Механическое удерживание земляных масс: Механическое удерживание земляных масс на склоне обеспечивают контрфорсными сооружениями различных конструкций...

Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

Механическое удерживание земляных масс: Механическое удерживание земляных масс на склоне обеспечивают контрфорсными сооружениями различных конструкций...

Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

Топ:

Оценка эффективности инструментов коммуникационной политики: Внешние коммуникации - обмен информацией между организацией и её внешней средой...

Марксистская теория происхождения государства: По мнению Маркса и Энгельса, в основе развития общества, происходящих в нем изменений лежит...

Характеристика АТП и сварочно-жестяницкого участка: Транспорт в настоящее время является одной из важнейших отраслей народного хозяйства...

Интересное:

Подходы к решению темы фильма: Существует три основных типа исторического фильма, имеющих между собой много общего...

Искусственное повышение поверхности территории: Варианты искусственного повышения поверхности территории необходимо выбирать на основе анализа следующих характеристик защищаемой территории...

Уполаживание и террасирование склонов: Если глубина оврага более 5 м необходимо устройство берм. Варианты использования оврагов для градостроительных целей...

Дисциплины:

|

из

5.00

|

Заказать работу |

|

|

|

|

Accountants are people who are trained and experienced in the methods and systems of accounting. They are generally classified as private accountants or public accountants.

A private (or nonpublic) accountant is an accountant who is employed by a specific organization. A medium-sized or large firm may employ one or several private accountants to design its accounting system, manage its accounting department, and prepare the variety of reports required by management or by law, and provide managers with advice and assistance. Private accountants provide their services only to their employers.

Smaller and medium-sized firms that don't require full-time accountants can hire the services of public accountants. A public accountant is an accountant whose services may be hired on a fee basis by individuals or firms. Public accountants may be self-employed, or they may work for accounting firms. Accounting firms range in size from one-person operations to huge international firms with hundreds of accounting partners and thousands of employees.

Most accounting firms include on their staffs at least one certified public accountant (CPA), an individual who has met state requirements for accounting education and experience and has passed a rigorous three day accounting examination. The examination is prepared by the American Institute of Certified Public Accountants and covers accounting practice accounting theory, auditing, and business law. State requirements usually include a college accounting degree and from one to three years of on the-job experience. Details regarding specific requirements for practice as a CPA in a particular state can be obtained by contacting the respective State Board of Accountancy. Certification as a CPA brings both status and responsibility. Only an independent CPA can officially verify the financial contents of a corporation's annual report and express an opinion regarding the acceptability of the corporation's accounting practices.

Users of Accounting Information

The primary users of accounting information are managers. The firm's accounting system provides a range of information dealing with revenues, costs, accounts receivable, amounts borrowed and owed, profits, return on investment, and the like. This information can be compiled for the entire firm; for each product; for each sales territory store, or individual salesperson; for each division or department; and. generally in any way that will help those who manage the organization.

Much of this accounting information is proprietary; it is not divulged to anyone outside the firm. However, certain financial information is demanded by individuals and organizations that the firm must deal with.

Lenders require at least the information that is contained in the firm’s financial statements before they will commit themselves to short- or long-term loans. Suppliers generally ask for this information before they will extend trade credit to a firm.

|

|

Stockholders must, by law, be provided with a summary of the firm’s financial position in each annual report. In addition, potential investors must be provided with financial statements in the prospectus for each securities issue.

Government agencies require a variety of information pertaining to the firm's tax liabilities, payroll deductions for employees, and new issues of stocks and bonds.

The firm's accounting system must be able to provide all this information in the required form. An important function of accountants is to ensure that such information is accurate and thorough enough to satisfy outside groups. Accounting can be viewed as a system for transforming raw financial data into useful financial information.

I. COMPREHENSION

A) Answer the following questions:

1. Define the word “accounting”.

2. What do you know about the history of accounting? When did the first book of accounting principles appear? Who wrote it?

3. What do you know about modern accounting in the USA?

4. What is the difference between accounting and bookkeeping?

5. Who are accountants? How are they classified?

6. Who is a private accountant? What are his liabilities?

7. Who is a public accountant?

8. Who is a CPA? What examination should he pass? What does it cover?

9. Who are the primary users of accounting information? What does this information include?

10. What other users of accounting information do you know? Characterize them.

B) True or False?

1. The firm’s accounting system must be able to provide information about bank activities in the required form.

2. Much of the accounting information is revealed publicly.

3. Most accounting firms include on their staffs at least one CPA.

4. The primary users of accounting information are lenders.

5. A bookkeeper can generally be trained within a year or so.

6. Accounting and Bookkeeping deal with the same systems.

7. Private accountants provide their services only to their employees.

8. It can be argued that as a profession accounting dates for about several years ago.

9. Cost accounting systems had to be developed to analyse and control the financial operations of the manufacturing processes during the Industrial Revolution.

10. Suppliers generally ask for this information before they will commit themselves to short- or long-term loans.

C) List the differences between accounting and bookkeeping

| ACCOUNTING | BOOKKEEPING |

| 1. | 1. |

| 2. | 2. |

| 3. | 3. |

| 4. | 4. |

| 5. | 5. |

D) Here is a list of accountant’s characteristics. Put a tick next to the one which corresponds to the category of accountants.

| Characteristics | Private accountants | Public accountants | CPAs |

| They have passed a rigorous three-day accounting examination | |||

| Their services may be hired on a fee basis by individuals or firms | |||

| They are employed by specific organizations | |||

| They may be self-employed or may work for accounting firms | |||

| The examination they pass covers: accounting practice, theory, auditing and business law | |||

| They design accounting systems, manage accounting departments, prepare the variety of reports | |||

| They must have a college accounting degree and from 1 to 3 years of on-the-job experience |

II. VOCABULARY PRACTICE

A) Find the synonyms in the text:

|

|

a. practically = g. money to be received =

b. friar = h. explanation =

c. exact = i. information=

d. to gain experience = j. to offer credit =

e. very big = k. detailed =

f. to gather information = l. linked to =

B) Match the words with their definitions:

| 1. American Institute of Certified Public Accountants | a) Gives the owner the executive right to publish, use and sell a literary, musical, or artistic piece of work for a period not to exceed 50 years after the author’s death |

| 2. Auditing | b) Simultaneous production of a debit and a credit from processing a transaction |

| 3. Capital market | c) A place where securities with a maturity greater than one year are traded |

| 4. Double-entry-accounting | d) Governing body of accounting practices, which limits its membership to only those individuals who pass the CPA examination |

| 5. Copyright | e) Verification of authenticity of financial statements by an independent professional accountant |

C) Match the words with their synonyms:

| 1. Scholar (n) | a) Made by hands |

| 2. To argue | b) Friar |

| 3. Liabilities (n.pl.) | c) Potential, future |

| 4. Handicraft (n) | d) Erudite person |

| 5. Monk (n) | e) To prove |

| 6. Ongoing (adj) | f) Debts |

| 7. Assets (n.pl.) | g) Lasting |

| 8. Conservatism (n) | h)Wealth |

| 9. Would-be (adj) | i) Prudence |

D) Match the words with the definitions:

Overheads, to post, book of prime entry, double-entry bookkeeping, tax return, voucher.

a. a record in which certain types of transaction are recorded before becoming part of a double-entry bookkeeping system;

b. a form to be filled in every year by every citizen stating incomes and personal circumstances that will be used to assess the amount of tax payable;

c. a method of book keeping in which each transaction is recorded twice in two different accounts that are balanced: the debit and the credit sides of an account;

d. to make a bookkeeping entry in an account book from a book of prime entry;

e. any document that supports an entry in a book of account;

f. indirect costs.

E) Fill in the gaps with suitable words from the list given at the end of the exercise:

Accounting is a ……(1) of economics whose purpose is to …(2) information in financial terms on the …..(3) of an organization, on how past …..(4) decisions have influenced these resources and consequently it can be a useful instrument for decision-making concerning the ….(5) of resources for the future. As we see accounting looks both into the past and into the future of the resources of a company. The historical aspects are the concern of ….(6) accounting, whereas the …..(7) useful for future decision-making are the province of ……(8) accounting. The former type of approach is useful for the creditors and ….(9) of a company, the latter is required by the managers.

Accountancy is the name of the profession and used only in U.K.

Accountants are the professionals in the field of ….(10). They usually belong to specialized bodies. Thus ….(11) accountants are members of the Association of Certified Accountants (U.K.). They are recognized by the Department of Trade as qualified to ….(12) the accounts of limited companies. …. (13) accountants are members of one of the Institutes of Chartered Accountants (in England and Wales, Scotland, Ireland). In the U.S.A. the correspondent is the certified …(14) accountant, a member of the American Institute of Certified Public Accountants. Accountants produce …(15) statements, draw up cash flow forecasts, audit accounts of organizations, prepare …(16) returns, and calculate production costs as well as …(17).

To be able to produce such financial documents they must rely on the recording of transactions in account ….(18). Bookkeeping is a branch of accounting whose task is to record transactions. There are books of prime entry in which transactions are recorded in the order in which they are made. They are …(19)-books, daybooks, and journals. Later the transactions are …(20) to the ledger. This is a book in which all the accounts of a business using ….(21)-entry bookkeeping are contained. It is the ultimate record book, showing all transactions of the business and their result. Nowadays many companies use computer-…(22) information instead of the classical ledger.

|

|

Double-entry bookkeeping means that in this system each transaction is entered …(23). An asset that is bought is recorded with its value. On the other hand the money paid for it is recorded in a separate account. The ….(24) side of an account should balance the debit side of it.

Each entry is based on …(25). These can be invoices and ….(26). The latter is confirmation of a payment made. The former is a document stating the amount due for some goods or services supplied. It gives a description of the goods, states delivery and shipment details, alongside of unit price and ….(27) price.

Accounting; allocation; audit; books; branch; cash; certified; chartered; credit; double; financial (2 times); forecasts; management; managerial; overheads; posted; public; receipts; resources; shareholders; stored; supply; tax; total; twice; vouchers.

III. FOCUS ON GRAMMAR

A) Insert prepositions:

Lenders require (1) …. least the information that is contained in the firm’s financial statements before they will commit themselves (2) …… either short or long-term loans. Stockholders must (3) …. law, be provided (4) …. a summary (5) …. the firm’s financial position (6) …. each annual report. The information can be compiled (7) …. the entire firm. Public accountants may be self-employed, or they may work (8) … accounting firms. Because (9) … its great value business owners have been concerned (10) … financial information (11) …. hundreds of years.

B) WORD FORMATION

a) Make compound words (adjectives) by using the pattern Credit+ Worthy=Creditworthy. Use the following nouns to combine with “ worthy ”: praise; blame; note; sea; air; road; trust. Which of these correspond to the Romanian words listed below:

1. care are bonitate/платежеспособный

2. demn de laudă/заслуживающий похвалы

3. remarcabil, demn de luat in consideraţie/стоящий внимания

4. în stare bună de navigabilitate/мореходный

5. demn de încredere/заслуживающий доверия

6. apt pentru a circula pe drumurile publice/пригодный к поездке

7. condamnabil/заслуживающий порицания

8. apt de zbor/годный к полёту

b) From these compounds, nouns can be formed on the pattern: ”creditworthy+ness”=creditworthiness.

Mind the replacement of “y” by “i”.

Now combine the adjectives you obtained in exercise to create nouns. Which of them means?

1. credibilitate (bonitate)/платежеспособность

2. stare de navigabilitate/мореходность

3. caracter reprobabil/порицание

4. caracter laudabil/похвальность

5. caracter demn de remarcat/достопримечательность

IV. COLLOCATIONS

Fill in the table and put “+” in the square where the combination of the two elements is possible:

| a decision | sense | data | goods | transactions | a requirement | |

| Make | ||||||

| Meet | ||||||

| Record | ||||||

| Provide | ||||||

| Supply |

V. DISCUSSION POINT

A) Comment on the following statements:

4. There is no accounting for tastes.

5. Accounting has been surprisingly interconnected with technology.

|

|

6. History does not repeat itself. But it rhymes. (M.Twain)

7. A successful merchant needs three things: sufficient cash or credit, an accounting system that can tell him how he’s doing and a good bookkeeper to operate it.

B) Accounting jokes

Read them and find out what characteristics accountants have:

1. An accountant is having a hard time sleeping and goes to see his doctor: “Doctor, I just can’t get to sleep at night”.

“Have you tried counting sheep?”

“That’s the problem – I make a mistake and then spend three hours trying to find it”.

2. An accountant visited the National History Museum. While standing near the dinosaur he said to his neighbour:

“This dinosaur is two billion years and ten months old”.

“Where did you get this exact information?”

“I was there ten months ago and the guy told me that the dinosaur is two billion years old”.

3. - When does a guy decide to become an accountant?

- When he realizes he doesn’t have the charisma to succeed as an undertaker.

4. - What do you call an accountant who is seen talking to someone?

- Popular.

5. - What’s an extroverted accountant?

- One who looks at your shoes while he’s talking to you instead of his own.

VI.WRITING

Translate into English:

Dezvoltarea contabilităţii şi a funcţiei acesteia

Contabilitatea a apărut în stadiul timpuriu al dezvoltării umane în scopul reflectării cantitative a mijloacelor unor producători. Obiectul, scopul şi funcţiile contabilităţii caracterizează particularităţile acelui nivel al dezvoltării sociale, procesele căruia aceasta le reflectă.

Rolul contabilităţii a crescut, mai ales, în legătură cu crearea centrelor comerciale mari.

Treptat contabilitatea a început să se transforme în ştiinţă, având obiectul şi metoda de cunoaştere proprii. Contabilitatea s-a dezvoltat mai pe larg în Roma Antică. Primii care au expus regulile dublei înregistrări au fost Benedict Cotrulli şi Luca Paciolo (sec.XV). Autorul operei „Cu privire la comerţ şi comerciantul onest”, în care, în special, sunt expuse regulile înregistrărilor în registrele contabile este Benedict Cotrulli.

Fondatorul contabilităţii se consideră Luca Paciolo (1445 – 1515) care este cunoscut ca autorul primei cărţi de contabilitate. El a fost profesor de matematică, însă numele lui a intrat în istorie datorită tratatului consacrat utilizării conturilor şi înregistrărilor contabile.

Dezvoltarea contabilităţii a dus la apariţia profesiei de contabil sau socotitor. Cuvântul „contabil” (omul care ţine registrele) a apărut de asemenea în sec. XV. În anul 1448 împăratul Imperiului Roman Maximilian I l-a numit în calitate de primul contabil pe Christofer Stechter. Începând de la acest moment contabilitatea se consideră profesie. Însă abia în sec. XIX contabilitatea a devenit o ştiinţă veritabilă. În mijlocul sec. XX în Italia, Franţa, Elveţia şi Germania au apărut multe opere despre obiectul, scopul şi metoda contabilităţii.

|

|

|

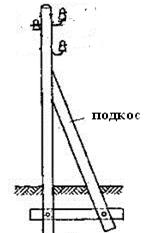

Опора деревянной одностоечной и способы укрепление угловых опор: Опоры ВЛ - конструкции, предназначенные для поддерживания проводов на необходимой высоте над землей, водой...

Историки об Елизавете Петровне: Елизавета попала между двумя встречными культурными течениями, воспитывалась среди новых европейских веяний и преданий...

Общие условия выбора системы дренажа: Система дренажа выбирается в зависимости от характера защищаемого...

Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

© cyberpedia.su 2017-2024 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!