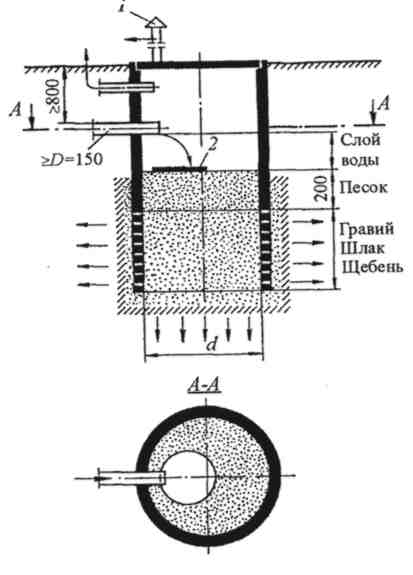

Индивидуальные очистные сооружения: К классу индивидуальных очистных сооружений относят сооружения, пропускная способность которых...

Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

Индивидуальные очистные сооружения: К классу индивидуальных очистных сооружений относят сооружения, пропускная способность которых...

Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

Топ:

Основы обеспечения единства измерений: Обеспечение единства измерений - деятельность метрологических служб, направленная на достижение...

Организация стока поверхностных вод: Наибольшее количество влаги на земном шаре испаряется с поверхности морей и океанов...

Характеристика АТП и сварочно-жестяницкого участка: Транспорт в настоящее время является одной из важнейших отраслей народного хозяйства...

Интересное:

Берегоукрепление оползневых склонов: На прибрежных склонах основной причиной развития оползневых процессов является подмыв водами рек естественных склонов...

Влияние предпринимательской среды на эффективное функционирование предприятия: Предпринимательская среда – это совокупность внешних и внутренних факторов, оказывающих влияние на функционирование фирмы...

Распространение рака на другие отдаленные от желудка органы: Характерных симптомов рака желудка не существует. Выраженные симптомы появляются, когда опухоль...

Дисциплины:

|

из

5.00

|

Заказать работу |

|

|

|

|

Study and Learn the Words:

| English | English equivalents | Romanian | Russian |

| balance sheet (n) | financial statement summarizing the assets, liabilities and net worth of an individual or a business at a given date: so called because the sum of the assets equals the total of the liabilities plus the net worth | bilanţ contabil | балансовый отчет |

| inventory (n) | an itemized list or catalogue of goods, property | inventar | инвентарь |

| assets (n,pl.) | every possession an organization has | active | активы |

| liabilities (n,pl.) | the debts of a person or business | pasive | пассивы |

| owners’equity (n) | capital propriu | собственный капитал | |

| raw data | not processed, edited, interpreted information | date neprelucrate | необработанные данные |

| double-entry bookkeeping | a system of bookkeeping in which every transaction is entered as both a debit and a credit in conformity with the underlying accounting equation which states that assets equal liabilities plus net worth | contabilitatea dublei înregistrări | система бухгалтерского учета по методу двойной записи |

| marketable securities | securities that can be sold easily | capital de rulaj sau circulant | легкореализуемые ценные бумаги |

| receivables or accounts receivable, debtors | accounts suitable for acceptance | conturi de încasat, creanţe | счета к получению, дебиторская задолженность |

| insurance premium | the amount payable or paid, in one sum or periodically, for an insurance policy | primă de asigurare | страховой взнос |

| depreciation (n) | a decrease in value of property through wear, deterioration, or obsolescence | depreciere, devalorizare, amortizare | обесценивание, амортизация |

| notes receivable | cambii spre recepţionare | векселя к получению | |

| to apportion the cost | to divide and distribute costs | a distribui, a împărţi costurile | распределять расходы |

| intangible assets | assets that have no real existence | active nemateriale | нематериальные активы |

| patent (n) | a document granting the exclusive right to produce, sell, or get profit from an invention, process, for a specific number of years | patent | патент |

| copyright (n) | the exclusive right to the publication, production, or sale of the right to the literary, dramatic, or artistic work | drept de autor | авторское право |

| trademark (n) | a symbol, design, word, letter used by a manufacturer or dealer to distinguish a product or products from those of competitors | marcă comercială | коммерческая марка |

| promissory note (n) | a written promise to pay a certain sum of money to a certain person or bearer on demand or on a specified date | ordin de plată | долговое обязательство, вексель |

| accounts payable, creditors | debts that must be paid to an organization | datorii spre plată, conturi de creditor | счета к оплате, кредиторская задолженность |

| to incur expenses | a avea cheltuieli | нести затраты | |

| allowance for doubtful accounts | corecţii la creanţe dubioase | поправка на сомнительные счета |

The accounting equation is a simple statement that forms the basis for the accounting process. It shows the relationship among the firm’s assets, liabilities, and owners' equity.

|

|

Assets are the things of value that a firm owns. They include cash, inventories, land, equipment, buildings, patents, and the like.

Liabilities are the firm's debts and obligations—what it owes to others.

Owners' equity is the difference between a firm's asset and its liabilities—what would be left over for the firm's owners if its assets were used to pay off its liabilities.

The relationship among these three terms is almost self-evident: Owners’ equity = assets - liabilities. By moving terms algebrically, we obtain the standard form of the accounting equation:

Assets = liabilities + owners' equity

Implementation of this equation begins with the recording of raw data that is, the firm's day-to-day financial transactions. It is accomplished: through the double-entry system of bookkeeping.

The concept of Balance Sheet is very old. No one knows exactly when and who invented this accounting device. Like accounting the balance sheet is an anonymous opera and generations of authors, theoreticians have contrinuted to its development since the civilization appeared. It is prepared and presented on a specified date: 31st March, 30th June, 30th September, and 31st December. Also it can be prepared quarterly, annually, and semiannually.

The word “balance sheet” corresponds to the notion of “weighing machine” with two scales that must always be in balance and it derives from the word “ bi” – two and “lanx” – scale of the balance.

The specifics of the balance sheet in the Republic of Moldova is that it is composed of two parts: the left side is called assets and the right side is called liabilities.

In the USA the BS has only one section and the assets, liabilities and owners’equity follow this order.

The Balance Sheet

A balance sheet (or statement of financial position) is a summary of afirm's assets, liabilities, and owners' equity accounts at a particular time, showing the various dollar amounts that enter into the accounting equation. The balance sheet must demonstrate that the accounting equation does indeed balance. That is, it must show that the firm's assets are equal to its liabilities plus its owners' equity. As previously noted, the balance sheet is prepared at the end of the accounting period, which usually covers one year. Most firms also have balance sheets prepared semiannually, quarterly, or monthly.

Assets

In the USA on a balance sheet, assets are listed in order, from the most liquid to the least liquid. The liquidity of an asset is the ease with which it can be converted into cash.

Current Assets Current assets are cash and other assets that can be quickly converted into cash or that will be used within one year. Because cash is the most liquid asset, it is listed first. Following that are marketable securities —stocks, bonds, and so on—that can be converted into cash in a matter of days.

|

|

Next are the firm's receivables. Its accounts receivable, which result from the issuance of trade credit to customers, are generally due within sixty days. However, the firm expects that some of these debts will not be collected. Thus it has reduced its accounts receivable by a 5 percent allowance for doubtful accounts. The firm's notes receivable are receivables for which customers have signed promissory notes. They are generally repaid over a longer period of time.

Merchandise inventory represents the value of goods that are on hand for sale to customers. These goods are listed as current assets because they willbe sold within the year. For a manufacturing firm, merchandise inventory can also represent raw materials that will become part of a finished product or work in process that has been partially completed but requires further processing.

Prepaid expenses are assets that have been paid for in advance but not yet used. An example is insurance premiums. They are usually paid at the beginning of the policy year for the whole year. The unused portion (say, for the last four months of the policy year) is a prepaid expense—a current asset.

Fixed Assets Fixedassets are assets that willbe held or used for a period longer than one year. They generally include land, buildings, and equipment.

The values of fixed assets are decreased by their accumulated depreciation. Depreciation is the process of apportioning the cost of a fixed asset over the period during which it will be used. The amount that is allotted to each year is an expense for that year, and the value of the asset must be reduced by that expense.

Intangible Assets Intangible assetsare assets that do not exist physically but have a value based on legal rights or advantages that they confer on a firm. They include patents, copyrights, trademarks, and goodwill. By their nature, intangible assets are long-term assets. They are of value to the firm for a number of years.

Goodwill is the value of a firm's reputation, location, earning capacity, and other intangibles that make the business a profitable concern. Goodwill is not normally listed on a balance sheet unless the firm has been purchased from previous owners.

|

|

|

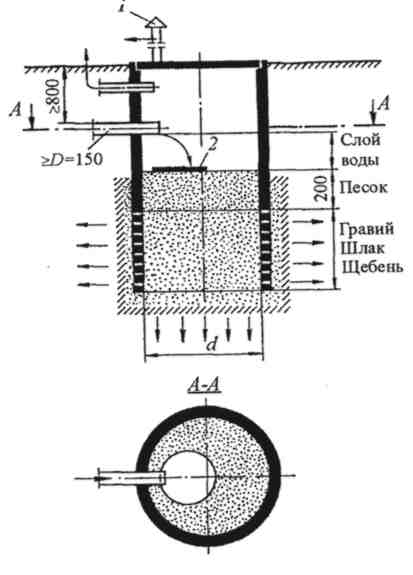

Опора деревянной одностоечной и способы укрепление угловых опор: Опоры ВЛ - конструкции, предназначенные для поддерживания проводов на необходимой высоте над землей, водой...

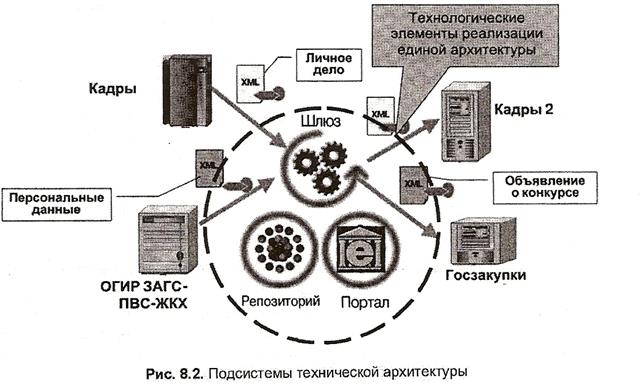

Архитектура электронного правительства: Единая архитектура – это методологический подход при создании системы управления государства, который строится...

История развития пистолетов-пулеметов: Предпосылкой для возникновения пистолетов-пулеметов послужила давняя тенденция тяготения винтовок...

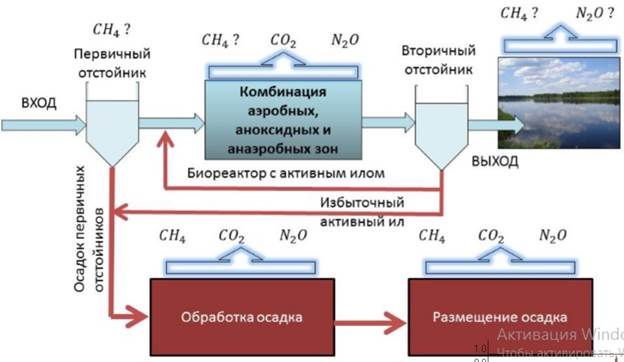

Эмиссия газов от очистных сооружений канализации: В последние годы внимание мирового сообщества сосредоточено на экологических проблемах...

© cyberpedia.su 2017-2024 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!