Типы оградительных сооружений в морском порту: По расположению оградительных сооружений в плане различают волноломы, обе оконечности...

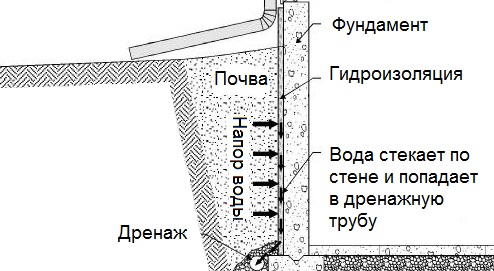

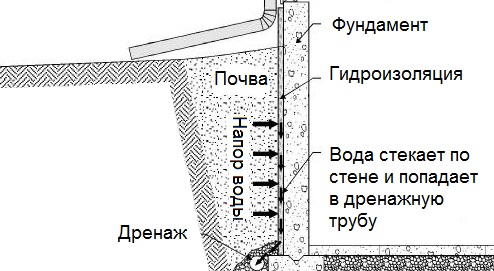

Общие условия выбора системы дренажа: Система дренажа выбирается в зависимости от характера защищаемого...

Типы оградительных сооружений в морском порту: По расположению оградительных сооружений в плане различают волноломы, обе оконечности...

Общие условия выбора системы дренажа: Система дренажа выбирается в зависимости от характера защищаемого...

Топ:

Определение места расположения распределительного центра: Фирма реализует продукцию на рынках сбыта и имеет постоянных поставщиков в разных регионах. Увеличение объема продаж...

Основы обеспечения единства измерений: Обеспечение единства измерений - деятельность метрологических служб, направленная на достижение...

Когда производится ограждение поезда, остановившегося на перегоне: Во всех случаях немедленно должно быть ограждено место препятствия для движения поездов на смежном пути двухпутного...

Интересное:

Что нужно делать при лейкемии: Прежде всего, необходимо выяснить, не страдаете ли вы каким-либо душевным недугом...

Подходы к решению темы фильма: Существует три основных типа исторического фильма, имеющих между собой много общего...

Средства для ингаляционного наркоза: Наркоз наступает в результате вдыхания (ингаляции) средств, которое осуществляют или с помощью маски...

Дисциплины:

|

из

5.00

|

Заказать работу |

|

|

|

|

Text 1: Read and translate the text and find in the text:

MONEY AND ITS FUNCTIONS

Money has four functions: a medium of exchange or means of payment, a store of value, a unit of account and a standard of deferred payment. When used as a medium of exchange, money is considered to be distinguished from other assets.

Money as the medium of exchange is believed to be used in one half of almost all exchange. Workers exchange labour for money, people buy or sell goods in exchange for money as well.

People do not accept money to consume it directly but because it can subsequently be used to buy things, they wish to consume. To see the advantages of a medium of exchange, imagine a barter economy, that is, an economy having no medium of exchange. Goods are traded directly or swapped for other goods. The seller and the buyer eachmust want something the other has to offer. Trading is very expensive. People spend a lot of time and effort finding others with whom they can make swaps. Nowadays, there exist actually no purely barter economies, but economies nearer to or farther from the barter type. The closer is the economy to the barter type, the more wasteful it is.

Serving as a medium of exchange is presumed to have for centuries been an essential function of money.

The unit of account is the unit in which prices are quoted and accounts are kept. In Britain, for instance, prices are quoted in pounds sterling; in France, in French francs. It is usually convenient to use the same unit to measure the medium of exchange as well as to quote prices and keep accounts in. However, there may be exceptions. During the rapid German inflation of 1922-23 when prices in marks were changing very quickly, German shopkeepers found it more convenient to use US dollars as the unit of account. Prices were quoted in dollars though payment was made in marks. The same goes for Russia and other post-communist economies who used the US dollar as a unit of account, keeping their national currencies as means of actual payment. The higher is the inflation rate, the greater is the probability of introducing a temporary unit of account alongside the existing units for measuring medium of exchange.

Money is a store of value, for it can be used to make purchases in future. For money to be accepted in exchange, it has to be a store of value. Unless suitable for buying goods with tomorrow, money will not be accepted as payments for the goods supplied today. But money is neither the only nor necessarily the best store of value. Houses, stamp collections, and interest-bearing bank accounts all serve as stores of value.

Finally, money serves as a standard of deferred payment or a unit of account over time. When money is borrowed, the amount to be repaid next year is measured in units of national currency, pounds of sterling for the United Kingdom, for example. Although convenient, this is not an essential function of money. UK citizens can get bank loans specifying in dollars the amount that must be repaid next year.

|

|

Thus, the key feature of money is its use as a medium of exchange. For money to be used successfully as a means of exchange, it must be a store of value as well. And it is usually, though not always, convenient to make money the unit of account and standard of deferred payment.

Vocabulary:

to quote – регистрировать, называть

the same goes for… – то же самое относятся к…

The... the... – чем … тем …

The more the better. – Чем больше, тем лучше.

for – 1. prep для, за, на; в течение; 2. cj (после запятой) так как, потому что

for example / for instance – например

for + noun + Infinitive – для того, чтобы что-то было сделано

medium n (зд. -dia) – средство, способ

exchange – обмен

medium of exchange – средство обмена, средство обращеня (как функция денег)

in exchange for smth – в обмен на что-л

exchange v (smth for smth) – менять, обменивать (что-л на что-л)

exchange rate – обменный курс

the exchange rate of rouble against US dollar – обменный курс рубля по отношению к американскому доллару

means n – (употребляется с глаголом в ед. ли мн. ч.) средство, средства

store n – запас, резерв

store of value – средство сбережения; средство образования капитала; средство «сохранения стоимости» (как функция денег)

store v – накапливать, запасать; хранить

account n – 1. расчет, подсчет; 2. счет; запись финансовых операций.

unit of account – расчетная единица

to keep an account – вести счет

defer v – откладывать, отсрочивать

deferred payment – отложенный, отсроченный платеж

distinguish v – (smth from smth) отличать, различать (одну вещь от другой); (between things) проводить различие (между двумя вещами)

accept v – принимать

barter n – бартер (способ торговли, состоящий в обмене товарами и услугами без использования денег)

trade v 1. (in smth with smb) торговать (чем-л с кем-л);2. (smth for smth) обменивать (что-л на что-л)

trade n – торговля

swap v (smth for smth) менять (что-л на что-л) (употребляется преимущественно для обозначения бартерных операций)

swap n – обмен

to make a swap – произвести обмен

expensive a – дорогой

nowadays adv – в наше время, в наши дни, теперь

actually adv – фактически, на самом деле

actual a – фактический

wasteful a – неэкономный, расточительный

waste v – расточать, попусту тратить, терять (время, средства)

convenient a – удобный

exception n – исключение

|

|

with the exception of this bank – за исключением этого банка

rapid a – быстрый, скорый

currency n – валюта

temporary a – временный

alongside prep – наряду с, вместе с

finally adv – в конце концов, в заключение

repay (repaid, repaid) v – возвращать (долг)

loan n – заем, ссуда

Text 2: Read the text and find the sentences which have the same information with the sentences in Text 1.

MONEY AND ITS FUNCTIONS

The main feature of money is its acceptance as the means of payment or medium of exchange. Nevertheless, money has other functions. It is a standard of value, a unit of account, a store of value and a standard of deferred payment.

The Medium of Exchange

Money, the medium of exchange, is used in one-half of almost all exchange. Workers work for money. People buy and sell goods in exchange for money. We accept money not to consume it directly but because it can subsequently be used to buy things we wish to consume. Money is the medium through which people exchange goods and services.

In barter economy there is no medium of exchange. Goods are traded directly or swapped for other goods. In a barter economy, the seller and the buyer each must want something the other has to offer. Each person is simultaneously a seller and a buyer. There is a double coincidence of wants.

Trading is very expensive in a barter economy. People must spend a lot of time and effort finding others with whom they can make mutually satisfactory swaps. Since time and effort are scarce resources, a barter economy is wasteful.

Money is generally accepted in payment for goods, services, and debts and makes the trading process simpler and more efficient.

Other Functions of Money

Money can also serve as a standard of value. Society considers it convenient to use a monetary unit to determine relative costs of different goods and services. In this function money appears as the unit of account, is the unit in which prices are quoted and accounts are kept.

To be accepted in exchange, money has to be a store of value. Money is a store of value because it can be used to make purchases in the future.

Houses, stamp collections, and interest-bearing bank accounts all serve as stores of value. Since money pays no interest and its real purchasing power is eroded by inflation, there are almost certainly better ways to store value.

Finally, money serves as a standard of deferred payment or a unit pf account over time. When you borrow, the amount to be repaid next year is measured in money value.

Different Kinds of Money

Golden coins are the examples of commodity money, because their gold content is a commodity.

A token money is a means of payment whose value or purchasing power as money greatly exceeds its cost of production or value in uses other than as money.

A $10 note is worth far more as money than as a 3x6 inch piece of high-quality paper. Similarly, the monetary value of most coins exceeds the amount you would get by melting them down and selling off the metals they contain. By collectively agreeing to use token money, society economizes on the scarce resources required to produce money as a medium of exchange. Since the manufacturing costs are tiny, why doesn't everyone make $10 notes? The essential condition for the survival of token money is the restriction of the right to supply it, Private production is illegal.

Society enforces the use of token money by making it legal tender. The law says it must be accepted as a means of payment. In modem economies, token money is supplemented by IOU money.

An IOU money is a medium of exchange based on the debt of a private firm or individual.

A bank deposit is IOU money because it is a debt of the bank. When you have a bank deposit the bank owes you money. You can write a cheque to yourself or a third party and the bank is obliged to pay whenever the cheque is presented. Bank deposits are a medium of exchange because they are generally accepted as payment.

|

|

Vocabulary:

the means of payment – средство платежа

medium of exchange – средство обращения

a standard of value – мера стоимости

a unit of account – единица учета

a store of value – средство сбережения (сохранения стоимости)

a standard of deferred payment – средство погашения долга

subsequently – впоследствии

a barter economy – бартерная экономка

to swap (to exchange, to barter) – обменивать, менять

to hand over in exchange – передать, вручить в обмен

a double coincidence of wants – двойное совпадение потребностей

a monetary unit – денежная единица

to remind of – напоминать

to be worthless – обесцениваться

an interest-bearing bank account – счет в банке с выплатой процентов

to pay interest – приносить процентный доход

to erode – зд. фактически уменьшаться

hard currency – твердая (конвертируемая) валюта

soft currency – неконвертируемая валюта

invariably – неизменно, постоянно

commodity money – деньги-товар

token money – символические деньги (дензнаки, жетоны, и т.п.)

to melt down – расплавить

tiny costs – мизерные затраты

to supplement – дополнять

legal tender – законное платежное средство

IOU money (I Owe You – я вам должен) деньги – долговое обязательство

a bank deposit – вклад в банке

Exercise 1: Choose the correct word:

1. Pounds (фунт) and ounces (унция) were traditional measures widely used in Britain, often (alongside / besides) metric measures before 2000.

2. Barter economies are believed to be more (convenient / wasteful) than the ones based on money.

3. We (distinguish between / accept both) real and nominal GNP.

4. (The exchange rate / barter) is known to be regulated by the Central Bank.

5. When measured, depreciation should be subtracted (вычитать) from the GNP to give a clear picture of the output that is (temporarily / actually) available for national consumption.

6. Initially, gold and other valuable metals were used (to keep an account of / to store) wealth over time.

7. Large firms are supposed to have a better chance of obtaining a loan from a bank than smaller firms, though there may be (exceptions / exchanges).

1. Plastic cards are reported to be (accepted / deferred) for payment only in Moscow, St. Petersburg, Lipetsk, Chelyabinsk and a few other cities and there is no commonly (accepted / distinguished) standard.

2. Due to poor communications across the country and the high initial cost of introducing (внедрять) plastic cards, Russia (finally / temporarily) has a less developed plastic card infrastructure than most European countries.

Exercise 2: Match the two parts of the sentences:

| 1. Classical economists considered money to be no more | a) either through private exchange dealers or a country's central bank. |

| 2. Money is an asset | b) known to be a means of measuring the value of men's labour. |

| 3. Money is used as a standard of deferred payment, | c) of exchanging one kind of financial asset or liability for another. |

| 4. Loans provided by commercial banks, building societies, etc. | d) than a medium of exchange. |

| 5. In addition to being a means of exchange money is also | e) or currency. |

| 6. Swap in a money market is a process | f) for it is an accepted measure of future payments in contracts. |

| 7. Exchange rate is | g) without the use of money. |

| 8. GNPs are measured in the country's local monetary unit, | h) the price of one currency in terms of some other currency, for instance, the price at which dollars might be exchanged for pounds. |

| 9. The foreign exchange market is a market where foreign currencies are sold and bought | i) are an essential source of money for everyday consumption and purchase of personal and business assets. |

| 10. Barter is a method of trading goods and services for other goods and services | j) that is accepted as a means of payment. |

|

|

Exercise 3: Fill in the gaps with the words and word combinations from Vocabulary to Text 1:

1. Money has no value in itself but serves as a … … … between commodities which we consider to be valuable for us.

2. Governments are supposed to... essential foods to meet the needs of

the population in case of emergency (в случае крайней необходимости, в чрезвычайных обстоятельствах).

3. Economists … … productive and unproductive labour.

4. Typically, consumers buy more of everything. However, there are.... Among... there are inferior goods.

5. Money as a … … … lets people determine prices for goods, and services and... them conveniently and less wastefully in a market rather than... one good directly for another as in barter....

6. A firm that has borrowed to see it through a sticky period (зд. помочь пережить тяжелые времена) may not be able to … … … when the bank demands.

7. When transferred from one bank... to another, money does not consist of any physical commodity.

8. Four Swedish ports are free trade zones where goods may be... duty-free for an unlimited period of time.

Exercise 4: Give Russian equivalents to the following using Vocabulary to Text 2:

1. exchange labour services for money

2. you must hand over in exchange a good or service

3. a double coincidence of wants

4. spend a lot of time and effort

5. make mutually satisfactory swap

6. a barter economy is wasteful

7. commodity generally accepted in payment for goods

8. prices are quoted and accounts are kept

9. its purchasing power is eroded by inflation

10. it's usually but not invariably convenient

11. cut back on other uses

12. exceeds its cost of production

13. by collectively agreeing

14. the survival of token money

15. society enforces the use of token money

16. token money is supplemented by IOU money

17. interest-bearing bank accounts

Exercise 5: Replace the words in italics by synonyms:

sometimes payment can be put off till later,

the vital feature of money;

its purchasing power is worn away,

the money is without value,

it is not always convenient;

time and effort are rare resources;

private production of money is against the law

Exercise 6: Find in the Text 2 English equivalents for the following:

1. средство платежа

2. средство обращения

3. мера стоимости

4. средство сбережения (средство сохранения стоимости)

5. единица учета

6. средство погашения долга

7. в обмен на

8. может быть впоследствии использовано

9. обмениваться товарам и услугами

10. бартерная экономика

11. измеряться

12. обесцененный

13. платить проценты

14. покупательная способность

15. промышленное использование

16. потребительское использование

17. деньги-товар

18. денежные знаки (символические деньги)

19. денежная стоимость

20. ограничение права

21. вклад в банке

22. банковская ссуда

23. законное платежное средство

24. долговое обязательство

Exercise 7: Translate the sentences with conjunction the … the … into Russian:

1. The greater a person's income, the more he will usually buy.

2. The higher the labour productivity, the lower the production cost.

3. The higher is the demand, the higher can the price for the commodity be.

4. The greater is the number of sellers in a market, the better choice can a buyer make.

5. The more inelastic is the demand, the more will a tax fall on purchasers rather than sellers.

6. The more efficiently is the equipment used, the higher is the labour productivity and the more effective is the production.

|

|

7. In each industry, the more workers there are, the greater is the total output of the good produced.

8. The higher the real wage, the more individuals the labour force comprises.

Exercise 8: Work out the meaning of for. Translate the sentences into Russian.

1. Information resources are too scarce (скудный) for statistics to avoid (избегать) compromises.

2. Smaller firms have for some time been believed to be at a disadvantage compared with large firms when they need to borrow.

3. Present-day economists do not distinguish profit from rent, for they think capital to comprise various kinds of property, land in particular.

4. Many economists specialize in a particular branch of the subject, for instance, urban economics studies city problems, land use, transport, and housing.

5. People can hold money (держать деньги в наличности или на расчетном счете в банке) to finance some future purchase without loss of purchasing power, for money serves as a store of value.

Exercise 9: Translate into English:

Существует несколько функций денег. Во-первых, и прежде всего, деньги являются средством платежа, или обращения; деньги можно использовать при покупке и продаже товаров и услуг. Деньги выступают также мерой стоимости. Общество считает удобным использовать денежную единицу в качестве масштаба для соизмерения относительных стоимостей различных благ и ресурсов.

Деньги служат средством сбережения. Поскольку деньги являются наиболее ликвидным товаром, то есть таким, который можно без проблем продать (обменять), то они являются очень удобной формой хранения богатства. Во время упадка в экономике, при высокой инфляции и обесценении денег, население, скорее всего, будет хранить богатство в виде недвижимости или других дорогостоящих товаров – предметах искусства, драгоценностях.

Деньги, которые, являются долговыми обязательствами государства, коммерческих банков и сберегательных учреждений, имеют стоимость благодаря товарам и услугам, которые приобретаются за них на рынке.

Exercise 10: Translate the following sentences into Russian paying attention to different comparative constructions:

1. Through macroeconomic policies the government attempts (пытаться) to stabilize the economy, keeping it as close (близкий) as possible to full employment with low inflation.

2. The statement (утверждение) "The stronger the government intervention, the higher the taxes" is not always true.

3. Nowadays events (событие) in other countries affect our daily lives much more than they did ten years ago.

4. The domestic price for grain that is much higher than the price in international grain market must have eventually been paid by the US taxpayers.

5. The stronger an economy, the more fully its currency performs its functions.

6. An asset which can be held for some time and then converted into money at the same price as its purchase price can be used as a store of value.

7. The prices for electricity next year are expected to be as high as this year and even higher.

8. The sales taxes vary from region to region, the taxes in our region are higher than those in the South.

Exercise 11: Translate the sentences into Russian:

1. The taxable income next year is expected to be (выше, чем) this year.

2. In a period of rapid inflation, money cannot perform its function as a store of value (так же хорошо, как) in periods with no or low inflation. This function comes to be (чаще) performed by real property assets (чем) by money.

3. The purchasing power of money is (намного ниже, чем) a year ago.

4. In Russia, the prices for farm products did not rise (так же значительно, как) the prices for inputs over the past decade.

5. If the demand for pounds is falling, it reflects the fact that pounds be come (менее дорогие) to Americans and British goods, services, and as sets can be bought (дешевле). This will make Americans demand (большие количества) of British goods, and finally (большие суммы) of pounds.

6. (Чем больше) labour is invested in a commodity, (тем выше) is its price.

7. Deutschemarks are known to have been used in post-communist Russia both as a unit of account and a store of value, though (не так широко, как) US dollars.

8. In the Russia of the late 1990s, the attractiveness (привлекательность) of gold bullions (слиток)as a store of value was (не такая высокая, как) the Central Bank had expected, for people could not sell them (по такой же цене, которую) they paid for them.

Exercise 12: Translate the sentences into Russian:

1. Loan is a sum of money which is borrowed by a person or business from another person or business, a bank in particular, and which is to be repaid within a certain period of time with interest.

2. The prices must have been temporarily depressed as a result of accumulated public stores of essential goods and the government programmes of producer support.

3. Although it was prohibited to use foreign currency as a medium of exchange or a means of payment, it is known to have been widely used as such in the Russia of the 1990s.

4. Middle price is the price for foreign currency or commodity which lies halfway between the actual buying price and the actual selling price quoted by dealers. Prices and exchange rates published in newspapers are actually middle prices.

5. The exchange rate of national currency against foreign currency is a reliable enough indicator of the domestic economy stability and its attractiveness for foreign investors.

6. We know means of payment to have varied over time from pebbles and oxen to money including credit cards and bank accounts.

7. Though recently introduced, Euro can be used for purchases by credit cards and travellers' cheques nowadays.

8. The IMF officials suspect that much of the $4.8 billion loans the IMF sent to Russia in the summer of 1998 may have been transferred by oligarchs to Switzerland and other Western countries.

Exercise 13: Translate the sentences into English:

1. Говорят, что использование нескольких национальных валют более расточительно для ряда стран, чем использование одной общей валюты.

2. Экономисты предполагали, что евро будет использоваться в странах Европейского Союза наряду с национальными валютами до 2003 года.

3. Полагают, что из-за пособий по безработице временная безработица превращается в постоянную.

4. Налоговая реформа 1990 года в Швеции положила конец ряду условий при которых налоги могли быть уменьшены, а уплата налога могла быть отсрочена.

5. Сообщалось, что большинство европейских банков начали предлагать счета в евро и начали торги по евро, как только была введена новая денежная единица.

6. Ссуды, предоставленные коммерческими банками, стротельными обществами и т.п., должны рассматриваться как важнейший источник кредита в стране.

Exercise 14: Read and translate:

1. Before 1999 the Common Market (Общий рынок) member states had the common currency called ECU (European Common Unit). In 1999 the Common Market introduced (вводить) a new currency - Euro - used temporarily only in bank operations. Euro was more expensive than US dollar in January 1999. Since 2003 Euro is expected to be used not only in the banks.

2. The International Monetary Fund (IMF) is expected to expand international trade, stabilize exchange rates, and help countries having temporary balance of payments difficulties maintain their exchange rates. The IMF supplies the member country with the amount of foreign currency it wishes to purchase in exchange for the equivalent amount of its own currency. The member country must repay the amount buying back its own currency with a currency accepted by the Fund, usually within three to five years.

3. Up to the 1970s the IMF used a fixed exchange rate system which is a means for synchronizing and coordinating the exchange rates of member countries. The exchange rate of a currency is fixed against other countries' currencies, for instance, one US dollar = 260 Japanese yen. When fixed, the exchange rate is expected to be maintained over long periods, though countries may also choose to devalue or revalue their currencies.

In the early 1970s, however, a weakening of the US dollar made a large number of currencies "float" (плавать) to provide a greater degree of exchange rate flexibility (гибкость). With a floating exchange rate system, the value of each country's currency in terms of other currencies was determined by supply of and demand for it depending on the strength or weakness of balance of payments position in the economy in question.

Most currencies have continued to float although there have been exceptions. Fixed exchange rates are known to have been imposed on a limited basis, as in the European Community.

Nowadays, fixed exchange rates are believed to be preferred to floating ones, since they are said to provide more convenient and less risky conditions for foreign trade.

Text 3: Read the text translate and entitle it.

To serve as a means of deferred payment is an important function of money due to the fact that most business is transacted on the basis of credit nowadays. When goods are supplied on credit, the buyer becomes the owner of the good at the time of delivery but he does not have to make payment at once. The buyer pays by installments (очередной взнос) within a certain period of time, for instance, three or even six months after delivery. When signed (подписывать), a special contract, usually referred to as "hire purchase contract", lets the buyer make payments over several years.

A complex system of consumer credit can only operate in a monetary economy. Sellers are not expected to deliver goods for promises of future payment in terms of any goods except money, for it will be difficult for them to say how much of which commodity they will need at which particular time in the future. If not required by the seller himself, the commodity received in payment may be difficult to trade for another one. Being a universal medium of exchange, money lets sellers rely on promises of payments in terms of money to be made in future.

Text 4: Read and translate the following text

|

|

|

Автоматическое растормаживание колес: Тормозные устройства колес предназначены для уменьшения длины пробега и улучшения маневрирования ВС при...

Историки об Елизавете Петровне: Елизавета попала между двумя встречными культурными течениями, воспитывалась среди новых европейских веяний и преданий...

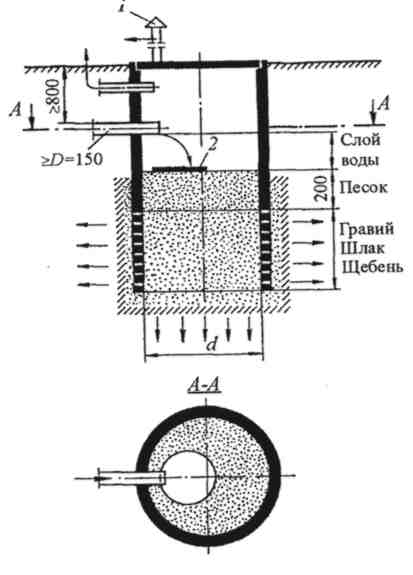

Индивидуальные очистные сооружения: К классу индивидуальных очистных сооружений относят сооружения, пропускная способность которых...

Общие условия выбора системы дренажа: Система дренажа выбирается в зависимости от характера защищаемого...

© cyberpedia.su 2017-2024 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!