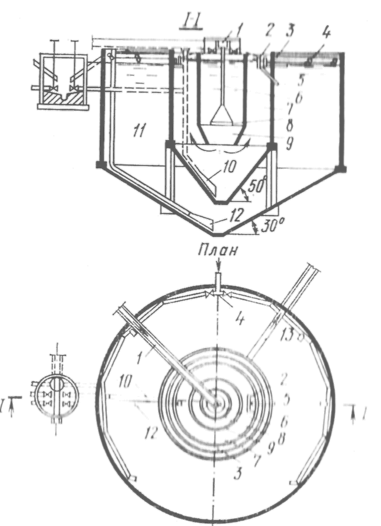

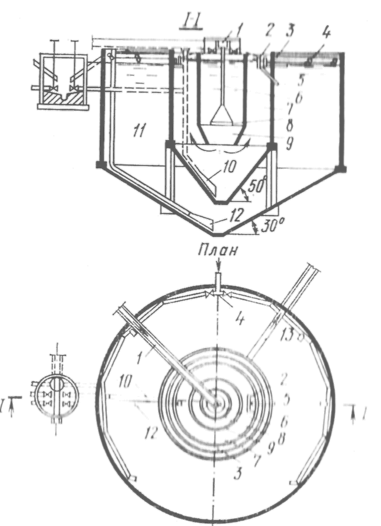

Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

Типы сооружений для обработки осадков: Септиками называются сооружения, в которых одновременно происходят осветление сточной жидкости...

Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

Типы сооружений для обработки осадков: Септиками называются сооружения, в которых одновременно происходят осветление сточной жидкости...

Топ:

Оснащения врачебно-сестринской бригады.

Процедура выполнения команд. Рабочий цикл процессора: Функционирование процессора в основном состоит из повторяющихся рабочих циклов, каждый из которых соответствует...

Оценка эффективности инструментов коммуникационной политики: Внешние коммуникации - обмен информацией между организацией и её внешней средой...

Интересное:

Что нужно делать при лейкемии: Прежде всего, необходимо выяснить, не страдаете ли вы каким-либо душевным недугом...

Финансовый рынок и его значение в управлении денежными потоками на современном этапе: любому предприятию для расширения производства и увеличения прибыли нужны...

Искусственное повышение поверхности территории: Варианты искусственного повышения поверхности территории необходимо выбирать на основе анализа следующих характеристик защищаемой территории...

Дисциплины:

|

из

5.00

|

Заказать работу |

|

|

|

|

The firms' liabilities are separated into two groups— current and long-term —on the balance sheet. These liability accounts and the owners’ equity accounts complete the balance sheet.

Current Liabilities A firm’s current liabilities are debts that will be repaid within one year. Accounts payable are short-term obligations that arise as a result of making credit purchases.

Notes payable are obligations that have been secured with promissory notes. They are usually short-term obligations, but they may extend beyond one year. Only those that must be paid within the year are under current liabilities. Many companies also list salaries payable and taxes payable as current liabilities. These are both expenses that have been incurred during the current accounting period but will be paid in the next accounting period. Such expenses must be shown as debts for the accounting period in which they were incurred.

Long-Term Liabilities Long-term liabilities are debts that need not be repaid for at least one year.

Owners' Equity For a sole proprietorship or partnership, the owners’ equity is shown as the difference between assets and liabilities. In. partnership, each partner's share of the ownership is reported separately by each owner's name. For a corporation, the owners' equity (sometimes referred to as shareholders' equity) is shown as the total value of its stock plus retained earnings that have accumulated to date.

The Income Statement

An income statement is a summary of a firm's revenues and expenses during a specified accounting period. The income statement is sometimes called the earnings statement or the statement of income and expenses. It may be prepared monthly, quarterly, semiannually, or annually. The main elements of an income statement are: revenues cost of goods sold, operating expenses, and net income.

I. VOCABULARY PRACTICE

A) Match the words with their definitions:

Assets, liabilities, owners’ equity, balance sheet, liquidity, current assets, marketable securities, notes receivable, prepaid expenses, fixed assets, depreciation, intangible assets, accounts payable, promissory notes.

1.The ease with which an asset can be converted into cash.

2. Assets that have been paid for in advance but not yet used.

3.Receivables for which customers have signed promissory notes.

4. Stocks, bonds, and so on—that can be converted into cash in a matter of days.

5.The things of value that a firm owns. They include cash, inventories, land, equipment, buildings, patents, and the like.

6.Cash and other assets that can be quickly converted into cash or that will be used within one year.

7.A summary of afirm’s assets, liabilities, and owners’ equity accounts at a particular time, showing the various dollar amounts that enter into the accounting equation

8.The difference between a firm’s asset and its liabilities—what would be left over for the firm’s owners if its assets were used to pay off its liabilities.

|

|

9.The firm’s debts and obligations—what it owes to others.

10. Assets that willbe held or used for a period longer than one year.

11. Sort-term obligations that may extend beyond one year.

12. Short-term obligations that arise as a result of making credit purchases.

13. Assets that do not exist physically but have a value based on legal rights or advantages that they confer on a firm.

14. Process of apportioning the cost of a fixed asset over the period during which it will be used.

B) Complete the text about balance sheets with the following words. The first one has been done for you:

assets, balance sheet (2 times), cash, cash held at bank, creditors, debtors, depreciation, draw up, liabilities, lists, owes, owns, statement, valuation

Every year a company will 1) draw up a 2) ________ to see how it stands financially. This document consists of two 3) _______ and is called a 4) _______. One list will contain all the things the company 5) _______. These are its 6) _______. The other list consists of the things the company 7) _______ and these are its 8) _______.

Every item has to be valued. One item will be the amount of 9) _______ the company has on its premises and another will be the amount standing on the bank account. This is called 10) _______. Some items can be valued exactly, but others can only be given an approximate 11) _______. Machinery or equipment, for instance, suffers from „wear-and-tear” and gradually loses its value. This process of losing value is assumed over a period of time and it is called 12) _______. Other assets include 13) _______. This item is the total amount owed by customers. Among liabilities there are 14) _______, that is the total amount owed to suppliers. When the 15) _______ is drawn, the company will be able to see how things are going.

C) Match the words with their translations:

1. venit pe acţiune/ прибыль на акцию

2. dobândă/ процент

3. profit nedistribuit/ нераспределённая прибыль

4. acţiune ordinară/ простая акция

5. costuri sociale/ социальные затраты

6. salarii/ зарплаты

7. acţionari/ акционеры

8. obligaţiune/ облигация

9. cont de profituri şi pierderi/ статья прибыли и убытков

10. costuri de exploatare/ эксплуатационные расходы

11. profit înaintea impozitării/ прибыль до налогообложения

12. dividend preferenţial/ дивиденд с привелигированной акции

13. cifră de afaceri/ общий торговый оборот

14. pensie/ пенсия

14. impozit pe firmă/ корпоративный налог

a. Shareholders i. earnings per share

b. corporation tax j. ordinary share

c. operating costs k. wages and salaries

d. debenture l. interest

e. turnover m. retained profit

f. pension n. social security costs

g. profit before tax o. profit and loss account

h. preference dividend

D) Match the words or phrases with their definitions:

1. consolidated statement 7. fixed assets

2. assets 8. treasury bill

3. liabilities 9. liquid assets

4. entity 10. current assets

5. equity 11. intangible assets

6. current liabilities 12. inventory

a. an organization for which separate accounts are kept;

b. what a company owes to people/ corporations from outside the entity;

|

|

c. debts to be paid within a year from the issuing of the financial statement;

d. what a company owns;

e. the claims of creditors and owners against the assets of an entity;

f. combination of accounting statements of different entities having the same shareholders, as if they formed a single entity;

g. anything owned by a company that can be readily turned into cash;

h. a short term bond sold by government to cover cash requirements, usually redeemable in three months;

i. amount of goods stored ready for sale (U.S.A.);

j. items belonging to a business that cannot be sold or turned into cash, being necessary for the operation of the company;

k. something a company ownes which cannot easily be computed and turned into cash;

l. something a company owns and will be turned into cash in the regular course of business (usually within one year).

E) Fill in the gaps with suitable words selected from the list given at the end of the text:

In accounting a set of accounts is kept for each company, corporation or store, each of them representing a separate...(1), distinct for accounting purposes from its owners. An entity is therefore what may be called any organization for which separate accounts are kept.

If a group of companies is treated as a single entity because the shareholders are the same, the accounting statements issued are called...(2) statement.

Assets are the economic...(3) of an entity or we may say that assets are what the company....(4). The claims of different parties against the assets of a company/entity are called...(5). They are subdivided into liabilities and owners’equity....(6) are the claims of the creditors of a company, people from outside the organization.

In a double-...(7) bookkeeping system of accounting, the basic accounting....(8) is Assets = Equity, as the two parts of an account must be balanced. An extended formulation of the equation will be Assets = Liabilities + owners’Equity. Assets are subdivided into two broad categories:...(9) assets and fixed assets.

Current assets are those that are part of the operating cycle of a business and are likely to be turned into...(10) within one year. Here we include what is sometimes called...(11) assets, that is funds readily available such as cash deposited in...(12) accounts in banks, Treasury...(13), that can be redeemed in three months, certificates of deposit, marketable securities, debtors (U.K.), or accounts...(14) (U.S.A.) should also be included here. Insurance policies expiring within one year can be added to the category of current assets.

...(15) assets include tangible assets such as plants, buildings, factories, land, that is those assets that cannot be...(16) into cash as they are required for the operation of the entity. Some...(17) assets, that cannot be readily computed and turned into cash, can be added to the category of fixed assets. Examples in this respect are patents, trademarks, copyrights.

Liabilities are what the company...(18) to people/corporations outside the entity. Here we include obligations of the company to supply money, goods or services to other parties.

Current liabilities are those....(19) due for payment within one year. They refer to creditors (U.K.) or accounts...(20) (U.S.A.), taxation payable, and other debts due for payment in the near future.

Long-term liabilities are to be...(21) at some distant time. Examples are long-term borrowings or mortgages.

| Bills; consolidated; cash; current (2 times); entity; entry; equation; equities; fixed; falling; intangible; liabilities; liquid; owes; owns; paid; payble; receivable; resources; turned. |

II. FOCUS ON GRAMMAR

A) Insert prepositions:

Merchandise inventory represents the value of goods that are ……. hand for sale to customers. 2. It must show that the firm's assets are equal ……. its liabilities plus its owners' equity. 3. The firms' liabilities are separated ……. two groups—current and long-term—on the balance sheet. 4. Long-term liabilities are debts that need not be repaid for ….. least one year. 5. These are both expenses that have been incurred during the current accounting period but will be paid ….. the next accounting period. 6. The amount that is allotted …. each year is an expense for that year, and the value of the asset must be reduced …. that expense. 7. Following that are marketable securities —stocks, bonds, and so on—that can be converted ……. cash …… a matter of days. 8. The balance sheet is prepared …… the end of the accounting period, which usually covers one year.

|

|

B) COMPLEX VERBS

Put the suitable verb in each gap to form a complex verb with the adverbial particle off:

to cut; give; go; keep; pay; run; see; switch; take; turn; write.

1. As the debtor has gone under, the creditor will have to … off the debt. 2. The plane …. off at 10 and two hours later it landed. 3. The bombs … off. 4. The fire has …. off a tremendous heat. 5. While speaking on the phone with an important client I …. off. 6. Her father … her off without a penny. 7. … off the grass! 8. Could you … me off three copies of the document? 9. …off the radio, please, I can’t concentrate on my work if it is on. 10. Don’t …off the light yet. 11. My friends came to the airport to …. me off. 12. The ship’s crew has been … off.

IV. Group the following under the appropriate headings:

property (US estate), patents, stocks and shares, Treasury bills, goodwill, creditors, equipment, taxation payable, copyright, bills receivable, mortgages, debtors, trade marks, buildings, certificates of deposit, franchise, production plants, vehicles, debts due to trade, loan capital

| ASSETS | LIABILITIES |

| debtors | creditors |

|

|

|

Общие условия выбора системы дренажа: Система дренажа выбирается в зависимости от характера защищаемого...

Папиллярные узоры пальцев рук - маркер спортивных способностей: дерматоглифические признаки формируются на 3-5 месяце беременности, не изменяются в течение жизни...

Автоматическое растормаживание колес: Тормозные устройства колес предназначены для уменьшения длины пробега и улучшения маневрирования ВС при...

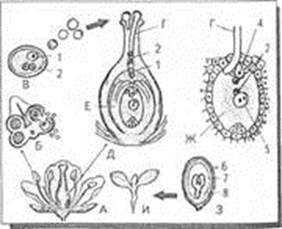

Двойное оплодотворение у цветковых растений: Оплодотворение - это процесс слияния мужской и женской половых клеток с образованием зиготы...

© cyberpedia.su 2017-2024 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!