Индивидуальные и групповые автопоилки: для животных. Схемы и конструкции...

Автоматическое растормаживание колес: Тормозные устройства колес предназначены для уменьшения длины пробега и улучшения маневрирования ВС при...

Индивидуальные и групповые автопоилки: для животных. Схемы и конструкции...

Автоматическое растормаживание колес: Тормозные устройства колес предназначены для уменьшения длины пробега и улучшения маневрирования ВС при...

Топ:

Методика измерений сопротивления растеканию тока анодного заземления: Анодный заземлитель (анод) – проводник, погруженный в электролитическую среду (грунт, раствор электролита) и подключенный к положительному...

Процедура выполнения команд. Рабочий цикл процессора: Функционирование процессора в основном состоит из повторяющихся рабочих циклов, каждый из которых соответствует...

Интересное:

Искусственное повышение поверхности территории: Варианты искусственного повышения поверхности территории необходимо выбирать на основе анализа следующих характеристик защищаемой территории...

Распространение рака на другие отдаленные от желудка органы: Характерных симптомов рака желудка не существует. Выраженные симптомы появляются, когда опухоль...

Инженерная защита территорий, зданий и сооружений от опасных геологических процессов: Изучение оползневых явлений, оценка устойчивости склонов и проектирование противооползневых сооружений — актуальнейшие задачи, стоящие перед отечественными...

Дисциплины:

|

из

5.00

|

Заказать работу |

|

|

|

|

A promissory note is a written pledge by a borrower to pay a certain sum of money to a creditor at a specified future date. Unlike trade credit, however, promissory notes usually require the borrower to pay interest. Although repayment periods may extend to one year, most promissory notes specify 60 to 180 days. The customer buying on credit is called the maker and is the party that

issues the note. The business selling the merchandise on credit is called the payee.

A promissory note offers two important advantages to the firm extending the credit. First, a promissory note are negotiable instruments that can be sold when the money is needed immediately.

UNSECURED BANK LOANS

Commercial banks offer unsecured short-term loans to their customers at interest rates that vary with each borrower's credit rating. The prime interest rate (sometimes called the preference rate) is the lowest rate charged by a bank for a short-term loan. This lowest rate is generally reserved for large corporations with excellent credit ratings. Organizations with good to high credit ratings may have to pay the prime rate plus 4 percent. Of course, if the banker feels loan repayment may be a problem, the borrower's loan application may be rejected.

Banks generally offer short-term loans through promissory notes. Promissory notes that are written to banks are similar to those discussed in the last section.

COMMERCIAL PAPER

A commercial paper is a short-term promissory note issued by a large corporations. A commercial paper is secured only by the reputation of the issuing firm; no collateral is involved. It is usually issued in large denominations, ranging from $5,000 to $100,000. Corporations issuing commercial papers pay interest rates slightly below those charged by commercial banks. Thus, issuing a commercial paper is cheaper than getting short-term financing from a bank.

Large firms with excellent credit reputations can quickly raise large sums of money. They may issue commercial paper totaling millions of dollars. However, a commercial paper is not without risks. If the issuing corporation later has severe financing problems, it may not be able to repay the promised amounts.

|

|

COMMERCIAL DRAFTS

A commercial draft is a written order requiring a customer (the drawee) to pay a specified sum of money to a supplier (the drawer) for goods or services. It is often used when the supplier is insure about the customer's credit standing.

In this case, the draft is similar to an ordinary check with one exception: The draft is filled out by the seller and not the buyer. A sight draft is a commercial draft that is payable on demand -whenever the drawer wishes to collect. A time draft is a commercial draft on which a payment date is specified. Like promissory notes, drafts are negotiable instruments that can be discounted or used as collateral for a loan.

|

|

|

|

|

|

Exercises

I. Translate into Russian.

|

|

Source; unsecured financing; promissory note; commercial draft; trade credit; loan; commercial paper; transaction; delayed payment; credit terms; pay interest; interest rate; invoice; amount; prompt payment; written pledge; sum of money; borrower; repayment period; buy on credit; deliver; provide aid; maker; payee; offer loans; credit rating; prime interest rate; questionable credit rating; large denomination; raise large sums of money; drawee; drawer; credit standing; sight draft; time draft; collateral; commercial draft.

II. Find the English equivalents.

Ссуда; давать ссуду; процент; процентная ставка; необеспеченное финансирование; покупать в кредит; условия кредита; счет-фактура; основная сумма; деловая операция; торговый кредит; долговое обязательство; коммерческая бумага; тратта (переводной вексель); условия; обеспечение (за лог); заемщик; трассат (лицо, на которое выставлена трат та); трассант (лицо, выписавшее переводной вексель- тратту); кредитоспособность; тратта (вексель) на предъявителя; срочная тратта.

III. Fill in each blank with a suitable word or word combi nation.

1. Trade credit is a payment... that a supplier grants to its customers.

2. The invoice that's....

3. A promissory note is a written... by a borrower to pay a certain sum of money at a specified date.

. 4. The customer buying on credit is called... and is the party that issues the promissory note.

5. The business selling the merchandise on credit is called....

6. Most promissory notes are... that can be sold when money is needed immediately.

7. The prime interest rate is the lowest rate charged by a bank for... loan.

8. A commercial paper is... issued by a large corporation.

9. A commercial paper is secured only by the... of the issuing. firm.

10. Issuing a commercial paper is... than getting short-term financing from a bank.

11. A commercial draft is a written... requiring a drawee to pay a specified sum of money to the... for goods or services.

12. A sight draft is a commercial draft that is payable on....

13. A... is a commercial draft on which a payment date is specified. 14. Like promissory notes drafts can be used as... for a loan.

IV. Translate into English.

1. Источники необеспеченного краткосрочного финансирования включают торговые кредиты, долговые обязательства, банковские ссуды, краткосрочные долговые обязательства (кредитно-денежные документы) и тратты (переводные векселя).

2. Торговый кредит — это отсрочка платежа, которую поставщик предоставляет своим клиентам.

3. Долговое обязательство — это письменное обязательство заемщика уплатить определенную сумму денег кредитору.

4. В отличие от торгового кредита долговые обязательства требуют, чтобы заемщик платил проценты.

|

|

5. Коммерческие банки предоставляют необеспеченные краткосрочные ссуды своим клиентам, которые меняются в зависимости от (with) кредитоспособности каждого заемщика.

6. Коммерческая бумага — это краткосрочное долговое обязательство, выпускаемое крупными корпорациями..

7. Коммерческая бумага не имеет специального (special) обеспечения.

8. Тратта (переводной вексель) — это письменный приказ, требующий, чтобы трассат (лицо, на которое выставле на тратта) уплатил конкретную сумму денег поставщику за товары или услуги.

9. Тратта часто используется, когда поставщик не уверен в кредитоспособности клиента.

V. Answer the questions.

1. What is unsecured financing?

2. What are the sources of unsecured short-term financing?

3. What is a trade credit?

4. What is the difference between a promissory note and trade credit?

5. In what case a loan application may be rejected by a bank?

6. What is a commercial paper secured by?

7. Why issuing a commercial paper is cheaper than getting short-term financing from a bank?

8. What is a commercial draft?

9. Can commercial drafts be used as collaterals for loans?

VI. Make up a written abstract of the above text.

VII. Retell the prepared abstract.

Unit7

Accounting

|

|

|

Индивидуальные и групповые автопоилки: для животных. Схемы и конструкции...

Семя – орган полового размножения и расселения растений: наружи у семян имеется плотный покров – кожура...

Автоматическое растормаживание колес: Тормозные устройства колес предназначены для уменьшения длины пробега и улучшения маневрирования ВС при...

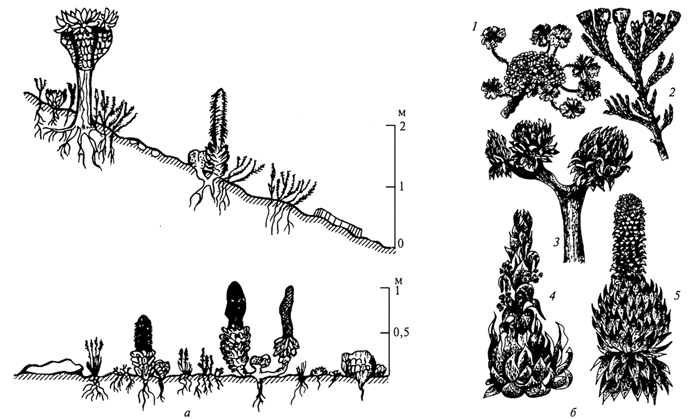

Адаптации растений и животных к жизни в горах: Большое значение для жизни организмов в горах имеют степень расчленения, крутизна и экспозиционные различия склонов...

© cyberpedia.su 2017-2024 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!