Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

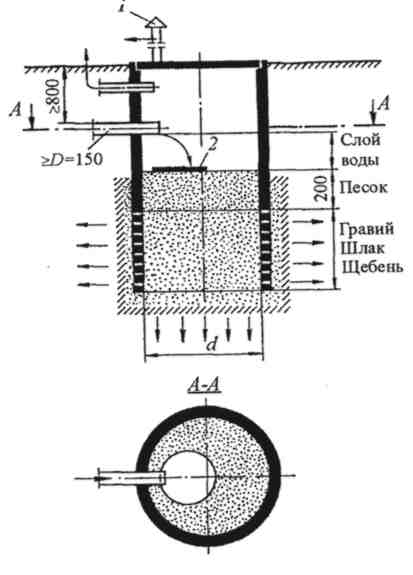

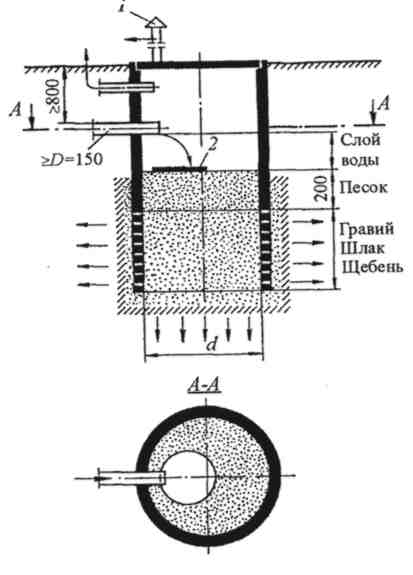

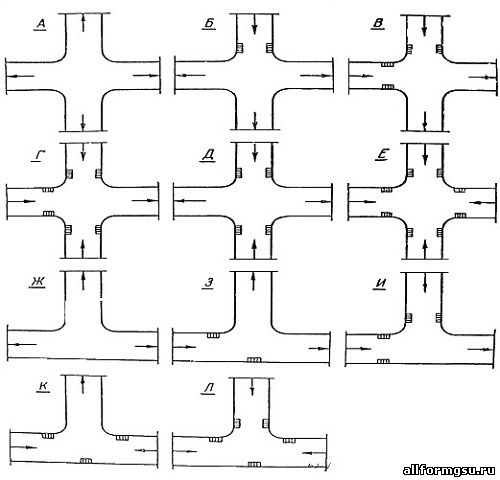

Индивидуальные очистные сооружения: К классу индивидуальных очистных сооружений относят сооружения, пропускная способность которых...

Кормораздатчик мобильный электрифицированный: схема и процесс работы устройства...

Индивидуальные очистные сооружения: К классу индивидуальных очистных сооружений относят сооружения, пропускная способность которых...

Топ:

Выпускная квалификационная работа: Основная часть ВКР, как правило, состоит из двух-трех глав, каждая из которых, в свою очередь...

Устройство и оснащение процедурного кабинета: Решающая роль в обеспечении правильного лечения пациентов отводится процедурной медсестре...

История развития методов оптимизации: теорема Куна-Таккера, метод Лагранжа, роль выпуклости в оптимизации...

Интересное:

Отражение на счетах бухгалтерского учета процесса приобретения: Процесс заготовления представляет систему экономических событий, включающих приобретение организацией у поставщиков сырья...

Финансовый рынок и его значение в управлении денежными потоками на современном этапе: любому предприятию для расширения производства и увеличения прибыли нужны...

Искусственное повышение поверхности территории: Варианты искусственного повышения поверхности территории необходимо выбирать на основе анализа следующих характеристик защищаемой территории...

Дисциплины:

|

из

5.00

|

Заказать работу |

|

|

|

|

In September 1998 thousands of students throughout the world will begin an introductory economics course. They will probably use only one textbook. For most, that one course will be their only brush with the dismal science. That is why basic economics textbooks are enormously influential. One, in particular, has been extraordinarily so: Paul Samuelson's "Economics", first published in 1948, has taught at least two generations of Americans (and many others) all they know about the subject.

As well as influence, textbooks can also bring their authors riches. Gregory Mankiw, an economist at Harvard University, was paid an advance of $1.4m for a basic textbook*, out in August 1997 that has been named as "the new Samuelson". Fortunately, this claim is only half-true. Like Mr Samuelson's book in its day, Mr Mankiw's book sets a new standard of clarity and liveliness. Like almost all modern texts, it uses many of the basic analytical tools developed by Mr Samuelson. But Mr Mankiw's aim, unlike Mr Samuelson's, is to elucidate rather than advocate. This is a big difference.

It is difficult to exaggerate the worldwide impact of Mr Samuelson's «Economics». Its 15 editions have sold more than 4m copies and it has been translated into 41 languages. Though its popularity has waned somewhat in recent years, many millions of people learned their economics from the textbook's lively prose. The book has great strengths. In microeconomics in particular, the pedagogy Mr Samuelson developed - diagrams of supply and demand, or cost curves, for instance - still set the discipline's standard. More problematic is his approach to macroeconomics. Although Mr Samuelson claimed that he had no great message to impart in his first textbook, he was actually introducing, explaining and advocating the then revolutionary economics of John Maenad Keynes. Hence the book reflected a belief in the need for active government and skepticism about market outcomes. Although it has evolved enormously over 15 editions, that tone remains.

Has this been for the best? In an intriguing recent paper, Mark Skousen of Rollins College in Florida studies the evolution of «Economics» and argues that its approach may have hindered people's understanding, Mr Samuelson's determination to provide a unified approach to macroeconomics created a false sense that there was a single way of thinking about how economies work. Readers of early editions would have the (wrong) impression that there was no longer disagreement about macroeconomics.

More important, the Keynesian basis of «Economics» means that large aspects of macroeconomics have been underplayed, and dubious policy prescriptions advocated. By concentrating principally on short-run aggregate demand, the book understated the importance of the causes of long-run economic growth. Its emphasis on Keynnes's concerns that people might save too much and so shrink the economy led through many editions to an anti-saving tone. Only in the 13th edition in 1998 did Messrs. Samuelson and Nordhaus bemoan the low level of American savings and suggest a close link between saving and economic growth.

|

|

Nor are the book's microeconomics beyond fault. «Economics» has remained convinced that government should correct market failures and provide public goods. Every edition since 1961, for instance, cites lighthouses as examples of public goods that markets cannot provide - even though in 1974 Ronald Coase, a Chicago economist and, like Mr Samuelson, a Nobel laureate, explained how many English lighthouses in the 19th century were commercially run. To be sure, some of this criticism is based on hindsight. In the 1950s or 1960s, Mr Samuelson's book would not have seemed as subjective or one-sided as it does today. And it has developed over time with Mr Samuelson's own ideas. But for all that, the book remains rooted in its time and in a single set of ideas.

Mr Mankiw's book, even if it becomes a bestseller, will not radically alter economic teaching in the way that Mr Samuelson's did. This is no criticism, for Mr Mankiw has produced something long overdue: an accessible introduction to modern economics. By writing more in the style of a magazine than a stodgy textbook and explaining even complex ideas in an intuitive, concise way, he will leave few students bored or bewildered. A second innovation is the book's structure and emphasis, which reflect today's economic realities and economists' understanding. International trade, for instance, looms large early on. The discussion of macroeconomics begins with long-run growth and only later moves to short-run fluctuations.

Most refreshing, though, is the book's even-handedness. Mr Mankiw seems to revel in setting out how different schools of thought have contributed to economists' current state of knowledge. Like «Economics», this book also mentions lighthouses. But it asks, «Are lighthouses public goods?» and gives the arguments on both sides. Whether the book's sales will justify Mr Mankiw's huge advance remains to be seen. But if, as it deserves, it becomes popular with the millions of students who take introductory economics, tomorrow's graduated might not only understand economics. They might even enjoy it.

* "Principles of Economics". Dryden Press.

TEXT 32: CAR CRASH AHEAD

There has been something special about cars and the making of them. Henry Ford turned the car-assembly line into an enduring symbol of industrialisation. Later, Alfred Sloan made General Motors into a model for the modern corporation: the inventor of operating divisions and marketing plans. Today the industry seems poised once again to become an example for other businesses, as car manufacturers grapple with the opportunities and challenges of globalisation. In theory, no business better illustrates the great opportunity that the opening up of world markets presents to the mature companies of the rich world. With a turnover of well over $1 trillion, and 10m employees, the car industry is still the world's largest manufacturing business. At present, many carmakers are doing well. The American Big Three (GM, Ford and Chrysler) and Japan's Toyota are rich in cash.

Nonetheless, having powered ahead for so long, the industry as a whole must now execute a death-defying turn. In the rich countries of Western Europe, Japan and North America, where the industry has until now earned most of its money, roads are becoming congested and markets saturated. Luckily for car makers, demand for cars in the developing world is set to grow, at just the right moment to make up for the shortfall in the traditional markets. But to steer in this new direction is harder than it looks. The reason is that it is not just the demand for cars that is growing in these new markets. For a while the supply of them will grow faster still, pushing down prices and profits everywhere.

|

|

Such is the rush to capture new markets in Asia and Latin America that on some estimates the industry will by 2000 have the capacity to produce about 22m more vehicles a year than the world wants. In other words, every car plant in America could close, and the world would still have too many cars. The Asia-Pacific region, already the world's biggest producer, will add the capacity to make extra 6m cars a year in the next five years. Worse still for the established companies, new entrants are joining the scramble. South Korea alone is building an industry with capacity about five times greater than the demand for cars in its domestic market. The South Koreans do not intend to confine their competition to the developing world. They will be muscling into Europe as well.

Unless you happen to be a carmaker, there is nothing to lament in all this. On the contrary, when too many cars pursue too few customers, consumers are sure to benefit. And not just consumers. One of the virtues of globalisation is that it will increase productivity and therefore prosperity in general. If they were lift to slug it out on their own, carmakers would in time compete the extra capacity away.

The more efficient firms would prosper and the weak would fall. Factories would be located in places - whether Detroit, Bavarian or Bangladesh - that have a comparative advantage in car making, and investors' capital would be allocated wherever it could earn the best return.

TEXT 33: FUN FOR THE MASSES

Are you better off than you used to be? Even after six years of sustained economic growth, Americans worry about that question. Economists who plumb government income statistics agree that American's incomes, as measured in inflation-adjusted dollars, have risen more slowly in the past two decades than in earlier times, and that some workers' real incomes have actually fallen. They also agree that by almost any measure, income is distributed less equally than it used to be. Neither of those claims, however, sheds much light on whether living standards are rising or falling. This is because "living standard" is a highly amorphous concept. Measuring how many people earn is relatively easy, at least compared with measuring how well they live.

A recent paper ("Less of a Luxury: The Rise of Recreation since 1888", June 1997). by Dora Costa, an economist at the Massachusetts Institute of Technology, looks at the living-standards debate from an unusual direction. Rather than worrying about cash incomes, Ms Costa investigates Americans' recreational habits over the past century. She finds that people of all income levels have steadily increased the amount of time and money they devote to having fun. The distribution of dollar incomes may have become more skewed in recent years, but leisure is more evenly spread than ever.

Ms Costa bases her research on consumption surveys dating back as far as 1888. The industrial workers surveyed in that year spent, on average, three-quarters of their incomes on food, shelter and clothing. Less than 2% of the average family's income was spent on leisure. But that average hid large disparities. The share of a family's budget that was spent on having fun rose sharply with its income: the lowest-income families in this working-class sample spent barely 1% of their budgets on recreation, while higher earners spent more than 3%. Only the latter group could afford such extravagances as theatre and concert performances, which were relatively much more expensive than they are today.

Since those days, leisure has steadily become less of a luxury. By 1991, the average household needed to devote only 38% of its income to the basic necessities, and was able to spend 6% on recreation. Moreover, Ms Costa finds that the share of the family budget spent on leisure now rises much less sharply with income than it used to. At the beginning of this century a family's recreational spending tended to rise by 20% for every 10% rise in income. By 1972-1973, a 10% income gain led to roughly a 15% rise in recreational spending, and the increase fell to only 13% in 1991. What this implies is that Americans of all income levels are now able to spend much more of their money on having fun.

|

|

One obvious cause is that real income overall has risen. If Americans in general are richer, their consumption of entertainment goods is less likely to be affected by changes in their income. But Ms Costa reckons that rising incomes are responsible for at most half of the changing structure of leisure spending. Much of the rest may be due to the fact that poorer Americans have more time off than they used to. In earlier years, low-wage workers faced extremely long hours and enjoyed few days off. But since the 1940s, the less skilled (and lower paid) have worked ever-fewer hours, giving them more time to enjoy leisure pursuits.

Conveniently, Americans have had an increasing number of recreational possibilities to choose from. Public investment in sports complexes, parks and golf courses has made leisure cheaper and more accessible. So too has technological innovation. Where listening to music used to imply paying for concert tickets or owning a piano, the invention of the radio made music accessible to everyone and virtually free. Compact discs, videos and other paraphernalia have widened the choice even further.

At a time when many economists are pointing accusing fingers at technology for causing a widening inequality in the wages of skilled and unskilled workers, Ms Costa's research gives it a much more egalitarian face. High earners have always been able to afford amusement. By lowering the price of entertainment, technology has improved the standard of living of those in the lower end of the income distribution. The implication of her results is that once recreation is taken into account the differences in Americans' living standards may not have widened so much after all.

These findings are not water-tight. Ms Costa's results depend heavily upon what exactly is classed as a recreational expenditure. Reading is an example. This was the most popular leisure activity for working men in 1888, accounting for one quarter of all recreational spending. In 1991, reading took only 16% of the entertainment dollar. But the American Department of Labour's expenditure surveys does not distinguish between the purchase of a mathematics tome and that of a best-selling novel. Both are classified as recreational expenses. If more money is being spent on textbooks and professional books now than in earlier years, this could make "recreational" spending appear stronger than it really is.

Although Ms Costa tries to address this problem by showing that her results still hold even when tricky categories, such as books, are removed from the sample, the difficulty is not entirely eliminated. Nonetheless, her broad conclusion seems fair. Recreation is more available to all and less dependent on income. On this measure at least, inequality of living standards has fallen.

So why the pervasive feeling that people are worse off? One reason may be that while lower-income families now enjoy more leisure, technology has created new leisure activities that they may desire but cannot afford. Or maybe the greater variety and quality of entertainment options makes Americans value their free time more than they used to, thereby making the feeling of over-work more onerous. When it comes to well being, perceptions play a large role. People who spend more time and money on having fun do not necessarily enjoy life more.

|

|

|

Типы оградительных сооружений в морском порту: По расположению оградительных сооружений в плане различают волноломы, обе оконечности...

Организация стока поверхностных вод: Наибольшее количество влаги на земном шаре испаряется с поверхности морей и океанов (88‰)...

Поперечные профили набережных и береговой полосы: На городских территориях берегоукрепление проектируют с учетом технических и экономических требований, но особое значение придают эстетическим...

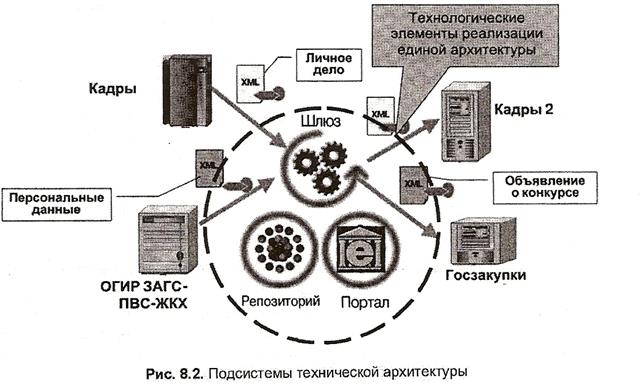

Архитектура электронного правительства: Единая архитектура – это методологический подход при создании системы управления государства, который строится...

© cyberpedia.su 2017-2024 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!