is weak, banks and other investors will discriminate on their own often better than regulators between insolvent banks and banks with temporary liquidity problems. Insuring deposits, by contrast, can create significant moral hazard problems because insured banks are able to attract low-cost funds regardless of how risky their loans are.

© World Development Report

Task 2. Building Vocabulary

1 è Before you read the text, study Key Words and Word-Combinations and give Russian equivalents for them.

KEY WORDS AND WORD-COMBINATIONS

to strike a balance

problem / troubled banks

to service loans

financial intermediaries

to resolve financially distressed institutions

insolvent banks

to receive preferential treatment

to reduce incentives for excessive risk taking

to incur lower costs

improved prudential regulation and supervision

market-oriented supervisory agency

market-driven consolidation of banks

to introduce high minimum capital requirement

to act prudently in the absence of adequate supervision

greater transparency through better disclosure of bank balance sheets

to set mandatory standards

improved classification of nonperforming loans

undercapitalised banks

to forestall a decentralized restructuring of enterprises

to argue for comprehensive loan forgiveness

to cancel the nonperforming debt of state enterprises

decentralized case-by-case approach

problem loans

to limit new loans and restructure old ones

to take over bad loans

to be saddled with quasi-fiscal responsibilities

to make realistic provisions for loan losses

to impede foreign entry

2 è The vocabulary exercises below will help you to master the key vocabulary. It will provide you with the required vocabulary to speak on the problem under consideration

A. Find in the text English equivalents for the following word-combinations.

1. Принимать комплексную стратегию; ключевой фактор.

2. Получать некоторые льготы; обслуживать задолженность; неплатежеспособные банки; снижать привлекательность операций с повышенным риском; финансовые посредники; урегулировать проблемы учреждений, оказавшихся в кризисном финансовом положении; проблемные / убыточные банки; нести меньшие расходы (затраты).

3. Усовершенствованное взвешенное регулирование и надзор; консолидация банков в рыночных условиях; независимый контрольный орган, руководствующийся рыночными принципами; большая прозрачность благодаря доступу к банковским балансовым счетам; повысить уровень обязательного минимального капитала; нормы учета и отчетности; проводить взвешенную политику в отсутствии адекватного надзора; строгая классификация нефункционирующих кредитов; установить обязательные стандарты.

4. Банки с недостаточным оборотным капиталом; списывать просроченную задолженность госпредприятий; погашать нефункционирующие займы; нарушать процесс децентрализованной перестройки предприятий; выступать за списание всех долгов; децентрализованный подход, рассматривающий каждый конкретный случай; выполнять обременительные квази-финансовые функции; просроченные займы; создавать реалистичные резервы для покрытия убытков, ограничивать предоставление новых займов и реструктуризация старых.

5. Мешать проникновению иностранных банков на внутренний рынок.

B. Find the following English word-combinations in Text 3 and think of corresponding Russian equivalents.

1. An important consideration in striking the balance between an entry and a rehabilitation approach.

2. Sizable loan losses are unavoidable; private shareholders should lose their stakes in liquidated or restored banks.

3. Regulations aimed at improving the functioning of the financial system; to prevent every banking failure; to focus on addressing problem banks, on screening entrance; to improve incentives for banks to adopt prudent practices; to keep out applicants with poor prospects or fraudulent ventures; many warning signals prior to the fraud-induced failures of some banks.

4. Money-losing firms; to develop skills in debt workout and recovery; banks are held accountable for their problem loans; to have enough capital to make provisions against problem loans; to restore the health of financial system; resources are frequently squandered or used fraudulently; to build up banks’ capital base; to allow banks to grow out of their bad loans; to eliminate quasi-fiscal demands on banks.

5. Low confidence in the financial sector; sizable unofficial economies; cash represents a large share of the money stock; to protect the payments system from bank failure; entry by foreign banks; to single out a few select banks for financial assistance; to invest only in safe assets such as government obligations; to engage in limited interbank lending; to contain the contagious effects of bank failure.

Task 3. Scanning

è Scan the text to find the following:

1) three steps required to solve the problems of financially distressed institutions;

2) decisive measures that should be taken by governments to allow banks to grow out of their bad debt problems.

Task 4. Discussing the content

1 è Paragraph 4 says that in most transition economies accounting and information disclosure standards for banks — and other enterprises — are far below those in market economies. Some recommendations are given to improve the situation. Comment on these recommendations considering the present situation in Russian banking system.

2 è Paragraph 9 considers two reasons standing behind deposit insurance. It focuses on what experience suggests. Analyse the presented material and say how and to what extent it can be applied to Russian financial reality.

TEXT 4

Task 1. Skimming for main ideas

è Skim through the text and identify the topic of each paragraph. Select those aspects that should be included into your plan.

è Skim through the text and identify the topic of each paragraph. Select those aspects that should be included into your plan.

N ecessary vocabulary is provided in the Vocabulary Box.

…и когда правительство должно оставаться в стороне?

1. В некоторых странах сохраняется вмешательство правительства в сферу финансов и централизованное распределение ресурсов (как правило, нерентабельным предприятиям и отраслям). В других странах предприятия и министерства обязаны держать средства в проблемных банках. Во многих странах с переходной экономикой предлагалось в той или иной форме централизованное предоставление кредитов определенным отраслям. Распределение ресурсов подобными административными мерами препятствует развитию сильной финансовой системы на рыночной основе. Это также ослабляет лучшие банки, снижает эффективность функционирования финансовой системы и подрывает авторитетность финансового регулирования.

2. Сохранение государственных банков, специализирующихся на финансировании отдельных отраслей или видов деятельности, не позволяет преодолеть нерациональное распределение ресурсов, унаследованное от системы централизованного планирования. Во многих странах специализированных банков уже не существует. Государственные банки развития, как правило, неэффективны, и это положение едва ли изменится в условиях слабо развитой организационной структуры, характерной для большинства стран с переходной экономикой. Там, где государственные банки работали эффективно, кредитование осуществлялось в строго ограниченных пределах. Например, в Японии государственные финансовые учреждения используют краткосрочные тщательно разработанные программы кредитования.

3. В большинстве стран правительство испытывает давление, заставляющее предоставлять кредиты для финансирования сельского хозяйства, находящегося в критическом положении. Особенно актуальна эта проблема в СНГ. Сельскохозяйственные банки, подобно большинству специализированных банков, неликвидны, а часто и неплатежеспособны. Те из них, которым удается сохраниться после реформ, обычно уменьшаются в размерах. Новые банки неохотно обслуживают сельское хозяйство из-за высокого уровня риска в секторе, низкой прибыльности, почти полного отсутствия финансовой информации о заемщиках, плохой регистрации земельных участков и трудностей с использованием их в качестве обеспечения.

4. Учреждение кооперативных финансовых организаций, в некоторых случаях на основе бывшего сельскохозяйственного банка, может стать конструктивным шагом на пути к созданию автономной системы финансирования сельского хозяйства.

5. Жилищное строительство во многих странах с переходной экономикой резко сократилось, отчасти по причине недостатка финансирования. В большинстве стран финансирование строительства ограничено низким уровнем накоплений и отсутствием развитой институциональной структуры. Пользуясь привилегированным положением, государственные банки в некоторых случаях тормозили развитие рыночного финансирования в области жилищного строительства. Для оживления строительного рынка предлагались различные специализированные финансовые учреждения и государственные программы. Однако эти предложения игнорируют основные препятствия на пути финансирования жилищного строительства во многих странах: отсутствие четкого законодательства об ипотечных ссудах, регулирование квартирной платы, не способствующее приобретению собственного жилья, отсутствие институциональных инвесторов, макроэкономическая нестабильность и высокий уровень инфляции. В других условиях подобные программы скорее способны отвлечь внимание от тех мер, которые действительно необходимы для развития эффективной системы финансирования жилищного строительства и могут быть сопряжены с крупными бюджетными затратами.

© World Development Report

Vocabulary Box

to inhibit the development of a market-based financial system

to reduce the credibility of financial regulation

to carry on the legacy of poor reserve allocation

to perform poorly

weak institutional environment

to circumscribe lending tightly

to provide credit for rural finance

to collateralize

constructive approach to self-sustaining rural finance

to constrain housing finance by low saving

to revitalize the housing market

fundamental constraints on housing finance

heavy fiscal costs

Task 2. Pr é cis / Abstract writing

è Texts 3 and 4 “Where Government Should Lead…” and “Where Government Should Fear to Tread” consider the role and tasks of government in transition countries in the process of restructuring the financial sector. Write the plan of the whole text. Revise Composition and Language Focuses (Part 1) essential for précis writing. Look through the best patterns given in Supplement I. Write an abstract in two languages.

TEXT 5

Task 1. Skimming

è Skim through the text and identify the topic of each paragraph.

Developing capital markets

1. Capital markets are, at their most basic, easy to define and almost as easy to create. In a sense, a capital market exists wherever financial securities, vouchers, stocks, or bonds change hands, whether on a formal securities exchange, within a less structured but established medium such as an over-the-counter market, or informally between any buyer and any seller. Yet, the trick to capital markets is not bringing them into being but nurturing them so that they play their proper supporting role in the broader process of transition. For capital markets, especially the more formal kind, that role is largely one of facilitating the reallocation of property rights. Capital markets are especially needed after the initial distribution of vouchers and shareholdings in a mass privatization program, but also for the sale of state assets through direct share offerings. Some of the standard benefits of capital markets in a market economy can often be even more valuable for transition countries: capital markets improve corporate governance by monitoring managers and trading shares actively; they allow cash-strapped governments to issue bonds, and firms to make share and bond offerings; and they support long-term housing finance and pension reform. But even healthy capital markets are not self-sufficient; they rely heavily on well-functioning banks, to process payments and act as custodians, and money markets, to provide benchmarks for pricing securities. Both are greatly lacking in many transition economies. In addition, property rights are often poorly defined, there is a lack of necessary market skills and experience, and minority shareholder protection is extremely limited.

2. The more formal, centralized type of securities exchange is not particularly difficult to set up. At least nineteen transition economies have done so. And almost all countries in CEE, several NIS, China and Vietnam have adopted (or are adopting) supporting, comprehensive securities laws. Yet both market capitalization and share turnover in these formal markets have tended to be low by both developing and industrial country standards. Accordingly, the new markets have raised only limited funding. In CEE and the NIS only the best firms have been able to raise any financing, altogether less than $1 billion from 1991 to 1995. In China new equity offerings have been comparatively large, amounting to more than $1 billion in 1993 alone. They still, however, account for only a small portion of total enterprise investment. In Russia and the Czech Republic, capital markets including informal markets are mostly used to build up controlling stakes, which investors then tend to hold; turnover on formal markets is consequently low. In very few countries has equity trading been active and had a disciplinary effect on managers.

3. Bringing capital markets to life in transition countries will mean raising both the supply of securities and, naturally, the demand for them, as well as improving the institutional background for transactions. On the supply side, bond markets, which often precede stock markets, have tended to develop because governments need to raise non-inflationary finance. Similarly, rapid privatizers among developing countries have experienced much faster growth in stock market capitalization than have slow privatizers. This is also true among transition economies: stock market capitalization is greater in relation to GDP in mass privatizers such as Russia and the Czech and Slovak Republics. Yet trading activity and individual share prices are generally much lower among mass privatizers than in other countries, largely because demand is low and institutions are weak. China, with its limited privatization, is a notable exception, with high turnover due in part to speculation.

4. Boosting domestic demand for securities, and boosting securities trading, will require stable macroeconomic policies to raise saving, as well as the emergence of institutional investors such as private pension funds and insurance companies. Policymakers will also need to improve the protection of creditors and investors, especially minority shareholders, and vigorously punish fraud and other white-collar crimes. Enhanced disclosure requirements could help capital markets develop. Although many transition economies have made significant progress in enacting modern securities laws, few have succeeded in enforcing them, since supervisory institutions are often still lacking.

5. In developing and improving rules and institutions, countries need to strike a balance between a top-down approach, where the government takes the initiative, and one that is more bottom-up, in that supply and demand create pressures for the types of markets countries need and the rules and institutions to govern them. Top-down strategies can deliver higher standards but risk overregulation and may fail to meet markets' true needs. Standards in several CEE countries, for example, are relatively high, but only government bonds and several dozen stocks are actively traded. This is especially likely when infrastructure is developed well in advance of demand or supply. Albania, for example, enacted a well-designed capital markets law, but its capital markets are not yet functioning for lack of strong banks, institutional investors, functioning courts, qualified lawyers, and a well-staffed regulatory commission. Top down approaches are especially problematic since most countries need rapid change in the way firms are managed through mass privatization and other programs and this can be slowed by overregulation.

6. A bottom-up approach can have advantages. Experience in transition economies and elsewhere shows that more effective rules and institutions tend to develop when they advance in step with demand and supply, rather than behind or well in front of them. There is also evidence that market participants, seeking to protect their own interests, tend to self-regulate through cross-monitoring, especially when trading in large volumes. In Russia, a system for over-the-counter trading in stocks and rules governing trades were introduced because brokers realized that it was in their own interest to share information with others and agree on common standards. The bottom-up approach still requires a supportive role for the government, especially in promoting the necessary institutions and in vetting the rules of the game, but it does not risk stifling a nascent market. China is an example of bottom-up regulatory development: the emergence of regional exchanges prompted regional regulators to formulate their own rules first, which were later absorbed into an over-arching national regulatory framework.

7. Foreign demand can be particularly helpful in lifting standards and increasing confidence. Foreign portfolio investors stimulate infrastructure improvements because they demand good custody, trustee, audit, and bank payments systems fiduciary functions missing in many transition economies. In Russia, for example, a British company acquired 20 percent of the shares of an aluminum company, but its share ownership was later annulled by the company's management. The resulting international outcry spotlighted the deficiencies of Russia's regulatory process, leading to pressures for third-party registry facilities and a national registry company. A joint venture between Russian and several foreign institutions (the International Finance Corporation, the European Bank for Reconstruction and Development, and the Bank of New York) now handles custodian arrangements for shares, making purchases much easier and more attractive. Capital market development can also be accelerated through “demonstration” projects, such as portfolio and venture capital funds.

8. Capital markets in their various forms have played an important role in the transfer and initial reallocation of company ownership (vouchers and shares), particularly in mass-privatizing countries. Individual shareholders (including insiders) have sold their shares, often through informal markets, and strategic investors have sought to establish controlling ownership stakes. There are historical precedents for this process. In post-World War II Japan corporate ownership structure changed rapidly from one of wide distribution among individuals to one of institution-centered ownership with extensive cross-holdings. But increasing ownership concentration leads to illiquidity, especially in formal markets. In many transition economies with mass privatization programs, investors have held on to their stakes after the initial round of trading. Trading often occurs in blocks of the formal exchanges such as the case with 80 to 90 percent of shares exchanged in the Czech Republic as investors try to build up controlling stakes. Other countries show a similar trade off between concentration of ownership and market liquidity. Given the lack of sound corporate governance and scarcity of financial skills, concentrated outside ownership (combined with monitoring by banks) has its advantages in most transition economies. At least in the short run it is probably preferable to highly liquid and speculative capital markets that may impose little or no discipline on managers.

© World Development Report

Task 2. Building vocabulary

1 è Before you read the text, study Key Words and Word-Combinations and give Russian equivalents for them.

KEY WORDS AND WORD-COMBINATIONS

over-the-counter market

to sell state assets through direct share offerings

to allow cash-strapped governments to issue bonds

to process payments and act as custodians

to provide benchmarks for pricing securities

market capitalization

to raise limited funding / financing

to build up controlling stakes

to improve the institutional background for transactions

need to raise noninflationary finance

emergence of institutional investors

enhanced disclosure requirements

top-down strategies

to risk overregulation

government bonds and companies’ stocks

bottom-up approach

to stifle a nascent market

fiduciary functions (custody, trustee, audit and bank payment system)

to spotlight the deficiencies of regulatory process

third-party registry facilities

to handle custodian arrangements for shares

portfolio funds

venture capital funds

transfer of company ownership (vouchers and shares)

to establish controlling ownership stakes

institution-centered ownership with extensive cross-holding

trade off between concentration of ownership and market liquidity

highly liquid and speculative capital markets

2 è The vocabulary exercises below will help you to master the key vocabulary. It will provide you with the required vocabulary to speak on the problem under consideration

A. Find in the text English equivalents for the following word-combinations.

Давать возможность выпускать государственные облигации в условиях бюджетного дефицита; уровень рыночной капитализации; наращивать контрольный пакет акций; прямое предложение акций; формировать курсы ценных бумаг; привлекать ограниченное финансирование; вторичный рынок ценных бумаг; осуществлять платежи и выступать в качестве финансового агента; улучшать институциональную среду для совершения сделок; наращивать финансирование без инфляционного роста; государственные облигации и акции компаний; сталкиваться с риском чрезмерного регулирования; инициатива снизу; строгие правила предоставления информации; административный подход; фидуциарные функции (доверительное хранение чужих активов, управление кредитами, аудит); подавлять зарождающийся рынок; выявлять недостатки системы регулирования; появление институциональных инвесторов; фонды рискового капитала; процедура регистрации сделок с участием третьей стороны; передача собственности компаний;(через ваучеры и акции); портфельные фонды; выполнять функции доверительного хранения чужих активов; совместное владение обширными активами различных компаний; высоколиквидные рынки капитала; создать контрольный пакет акций; выбор между концентрацией собственности и ликвидностью рынка; фонды венчурного капитала.

B. Find the following English word-combinations in Text 5 and think of corresponding Russian equivalents.

A less structured but established medium; to facilitate the reallocation of property rights; to improve corporate governance by monitoring managers; to rely heavily on well-functioning banks; to define property rights; centralized type of securities exchange; to adopt comprehensive securities laws; to account for only a small portion of total enterprise investment; to bring capital markets to life; to boost domestic demand for securities; to deliver high standards; to develop infrastructure well in advance of demand and supply (or in step with…); national regulatory framework; to stimulate infrastructure improvements; to demand good custody, trustee, audit and bank payments system; to annul share ownership; national registry company.

3 è Word Study

è Here is a list of economic terms frequently used in the analysis of transition economies’ financial systems. Study word-combinations with these terms to enrich your vocabulary in order to sound more expertly. Comment on restructuring banks and building new financial systems in Russia.

Assets 1. актив(ы)

2. имущество, средства;

капитал

~ and liabilities актив и пассив баланса

available ~ свободные активы

capital ~ основной капитал; основные средства

current ~ 1. оборотный капитал, средства, фонды

|

|

|

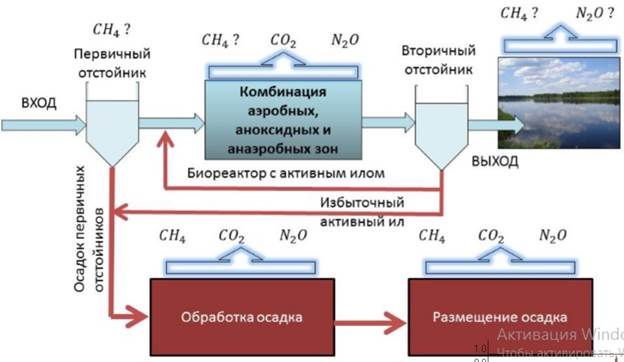

Эмиссия газов от очистных сооружений канализации: В последние годы внимание мирового сообщества сосредоточено на экологических проблемах...

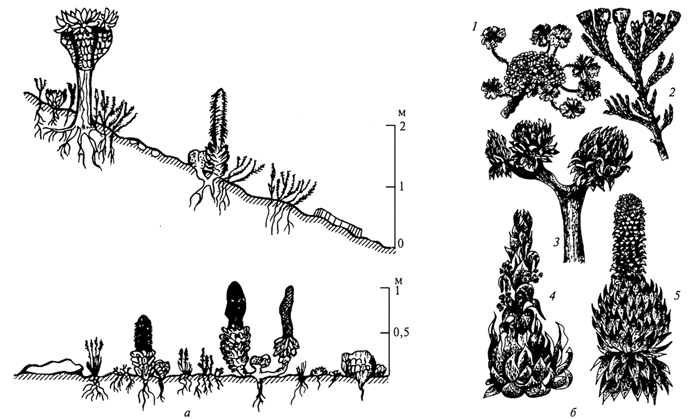

Адаптации растений и животных к жизни в горах: Большое значение для жизни организмов в горах имеют степень расчленения, крутизна и экспозиционные различия склонов...

История развития хранилищ для нефти: Первые склады нефти появились в XVII веке. Они представляли собой землянные ямы-амбара глубиной 4…5 м...

Папиллярные узоры пальцев рук - маркер спортивных способностей: дерматоглифические признаки формируются на 3-5 месяце беременности, не изменяются в течение жизни...

© cyberpedia.su 2017-2024 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!