Организация стока поверхностных вод: Наибольшее количество влаги на земном шаре испаряется с поверхности морей и океанов (88‰)...

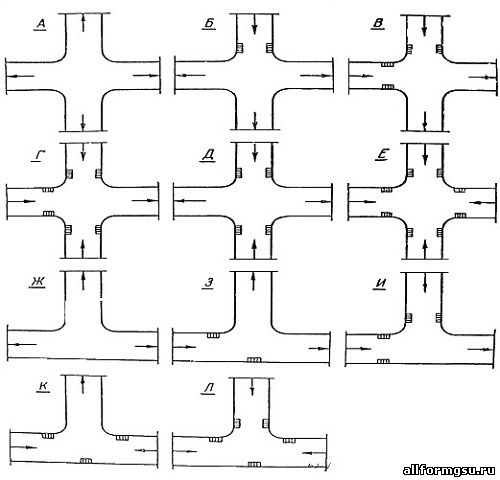

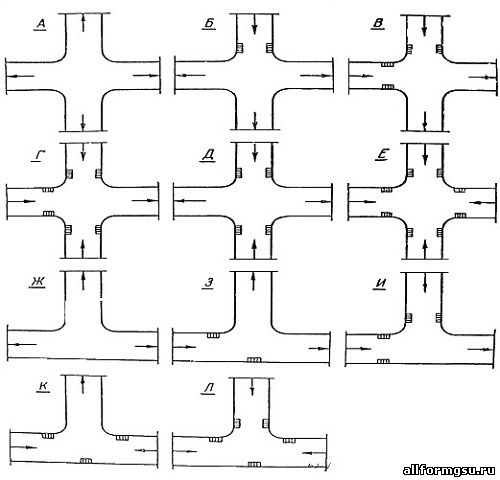

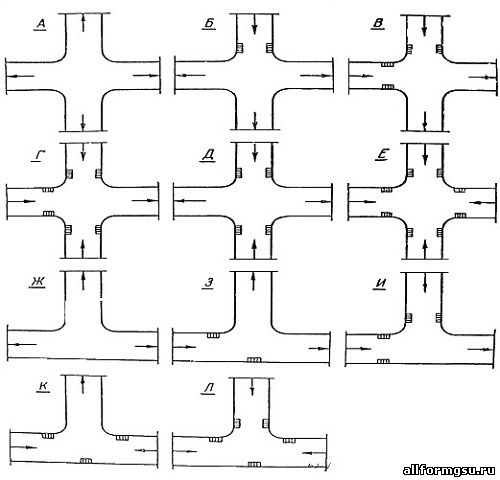

Общие условия выбора системы дренажа: Система дренажа выбирается в зависимости от характера защищаемого...

Организация стока поверхностных вод: Наибольшее количество влаги на земном шаре испаряется с поверхности морей и океанов (88‰)...

Общие условия выбора системы дренажа: Система дренажа выбирается в зависимости от характера защищаемого...

Топ:

Отражение на счетах бухгалтерского учета процесса приобретения: Процесс заготовления представляет систему экономических событий, включающих приобретение организацией у поставщиков сырья...

Устройство и оснащение процедурного кабинета: Решающая роль в обеспечении правильного лечения пациентов отводится процедурной медсестре...

Марксистская теория происхождения государства: По мнению Маркса и Энгельса, в основе развития общества, происходящих в нем изменений лежит...

Интересное:

Принципы управления денежными потоками: одним из методов контроля за состоянием денежной наличности является...

Искусственное повышение поверхности территории: Варианты искусственного повышения поверхности территории необходимо выбирать на основе анализа следующих характеристик защищаемой территории...

Уполаживание и террасирование склонов: Если глубина оврага более 5 м необходимо устройство берм. Варианты использования оврагов для градостроительных целей...

Дисциплины:

|

из

5.00

|

Заказать работу |

|

|

|

|

Today every country has a Central Bank. It acts as a lender to commercial banks and it acts as a banker to the government, taking responsibility for the funding of the government's budget deficit and the control of the money supply which includes currency outside the banking system plus the sight deposits of the commercial banks against which the private sector can write cheques. Thus, money supply is partly a liability of the Central Bank (currency in private circulation) and partly a liability of commercial banks (chequing accounts of the general public).

The Central Bank controls the quantity of currency in private circulation and the one held by the banks through purchases and sales of government securities. In addition, the Central Bank can impose reserve requirements on commercial banks, that is, it can impose the minimum ratio of cash reserves to deposits that banks must hold. The Central Bank also sets discount rate which is the interest rate commercial banks have to pay when they want to borrow money. Having set the discount rate, the Central Bank controls the money market.

Thus, the Central Bank is responsible for the government's monetary policy. Monetary policy is the control by the government of a country's currency and its system for lending and borrowing money through money supply in order to control the level of spending in the economy.

The demand for money is a demand for real money, that is, nominal money deflated by the price level to undertake a given quantity of transactions. Hence, when the price level doubles, other things equal, we expect the demand for nominal balances to double, leaving the demand for real money balances unaltered. People want money because of its purchasing power in terms of the goods it will buy.

The quantity of real balances demanded falls as the interest rate rises. On the other hand, when interest-bearing assets are risky, people prefer to hold some of the safe asset, money. When there is no immediate need to make transactions, this leads to a demand for holding interest-bearing time deposits rather than non-interest-bearing sight deposits. The demand for time deposits will be larger with an increase in the total wealth to be invested.

Interest rates are a tool to regulate the market for bonds. Being sold and purchased by the Central Bank, bonds depend on the latter for their supply and price.

Interest rates affect household wealth and consumption. Consumption is believed to depend both on interest rates and taxes. Higher interest rates reduce consumer demand. Temporary tax changes are likely to have less effect on consumer demand than tax changes that are expected to be permanent.

There also exists a close relationship between interest rates and incomes. With a given money supply, higher income must be accompanied by higher interest rates to keep money demand unchanged.

A given income level can be maintained by an easy monetary policy and a tight fiscal policy or by the converse.

|

|

Vocabulary:

reserve requirements – процент резерва, т.е. отношение денежной суммы, которая должна храниться на резервном счете в банке, к объему вкладов до востребования

discount rate – учетная ставка

level of spending – зд. общий объем расходов

real money, that is, nominal money deflated by the price level – реальные деньги, т.е. номинальная сумма с учетом текущего уровня цен (деньги с учетом их покупательной силы)

responsibility – ответственность

to take a responsibility for smth – взять на себя ответственность за что-либо

responsible a – ответственный, несущий ответственность

to be responsible for smth – быть ответственным за что-либо

budget deficit – бюджетный дефицит (превышение государственных расходов над государственными доходами, которое должно покрываться либо за счет заимов, либо путем денежной эмиссии)

money supply – денежная масса в обращении; денежное предложение (количество денег, выпущенное в стране, обычно центральным банком)

outside prep – вне; за пределами

thus adv – следовательно, итак, в соответствии с этим; так, таким образом

circulation n – обращение

in addition (to it) – вдобавок, кроме того, к тому же

ratio n – отношение, коэффициент, пропорция, соотношение

interest rate – процентная ставка (отношение суммы платежей за использование финансового капитала к сумме займа)

monetary policy – денежно-кредитная, монетарная политика

policy n – политика

easy policy – мягкая, нежесткая полтика

tight policy – жесткая полтика

to adopt a policy – принимать политику

to implement / to pursue a policy – проводить, осуществлять политику

hence adv – следовательно, в результате

to alter v – изменять, переделывать, менять

because of prep – из-за, вследствие

on the one hand – с одной стороны

on the other hand – с другой стороны

wealth n – богатство, материальные ценности

permanent a – постоянный, долговременный

Exercise 1: Match the two parts of the sentences:

| 1. In the Russia of the late 90s there could clearly be seen a tendency of decreasing money supply alongside growing amount of cash, | a) implementing the government's monetary policy. |

| 2. A required reserve ratio | b) or means of holding wealth. |

| 3. Money supply is | c) the lower the demand for money. |

| 4. Money is a very special asset, | d) is a minimum ratio of cash reserves to deposits that the Central Bank makes commercial banks hold. |

| 5. The aims of a monetary policy are mostly | e) the excess of government spending over taxation and other revenues. |

| 6. Budget deficit is known to be | f) the same as the aims of economic policy in general. |

| 7. The Bank of England is responsible for | g) the whole amount of money in an economy. |

| 8. The higher the interest rate, | h) which resulted from transferring money into foreign assets. |

|

|

Exercise 2: Replace the Russian words in italics in brackets with English equivalents:

1. The government increased the (денежную массу в обращении) to maintain aggregate demand at full employment level.

2. The Bank of England (отвечает за) issuing new bonds to replace the old ones.

3. Money consists mainly of two things: currency (с одной стороны) and chequing accounts (с другой стороны).

4. In industry, most of the new technology (принятой) by the less developed countries is taken from the developed countries.

5. High (процентные ставки) in an economy may be expected to lower aggregate investment.

6. The European Parliament officer demanded (более жесткие) rules of distributing contracts in the future.

7. Governments, due to inappropriate (зд. неправильной) (бюджетной кредитно-денежной политики), frequently (несли ответственность за) excessive inflation.

8. (Мягкая кредитно-денежная политика) is believed to result in more rapid inflation, while (жесткая кредитно-денежная политика) helps (изменить) an economy into the one having slower inflation.

9. Having raised the (соотношение процента резерва), the Central Bank made commercial banks reduce their lending to build up reserves.

Exercise 3: Group the following words into synonyms’ and antonyms’ pairs:

long-term, to change, in addition, to lend out, mostly, within, hence, thus, in this way, to result in, outside, the latter, easy, permanent, to implement, constant, besides, tight, to alter, temporary, mainly, to result from, therefore, the former, to borrow, to pursue, to give rise to

Exercise 4: Fill in the gaps with the following words and word combinations in the correct form:

| interest rate, within, without, to alter, tight, outside, money supply, ratio (2), thus, in addition, in addition to, because of, responsibility (2), to implement |

1.... regulation of the Central Bank is considered to prevent sudden increases in … ….

2. Changes in the........ … on government securities often affect industrial share prices.

3. A gold card is a credit card that gives its holder access to various benefits … … … those offered to standard card holders.

4. Being the only manager and operative (зд. рабочий) at the same time, the owner of a one-person firm takes all the... for performance (зд. работа) of his business.

5. Most food can be produced... the household. … …, some part of the required food can be exchanged for other food or services... the household... money...., these transactions remain... statistics.

6. The Central Bank has the... for the government's monetary policy.

7. The... of pensioners to the labour force … … negative demographic tendencies is currently 0.5 percent smaller in Russia than in Germany or the United Kingdom. The... is expected to grow to an unfavourable one by 2007.

8. Although the Central Bank is constantly trading in securities to change the actual reserves of the banking system, it seldom... reserve requirements.

Exercise 5: Choose the correct word:

1. The control of the parliament over the Central Bank's policies is currently very weak in Russia, which is in line with the (permanent / temporary) tradition in most countries.

2. (Easy / tight) monetary policy can lead to a large decrease in output and jobs.

3. The way of adapting the European Union's statistical system to demands of the 21st century is of importance both inside and (outside / in addition) the European Union (EU).

|

|

4. To reduce the (budget deficit / monetary policy) by £1 billion it is necessary to cut government spending by £1 billion.

5. Affecting all banks at the same time, reserve requirement changes are believed to be a very powerful tool of (pursuing / altering) the whole of monetary policy.

6. (Hence / in addition to) being a means of exchange, money is also used to measure the value of men's labour.

7. The Federal Reserve System of the USA influences interest rates set by the banks operating both within and (except / outside) the System.

8. When adopting a certain (fiscal / monetary) policy, the Central Bank has to choose between reducing unemployment, on the one hand, and reducing inflation, on the other. (However / hence), the decision often depends on political rather than economic conditions.

9. Russian economists consider the fluctuations of the exchange rate of the rouble to depend not so much on the monetary policy of the Central Bank as on the condition at the foreign exchange markets abroad. The situation is not likely to be (altered / permanent) until investment environment in Russia becomes favourable (благоприятный).

Exercise 6: Insert the following connecting elements and fixed word combinations into sentences:

| on the one hand (2), on the other hand (2), since, therefore, hence (2), whereas, because of (2) |

1. Almost every day newspapers and television seem to refer to the problems of inflation, unemployment, and slow growth. These problems,..., are likely to determine the outcome of elections (результаты выборов).

2. The fiscal year in the United Kingdom begins on April 6 of one calendar year and ends on April 5 of the next year... in the USA it runs from July 1 to June 30 of the next year.

3. Industry-specific human capital has both advantages and disadvantages. … … … …, long years in the same job result in higher wages … … … …, when industries decline (приходить в упадок, замедлять рост), workers having human capital that is in low demand may remain unemployed for a long time.

4.... money is not an ideal form for holding wealth, we need to understand why it is held at all.

5. In the 1980s, wages in West Germany were about three times as much as those in East Germany … … a more productive capital use and more know-how.

6. Perhaps … … their social and political aspects, labour markets are often heavily regulated, more so in Europe than in the USA.

7. The labour supply is a measure which is offered at given wages over a given period of time.... it is determined by the number of workers and the average number of hours each worker is prepared to offer.

8. The financial sector appears to be permanently altered. … … … …, there is little very special about banking...., many of these activities are expected to be done by others either instead of or as well as by banks. … … … …, many of the things that other financial institutions now do will eventually become the business of some banks.

Exercise 7: Make all possible word combinations; translate them into Russian and give their definitions in English:

a)  considerable

considerable

responsible wealth

national

taxed

b)  permanent

permanent

because of budget deficit

to adopt

in addition to

|

c) to alter

to adopt

to pursue a policy

to implement

to raise

Exercise 8: Translate the following sentences with Participle constructions into Russian according to the Models:

Model 1: Having lowered the prices, the firm... → Снизив цены, фирма …

|

|

Having obtained a loan, the firm... → Получив ссуду, фирма …

1. Having settled the debts, the banks...

2. Having imposed a high level of taxes, the government...

3. Having repaid the loan, the firm...

4. Having examined the labour market, the company...

5. Having used up its natural resources, the country...

Model 2: Being used in this way, money... → Когда (если) деньги используют таким образом, они…

Being imposed by the government, ceiling prices... → Так как максимальные цены устанавливаются правительством, они…

1. Being issued by the government, bonds...

2. Being paid on time deposits, interest...

3. Being determined for each particular product, the elasticity of supply...

4. Being regulated by the OPEC, oil prices...

5. Being used as a medium of exchange, money...

Model 3: Having been raised, the prices... → После того, как цены были повышены, они…

Having been imposed, the protection tariff... → После того как (так как) был установлен протекцонный тариф, он…

1. Having been exhausted, natural resources...

2. Having been formed, the government...

3. Having been interviewed, the Prime Minister...

4. Having been reduced, government spending...

5. Having been decreased, the VAT...

6. Having been determined, the GNP...

Exercise 9: Translate the Participle constructions into Russian:

1. Being responsible for the government's debts, the Central Bank...

2. Being implemented in the economy, a tight fiscal policy...

3. Having raised the interest rate, the bank...

4. Having been adopted late in the year, the fiscal plan...

5. Having set the high discount rate, the Central Bank...

6. Having been raised, the discount rate...

7. Repurchasing (to repurchase – выкупить) the bills, the government...

8. Having been repurchased, the bills...

Exercise 10: Translate into English using Participle constructions:

1. Нанимая рабочих, фирма…

Наняв рабочих, фирма…

Когда рабочие наняты, они…

После того, как рабочие наняты, они…

2. Устанавливая учетную ставку, центральный банк…

Установив учетную ставку, центральный банк…

Так как учетная ставка устанавливается центральным банком, она…

После того, как учетная ставка установлена, она…

3. Делая вложения в человеческий капитал, вы…

Сделав вложения в человеческий капитал, общество…

Когда деньги вложены в человеческий капитал, они…

После того как сделаны вложения в человеческий капитал, они…

4. Покупая облигации, банк…

Купив облигации, банк…

Когда облигации покупает банк, они…

После того, как облигации куплены банком, они…

5. Выкупая векселя, заемщик…

Выкупив векселя, заемщик…

Если векселя выкупаются заемщиком, они…

Когда векселя выкуплены заемщиком, они…

Exercise 11: Translate the sentences into Russian:

1. In 1980, Professor Milton Friedman criticized the attempt of the Bank of England to control money supply indirectly through income, interest rates, and hence money demand.

2. Investment is unlikely to rise during a depression even if interest rate falls. Keynes argued that there was no assurance that savings would accumulate during a depression and thus depress interest rate, since savings depended on income and incomes were low because of high unemployment characteristic of a depression.

3. Keynesians believed that changes in money supply affected aggregate demand through their effects on interest rate. High interest rates reduce investment, which eventually reduces nation wealth. Low interest rates increase investment thus increasing national wealth. Because of the importance of these ratios, Keynesians considered a monetary policy tight or easy depending on current interest rates. High interest rates were interpreted as indicators of a tight monetary policy, whereas low interest rates were said to be indicators of an easy monetary policy.

|

|

4. The research has shown that it normally takes the Federal Reserve System about 14 months to detect a slowdown in economic activity, to alter its monetary policy and thus to affect a real GNP.

5. The Russian parliament would like to impose a tight control of the monetary policy currently adopted and implemented by the Central Bank of Russia.

Exercise 12: Translate the sentences into English. The underlined parts should be translated as Participle constructions.

1. В современных развитых странах отношение годового ВВП к денежной массе, находящейся в обращении, следующее: в Китае – 1,0, в Великобритании – 1,0, в Германии – 1,4 (существует тенденция уменьшения до 1,0), во Франции – 1,6, в Швейцарии – 0,8. В результате политики, проводимой правительством России с 1992 по 1998 годы, это соотношение возросло в нашей стране с 1,2 до 8,0, что сделало нормальную экономическую деятельность (activity) невозможной.

2. Проводя денежно-кредитную политику, центральный банк может влиять на денежную массу в стране.

3. Достигнув значительного экономического роста в последнее десятилетие, правительство увеличило богатство общества в целом.

4. При фантастическом богатстве природными ресурсами Россия сегодня стала одной из бедных стран.

5. С 1989 по 1997 год валовой внутренний продукт в Китае увеличился вдвое, достигнув 3366 миллиардов долларов. Это было в восемь раз больше, чем в России, и вдвое выше, чем в Германии.

Exercise 13: Translate the sentences into Russian paying attention to Participle constructions:

1. Money plays an essential role in the macroeconomy affecting prices, interest rates, and, eventually, all economic activity.

2. A firm has a balance sheet reporting assets of the firm at a specified time.

3. The 19th-century economists thought capital only to comprise wealth produced by industry in the past. Wealth, such as land and ore, not having been produced, was not included in capital.

4. Being an agreed measure of future payments in contracts, money serves as a standard of deferred payment.

5. The Central Bank can depress the level of interest rates increasing the quantity of money in circulation.

6. Only being provided with the required resources, an enterprise can work efficiently and increase its output.

7. Being responsible for the national debt, the Central Bank makes repayments on government securities, issues new long-term securities, makes regular payments of interest to holders of existing government securities.

8. Being issued by the Treasury (государственное казначейство, министерство финансов) on a weekly basis, bills may be considered an instrument of the monetary policy.

Text 2: Read and translate the text:

|

|

|

Организация стока поверхностных вод: Наибольшее количество влаги на земном шаре испаряется с поверхности морей и океанов (88‰)...

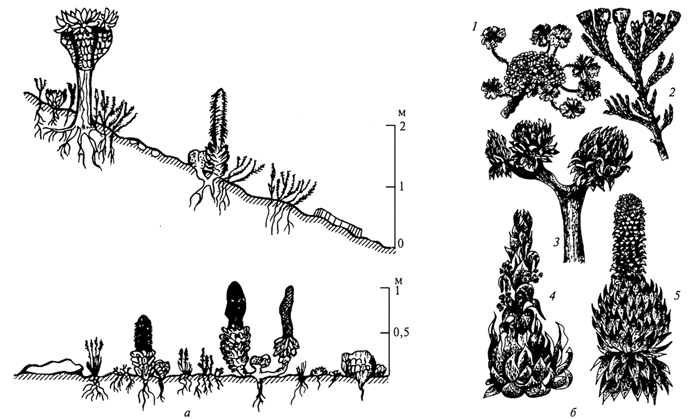

Адаптации растений и животных к жизни в горах: Большое значение для жизни организмов в горах имеют степень расчленения, крутизна и экспозиционные различия склонов...

Биохимия спиртового брожения: Основу технологии получения пива составляет спиртовое брожение, - при котором сахар превращается...

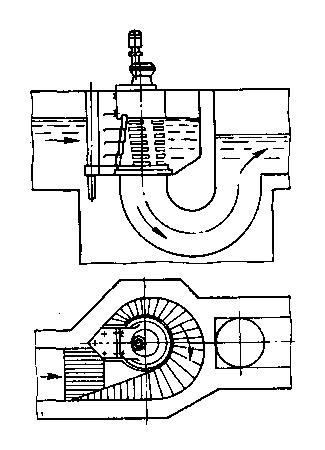

Состав сооружений: решетки и песколовки: Решетки – это первое устройство в схеме очистных сооружений. Они представляют...

© cyberpedia.su 2017-2024 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!