Индивидуальные и групповые автопоилки: для животных. Схемы и конструкции...

Типы оградительных сооружений в морском порту: По расположению оградительных сооружений в плане различают волноломы, обе оконечности...

Индивидуальные и групповые автопоилки: для животных. Схемы и конструкции...

Типы оградительных сооружений в морском порту: По расположению оградительных сооружений в плане различают волноломы, обе оконечности...

Топ:

Оценка эффективности инструментов коммуникационной политики: Внешние коммуникации - обмен информацией между организацией и её внешней средой...

Устройство и оснащение процедурного кабинета: Решающая роль в обеспечении правильного лечения пациентов отводится процедурной медсестре...

Интересное:

Финансовый рынок и его значение в управлении денежными потоками на современном этапе: любому предприятию для расширения производства и увеличения прибыли нужны...

Аура как энергетическое поле: многослойную ауру человека можно представить себе подобным...

Что нужно делать при лейкемии: Прежде всего, необходимо выяснить, не страдаете ли вы каким-либо душевным недугом...

Дисциплины:

|

из

5.00

|

Заказать работу |

Содержание книги

Поиск на нашем сайте

|

|

|

|

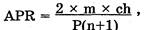

Credit costs vary from one lender to another, so think before you sign anything. Federal law requires that the lender tell you the total finance charges and the annual percentage rate or APR.

The finance charge is the total amount you pay to use credit. It includes interest costs and any other fees (such as service charges and insurance) that the seller or lender may be entitled to add to the loan.

The annual percentage rate, or APR, is the cost of credit calculated as a percent on an annual basis. For example, if someone lends you money at «only» 2.5 percent per month, the APR would be 30 percent (because 2.5 x 12 months = 30 percent).

Assume that a person borrowed $1000 at 10 percent interest. He agreed to pay the principal and interest back in 10 monthly installments. Calculate the APR with the following formula:

|

m is the number of payment periods per year (12 if the payments are made monthly; 52 if made weekly).

ch is the carrying charge or interest (the cost of the loan beyond the amount borrowed).

P is the principal (the amount borrowed).

n is the actual number of payments made.

Text 4: OBTAINING AND USING CREDIT

Credit is an arrangement that enables us to receive cash, goods or services now, with the understanding that we will pay for them in the future. Charge accounts, credit cards, installment plans, car loans and household mortgages are some of the best known forms of credit. Like so many things, credit has its advantages and disadvantages.

The principal advantages of credit are:

• Immediate possession. Credit enables us to enjoy goods and services immediately.

• Flexibility. Credit allows us to time our purchases so as to take advantage of sale items or other bargains even when our funds are low.

• Safety. Credit cards and charge accounts provide a safe and convenient means of carrying our purchasing power with us while we are shopping or traveling.

• Emergency funds. Credit gives us a cushion in an emergency (like an automobile breakdown when money is needed to get back on the road).

Here are some of the disadvantages of buying on credit:

• Overspending. Sometimes, credit cards and charge accounts make it too easy to spend money. Then, as the debts mount, it is often difficult to make the

necessary monthly payments.

• Higher cost. It usually costs more to buy on credit than for cash. One reason is that stores offering credit often charge more than those that sell only for cash. Another is that interest or other charges are often added to the cost of goods sold on credit.

• Untimely shopping. Credit shoppers often ignore sales and special prices because they can buy what they want on credit whenever they want it.

Who Can Borrow?

Lenders expect their money to be repaid along with the interest and other fees they charge for the use of their money. For that reason lenders will investigate the credit history of all loan applicants to determine that they are credit worthy. A credit history is the record of how individuals pay their bills and repay loans.

The Three C's

In judging an individual's credit worthiness, lenders often look at the «three C's» of credit: character, capacity and capital.

• Character refers to personal qualities – honesty and willingness to repay debts. If the record shows that bills were paid on time in the past, lenders will assume this will continue in the future.

• Capacity is a measure of the ability to repay debts. Creditors will want to know about the sources of income, how much the person earns and his other financial obligations.

• Capital refers to the things that people own – money in the bank, or property. In general, the more one owns, the easier it will be to repay one's debts. Lenders may also ask that some capital be offered as collateral, something pledged as security for the loan.

Text 5: WHAT KINDS OF CREDIT ARE AVAILABLE?

Credit for consumers falls into two categories: loan credit and sales credit.

Loan credit enables you to borrow money which can then be used to finance a purchase. Sales credit enables you to buy goods and services now and pay for them later. Here are some examples of each.

Home mortgages. Home mortgages are long-term loans (repayable in 10 to 30 years) used to finance the purchase of a home or apartment. Banks, savings and loans and other thrift institutions are the most likely sources of mortgage money. Home mortgages are repaid with interest, in equal monthly installments, over the life of the loan.

Auto and other consumer loans. Loans for financing the purchase of specific items like automobiles, or other goods and services, are available from a variety of thrift institutions and lending agencies. Auto and other consumer loans are usually repaid in equal monthly installments over the life of the loan.

Charge accounts. Charge accounts enable consumers to make purchases up to a specified limit, without paying cash. There is usually no charge for the use of a charge account if the balance is paid in full at the end of the month. However, interest is likely to be charged on balances that are not paid at the end of one month.

Credit cards. A credit card is a kind of charge account that entitles its holders to shop at many different places. Master Card, Visa, American Express and Diner's Club are four of the most widely used credit cards. Credit card purchases are billed monthly. Like charge accounts, there is usually no charge for credit card purchases that are paid in full when billed. However, there is an additional charge levied on unpaid balances.

Text 6: HOW TO ESTABLISH CREDIT

People frequently have difficulty borrowing or buying on credit because they have no credit history. To establish a «credit» people must prove that they are willing and able to handle financial obligations.

They might, for example, open a charge account in a department store or apply for a gasoline credit card. Prompt payment of the bills on these kinds of accounts will help establish a positive credit rating. If person has a savings account, they may already be eligible to apply for a passbook loan against the balance in that account. Here again, prompt repayment will add to credit rating. If necessary, it is possible to borrow before you have established a credit rating if you can find a co-signer. A co-signer is a person with an acceptable credit rating who guarantees to repay the loan if you are unable to do so. The point isthat a good credit rating is a valuable financial tool. While it may take some time to acquire and maintain, it will increase your financial options.

Vocabulary:

principal – основная сумма

finance charges – зд. оплата кредита

service charges – плата за обслуживание

annual percentage rate – ставка годового процента

installments – взносы

arrangement – договоренность

charge accounts – кредиты по открытому счету

household mortgage – жилищная ипотека

credit history – досье заемщика

capacity – способность

credit worthy – кредитоспособный

pledged as security for the loan – заявленное как обеспечение займа

loan credit and sales credit – ссудный кредит и коммерческий кредит

thrift institutions and lending agencies – сберегательные учреждения и кредитные агентства

good credit rating – хорошая кредитоспособность

UNIT 11: A MORTGAGE

Exercise 1: Fill in the spaces with the appropriate word or words.

1. My ________'s in the order of £ 10,000 a year.

2. The bank's got very good __________ with the organization you work for.

3. The Central Mortgage Agency can lend you the difference between the first mortgage and 80% of the __________ value of the house.

4. To what ________ are you in a position to help me?

5. I think £60,000 is a __________ of the value of the house.

6. My contract will be __________ at least twice.

7. Have you got any other _________ of income besides your salary?

8. I've already had a second _________ concerning the value of the house, and it seems that the price is reasonable.

9. If you'll just fill in this ________, we can send it to the CMA for you.

10. The bank can let you have a first __________ on your house, and the CMA can give you a second.

Text 1: Read the dialogue; translate it into Russian using Terminology.

Peter MacDonald works with the World Health Organization in Geneva. He started the job two months ago, and is at present looking for a suitable permanent place to live for himself and his family. His wife and children are still in Paris.

His present contract at the WHO is for a minimum of three years, but he has been assured that it will be renewed at least twice.

He has now found a house which seems ideal. It costs £60,000. Peter has about £12,000, and his problem is to find the rest.

He visits George Hudson at the bank to discuss the possibility of getting a mortgage.

MacDonald. Mr Hudson?

Hudson. Yes. Good morning. Come in.

MacDonald. Good morning.

Hudson. Have a seat, please.

MacDonald. Thank you.

Hudson. What can I do for you, Mr MacDonald?

MacDonald. I've been here for two months now. I work with the World Health Organization.Up till now, I've been living in a small apartment that belongs to a friend, and I've been looking round to find somewhere permanent to live. My family's still in Paris, by the way... my wife and children. I've recently found a house about twenty minutes from my office, which seems ideal... The price is £60,000. I've got some £12,000, and my problem is to find the rest. The reason I'm here, is to find out to what extent you are in a position to help me.

Hudson. First, I'd like to say that we aren't specialists in mortgages. But as you're a civil servant working for the WHO... we can probably help you, in view of our relations with that organization. How long is your contract with the WHO?

MacDonald. Three years minimum, but I've been assured that the contract will be renewed at least twice. Personally, I don't plan to be here all my life, but I think that eight to ten years is a reasonable estimate.

Hudson. What's your position in the organization, Mr Mac-Donald?

MacDonald. I'm here as a specialist in statistics, and I'm head of a small section. I presume you're interested in my income, however. It's in the order of £10,000 a year, in addition to expenses.

Hudson. Have you got a plan of the house?

MacDonald. A plan... no... but I can ask the agency to let you have one. It's quite big... It's got five bedrooms, and two living rooms, in addition to the kitchen, laundry, three bathrooms and so on. It's got quite a big garden too... oh, and a garage for two cars.

Hudson. What's the total area of the property?

MacDonald. It's about 2,200 square metres.

Hudson. (writing) About 2,200 square metres. Well, that's quite enough to keep you busy during your free time.

MacDonald. (laughing) Luckily my wife's very energetic, so she'll cut the grass.

Hudson. Good. You have £12,600 at your disposal.

MacDonald. Yes.

Hudson. First of all, we'll have to ask our architect to look at the house, just to see whether the price of £60,000 is reasonable.

MacDonald. Yes, I see. I'm sure your architect will agree with the price. I've already had a second opinion, and I'm told that the price is perfectly reasonable. What I'd like to have is some details on a mortgage...

Hudson. We'll allow you a first mortgage of 50% of the value of the property. In other words, £30,000. Now you say you have £12,000. Have you also got any investments that we could use as collateral?

MacDonald. Yes. I've got some bonds and some shares... to a value of some £20,000.

Hudson. We'd be able to lend you 60% of that. That would come to about £12,000. Let's see. £12,000 plus £30,000 plus £12,000... that comes to £54,000. You still need £6,000. There's an organization called the Central Mortgage. Agency, which gives second mortgages. They can lend you the difference between the first mortgage and 80% of the estimated value of the house. If we calculate the value of the house at £50,000... they' re always very cautious... 80% would be £40,000. If we deduct £30,000 for the first mortgage, that, leaves £10,000... just what you need.

MacDonald. Do you do everything necessary to obtain the second mortgage?

Hudson. We'll give you a form to fill in and send it on to the CMA. Shall we just calculate the annual cost such a mortgage would represent?

MacDonald. Certainly.

Hudson. The first mortgage is 7%. That comes to £2,100; the amortization at 2% comes to £600...; the loan against bonds... 7% too, that's to say, £840; the 20% lent by the CMA at 7.5% comes to £750; the amortization at 6%... £600. Let's just add that up. Nine... twenty-eight... four. That comes to four thousand eight hundred and ninety pounds a year.

MacDonald. In other words, about £400 a month... That's a lot.

Hudson. Have you got any other source of income?

MacDonald. Yes. My wife has some investments, and I think we'll have to look into that. I must say, housing is very expensive here.

Hudson. I agree, and the monthly cost of such an operation would be enormous.

MacDonald. Do you think it's worth buying a house? Or do I run a risk of a loss when I move on?

Hudson. In general, buying a house insures you against inflation if the price at the start is correct.

MacDonald. Well, thank you for your help. When do you think your surveyor could visit the house?

Hudson. Well, my telephone's 228.496. As soon as you have the documents on the house, you can call me, and we can fix an appointment with our architect.

MacDonald. Thank you very much. I'll be calling you in two or, three days.

Hudson. Thank you.

Vocabulary:

agency There's an agency which deals with second mortgages.

allow We'll allow you a first mortgage of 50% of the value of the property.

amortization The amortization on the first mortgage comes to 600 pounds sterling.

annual cost The annual cost of such an operation is enormous.

area The total area of the property is 2,200 square metres.

assured I've been assured that my contract will be renewed.

cautious The Central Mortgage Agency are always very cautious, so let's say the value of the property is only 50,000 pounds sterling.

contract I've got a three-year contract at the WHO.

estimate I think eight years is a reasonable estimate of the length of time I'll be living here.

estimated I'm sure your architect will agree with the estimated value of the

value house.

expenses I earn about 10,000 pounds sterling a year, plus expenses.

form If you fill in this form, we can send it to the CMA.

in a position To what extent are you in a position to help me?

inflation Buying a flat insures you against inflation.

insure Buying a house insures you against inflation.

mortgage We can let you have a first mortgage of 30,000 pounds sterling.

operation Such an operation would mean an enormous annual expense.

outright I haven't got enough money to buy the house outright. property What's the value of the property you want to buy? reasonable Our architect thinks the price you were given for the house is reasonable;

relations The bank's relations with the company you work for are good.

renewed How often do you think your contract will be renewed? represent What annual cost would such an operation represent?

second Have you had a second opinion concerning the value of the

opinion property?

source Have you got any other source of income besides your salary?

total The total area of the property I want is 2,200 square metres.

to what I'd like to know to what extent you're in a position extent to help.

value (v) I've had the property valued, and it's worth 66,000 pounds sterling.

Exercise 2: Paraphrase the following:

1. The reason I'm here, is to find out to what extent you are in a position to help me.

2. … … and my problem is to find the rest.

3. … … we can probably help you, in view of our relations with that organization. 4. I presume you're interested in my income, however.

5. Luckily my wife is very energetic.....

6. We'll allow you a first mortgage of 50% of the value of the property.

7. That would come to about £12,000.

8. … … they're always very cautious...

9. Do you do everything necessary to obtain the second mortgage?

10. My wife has some investments, and I think we'll have to look into that.

11. Do I run a risk of a loss when I move on?

Exercise 3: Complete each space with the appropriate word or words.

Buying a house is one way of _________ against _________. Normally, if you find a house that looks suitable, you have it _________. It's a wise idea, particularly if a very large __________ is _________, to have a second ________, just to make sure that the _________ given is _________.

Very few people, however, have enough _________ to buy ________ outright. They usually ______ a bank to see about getting a _______. The bank, of course, has to be very careful. They'll need a ______ of the house, and they'll have to ask their own _________ to take a look at it, to _________ the ________ value.

If the bank is ___________, they can let you have 50% of the __________ of the __________ as a first ________. If this doesn't __________ the entire _________, they can __________ you 60% of the _________ of any ______ or ___________ which you may have.

If you still haven't got enough, or if you haven't got any ______ which the bank can use as _________ for a second _______, then you can go to a specialized organization. They can give you a second ________, which will be the _______ between the first one and 80% of the _______ value of the ________.

With the __________ and _________ on both _______, and possibly the ________ on a __________ against __________, the annual ________ which such an _________ represents can be very high.

Exercise 4: Translate into Russian:

1. Analysts have been expecting higher earnings per share.

2. Oil brought the country $... in revenues last year, or nine tenths of its export income.

3. The firms are struggling to generate sufficient revenues to justify expensive new infrastructure.

4. Russian oil exports in... were worth $..., or 14 per cent of total export revenues. Much of that income could be wiped out.

5. Now all Member States of the European Commission have made the laundering of drug proceeds a criminal offence.

6. The mortgage bank is forecast to show a 9 per cent rise in pretax profit.

7. Investment in business development and loss of income from capital returns will hold back overall profitability.

8. Investors abandoned computer-related companies because of their disappointing earnings.

9. If the company does not earn a reasonable return, the share price will fall and thus make it difficult to attract additional capital.

10. Investment funds promise to be the biggest source of potential revenues.

11. In Austria gains from direct investments are often not declared at all.

12. Higher-than-expected operating profit coupled with the appointment of a new chief executive pushed shares of the Swedish banking group higher.

13. The measures aimed at raising government revenue wouldn't work well.

Text 2: MORTGAES

Mortgages are loans for buying homes. The mortgagee (the company providing the mortgage) has to provide a large sum of money to enable the mortgagor (the borrower) to buy a house or flat, and spread the repayment of capital and interest over a long period, say 20 years. From the lender's point of view, this means lending long and borrowing short. This tends to go against the tradition of bankers. So specialist companies called building societies were set up solely to handle the home loans business.

In a mortgage agreement the house buyer agrees to make monthly repayments, insure the house and take out life insurance. The building society keeps the title deeds of the property as additional security. In this way, the building society has complete security even if the house burns down or the mortgagor dies. Where the building society cannot obtain enough money from depositors it can borrow on the money markets. This means that the amount of money paid by house buyers each month varies from time to time according to variations in the interest rate.

It is also possible to obtain fixed interest mortgages. The advantage of this is that home buyers know exactly how much money they have to find each month throughout the term of the mortgage. This enables them to plan their financial affairs more exactly. The disadvantage is that the loan may be taken out at a time of high interest rates which the borrower has to continue paying although market rates fall. So the borrower is paying more than the current cost of borrowing. If market rates go up then the opposite is true and the fixed rate mortgage is an advantage. Then the borrower is paying less than the current cost of borrowing.

During the 1980s the financial services industry was deregulated, which meant that many government controls were removed. Building societies started to do banking business and offer interest-paying current accounts to their savers. To meet the competition banks started to provide mortgages and many other services traditionally provided only by other specialized institutions.

Vocabulary:

mortgagee A mortgagee is a company which lends money to buy a house.

mortgagor A mortgagor is an individual or a legal entity who borrow money to buy a house or flat.

lending long Lending long means granting long-term loans.

borrowing short Borrowing short means having short-term debts.

a building society Building societies specialize in granting long-term loans for buying homes.

monthly repayments Paying back every month.

title deed A title deed is a document which shows the legal ownership of the house.

fixed interest With the fixed interest mortgage the borrower / mortgagor

mortgage knows exactly how much money he / she has to find each month throughout the term of the mortgage.

variable interest With the variable interest mortgage the mortgagor pays

mortgage different amounts of money depending on the variations in the interest rates.

deregulation Deregulation is the removal of government controls on business.

Exercise 5: Complete each blank space with the appropriate word or words.

1. I haven't got enough in my ________ to cover a down-payment on a car.

2. In general, buying a house----- __________ you against inflation.

3. What's the total area of the _________ you want to buy?

4. The CMA are always very _________, so we'll estimate the value of the property at £ 10,000.

5. How would you _________ the loan to the bank?

6. We'll have to ask our architect to take a ___________ at the house.

7. The monthly cost of such an ____________ would be enormous.

8. Is this the department that _______________ short-term loans?

9. Have you got any __________ or shares that we could use as collateral?

10. I haven't had the property ________ yet, so I can't even give you __________ estimate of its value.

UNIT 12: TAXES AND PUBLIC SPENDING

Text 1: Read and translate the text:

TAXES AND PUBLIC SPENDING

In most economies government revenues come mainly from direct taxes on personal incomes and company profits as well as indirect taxes levied on purchase of goods and services such as value added tax (VAT) and sales tax. Since state provision of retirement pensions is included in government expenditure, pension contributions to state-run social security funds are included in revenue, too. Some small component of government spending is financed through government borrowing.

Government spending comprises spending on goods and services and transfer payments.

Governments mostly pay for public goods, that is, those goods that, even if they are consumed by one person, can still be consumed by other people. Clean air, national defense, health service are examples of public goods. Governments also provide such services as police, fire-fighting and the administration of justice.

A transfer is a payment, usually by the government, for which no corresponding service is provided in return. Examples are social security, retirement pensions, unemployment benefits and, in some countries, food stamps.

In most countries there are campaigns for cutting government spending. The reason for it is that high levels of government spending are believed to exhaust resources that can be used productively in the private sector. Lower incentives to work are also believed to result from social security payments and unemployment benefits.

Whereas spending on goods and services directly exhausts resources that can be used elsewhere, transfer payments do not reduce society's resources. They transfer purchasing power from one group of consumers, those paying taxes, to another group of consumers, those receiving transfer payments and subsidies.

Another reason for reducing government spending is to make room for tax cuts.

Government intervention manifests itself in tax policy which is different in different countries. In the United Kingdom the government takes nearly 40 percent of national income in taxes. Some governments take a larger share, others a smaller share.

The most widely used progressive tax structure is the one in which the average tax rate rises with a person's income level. As a result of progressive tax and transfer system most is taken from the rich and most is given to the poor.

Rising tax rates initially increase tax revenue but eventually result in such large falls in the equilibrium quantity of the taxed commodity or activity that revenue starts to fall again. High tax rates are said to reduce the incentive to work. If half of all we earn goes to the government, we may prefer to work fewer hours a week and spend more time in the garden or watching television.

Cuts in tax rates will usually reduce the deadweight tax burden and reduce the amount of taxes raised but might increase eventual revenue.

If governments wish to reduce the deadweight tax burden and balance spending and revenue, they are supposed to reduce government spending in order to cut taxes.

Vocabulary:

administration of justice – отправление правосудия

in return – в ответ

food stamps – продуктовые карточки, продовольственные талоны, по которым малоимущие граждане, как, например, в США, имеют право получать продукты питания в определенных магазинах, но не могут обменять их на деньги

to make room for – зд. создать условия для

the rich – богатые

the poor – бедные

reduce the deadweight tax burden – снизить налоговое бремя

result – результат

as a result – в результате

to result – происходить в результате

to result from – проистекать; обусловливаться чем-л

to result in – приводить к чему-л

most – 1. самый (употребляется перед прилагательными в превосходной степени после the); 2. весьма, крайне (перед прилагательными в превосходной степени после the и перед наречиями); 3. всего, всех (перед наречиями); 4. большинство, большая часть (перед существительными)

mostly – главным образом

that is – то есть

that is why – вот почему

so that – так, что(бы)

no - никакой (употребляется перед существительными)

mainly – главным образом, в основном

direct tax – прямой налог

indirect tax – косвенный налог (налог на товары или услуги, а не на частное лицо или компанию)

levy v – 1. облагать налогом; 2. собирать, взимать налоги

to levy a tax on smb – облагать кого-л налогом, взимать налог с кого-л

value added tax (VAT) – налог на добавленную стоимость (НДС)

sales tax – налог с оборота, налог на продажи (производители платят его, когда изделия считаются законченным товаром; оптовики – при продаже товара розничному продавцу; розничные продавцы – при продаже товара покупателям)

state n – государство

retirement pension – пенсия за выслугу лет

contribution – взнос

a contribution to a fund – взнос в фонд

social security fund – фонд социального обеспечения (государственный фонд для выплаты пособий по болезни и безработице, пенсий, пособий женщинам и детям)

borrowing n - заимствование

borrow v (smth from smb) – брать взаймы (что-л у кого-л), одалживать (что-л у кого-л)

comprise v (smth) – включать (что-л), состоять (из чего-л)

transfer payment – переводной платеж (производственный платеж, который не связан с оплатой товаров и услуг, например, пенсии, пособия по безработице, субсидии фермерам и т.д.)

pay (paid, paid) v (for smth) – платить (за что-л)

public goods – общественный товар, товар общественного пользования (благо, к которому одновременно имеют доступ все люди в данной экономике)

still cj – все де, тем не менее, однако

national defense – национальная оборона

unemployment benefit – пособие по безработице

cut (cut, cut) v – сокращать, снижать, уменьшать, урезывать

cut n – сокращение, снижение, уменьшение

reason n (for smth) – причина (чего-л)

for some reason – по какой-л причине

exhaust v – истощать, исчерпывать

productively adv – производительно, продуктивно

productive a – производительный, производственный

whereas cj – тогда как, в то время как

purchasing power – покупательная способность (стоимость денег, измеряемая в соответствии с количеством товара, который можно на них приобрести)

nearly adv – почти, чуть не

share n – доля, часть

tax rate – норма (ставка) налога (налогообложения) (налог, взимаемый на единицу облагаемой налогом суммы, выражаемый в процентном отношении, например, налог $5 на сумму в $100 значит, что ставка налога составляет 5%)

initially adv – с самого начала, вначале, первоначально

initial a – начальный, первоначальный, исходный

tax revenue – налоговые поступления, доходы от налогов

eventually adv – в конечном счете, в итоге, в конце концов

eventual a – конечный, окончательный

to tax v (smth) облагать налогом (что-л)

taxed commodity or activity – продукция или деятельность, облагаемая налогом; syn. taxable a – подлежащий обложению налогом

raise v – собирать, взимать (налоги, плату)

Exercise 1: Fill in the gaps with the words from Vocabulary:

1. The rise in oil prices raised the … of the OPEC and reduced... of oil-importing countries such as Germany and Japan. The world economy, … … …, was producing more for the OPEC and less for Germany and Japan.

2. Taxes... on goods and services are known as … …..., those... on income are called....

3. Due to a... capital use and more know-how, wages in West Germany were three times as much in... jobs as... in the East when the two Germanies united (объединяться) … … …, many East Germans moved (переехать) to the West.

4. In the 1980s British workers in the gas and electricity industries earned... £20 a week more than the national average.

5. The British national wealth... private assets (houses, factories, jewels) and national assets (the London Bridge, the paintings in the British Museum, the roads and telecommunications networks, and much more).

6.... the nominal GNP is computed using the actual selling prices, the real GNP is computed using prices that existed in some predetermined base year. The … … making a distinction between the nominal and real GNP is to know the general price increase, or inflation.

7. Keynes thought classical economists to consider... in national output of the different factors of production rather than the forces determining the level of general economic activity.

8. Governments affect for whom output is produced through taxation and … ….

9. Non-renewable resources are those... in the process of use.

Exercise 2: Match the two parts of the sentences:

| 1. Government spending is | a) goes to households as employees, owners, or renters. |

| 2. Spending and taxing, | b) payable to women at the age of 60 and men at the age of 65. |

| 3. Whereas a sales tax is raised only when a final good is sold to the consumer, | c) the VAT is raised at different stages of the production process. |

| 4. The governments in northern Europe often give out freely a great share of gross output privately produced as public goods, | d) the sum of government purchases of goods and services and transfer payments. |

| 5. What is not paid as corporate taxes or saved by firms | e) as its contribution to the Fund of Obligatory Medical Insurance (страхование). |

| 6. Social security payments and unemployment benefits are | f) those comprise medical services, school, child care, public trans port, national defense. |

| 7. Every firm in Russia is required to allocate two percent of the amount to be paid out as wage | g) believed to reduce incentives to work since they contribute to in come. |

| 8. A state retirement pension in most European countries is | h) the government plays an essential role in allocating resources in the economy. |

Exercise 3: Make synonyms and antonyms pairs with the following words:

to manufacture, considerable, to buy, advantage, almost, mostly, so that, great, home, expenditure, provided, unemployed, to need, to produce, to supply, to lead to, taxable, as, if, unproductive, efficient, unlike, to purchase, spending, to cut, to levy, initially, taxed, productive, employed, to require, disadvantage, to sell, like, to provide, since, in order to, mainly, nearly, to impose, to reduce, eventually, domestic, to give rise to

Exercise 4: Find sentences where the word most means:

a) «большинство, большая часть»

b) «весьма, крайне»

1. Most of public expenditure is financed through taxation and government borrowing.

2. In a situation of full employment, the supply of most goods and services will be inelastic.

3. Most often we look at the GNP per capita, or the average income in a country.

4. In 1986 there was a most sharp fall in world oil prices.

5. In most European countries and the USA, work experience (трудовой стаж) is required to receive unemployment benefits. For this reason, more people have an incentive to go into employment at an earlier age.

6. The International Monetary Fund (IMF) is considered to be one of the most influential multinational institutions stimulating international trade and maintaining balance-of-payments equilibrium.

7. The arts are a most important economic activity: their contribution to Britain's GDP was reported to be nearly £6,000 million in 1990.

8. As a result of the Industrial Revolution at the end of the 18th century, most workers became employed in large factories.

9. With some groups of population, payments from social security funds may be a most important contribution to household incomes.

Exercise 5: Translate the sentences into Russian paying attention to the meaning of the noun result and the verb to result:

1. A tax rate over 45 percent is known to result in a reduction in the taxes raised.

2. If labour supply is inelastic, there will be an increase in wages as a result of improvements in technology.

3. When transfers (e.g., unemployment benefits, disability payments) are added to labour incomes and distributed profits, the result is personal income.

4. Due to the tax reform the taxed income was lowered and an increase in tax revenue resulted though it was not as big as the government had expected it to be.

5. Higher profit resulted from decreased transportation expenses.

Exercise 6: Say in which sentences the words that and those are substitutes; translate the sentences into Russian.

1. Part of the profit goes to those who have provided the initial capital needed to start a business.

2. If markets allocate resources efficiently so that consumers' requirements are met at minimum cost, why should governments intervene in the economy at all?

3. To have on-farm and off-farm jobs at the same time is common practice in rural areas of the USA and Canada, especially among those working on small farms.

4. One reason why labour is a special commodity is that wages include the costs of investing in human capital, which brings in profit over a long period of time.

5. Unlike OPEC countries, oil-importing nations had to give up (отказаться от) much of their production in exchange for the imports that they required when prices for oil had risen.

6. Tax revenue following a reduction in taxable income and a rise of the number of taxpayers was expected to be much higher than that raised previously.

Exercise 7: Choose the correct word:

1. Public spending has to be financed (nearly / mostly) through taxation and government (borrowing / share).

2. Over the last 100 years real wages have increased between five and fifteen times, (whereas / still) working time has been cut by nearly half.

3. Because unemployment often results in personal trauma, (unemployment benefits / retirement pensions) are said to be needed for psychological reasons.

4. Natural resources research in the USA in the 1930s was (nearly / initially) based on collecting information from various sources.

5. Due to a more (productive / required) capital and more know-how, wages in West Germany in the early 1980s were about three times as much as (those / that) in the East. (Whereas / As a result), many East Germans moved to the West.

6. Productive processes are (mostly / still) prohibited because they are dangerous to workers or to the environment.

7. Long-term unemployed workers, who gradually (постепенно) lose their human capital and contact with the active labour force, (mainly / eventually) become unable to fill any vacancy.

8. The (social security funds / reasons) for which people may leave labour force are as follows: retirement, illness, return to school, child care, work in a home garden, etc.

9. (Initially / Eventually) minimum wages were introduced (productively / mainly) to protect young people from exploitation.

Exercise 8: Translate the following sentences with the word no into Russian:

1. Transfer payments are the payments for which no direct economic service is provided in return (в ответ).

2. No workers means no output.

3. A mother may work very hard caring for her children but she receives no wages for her work.

4. Closed economy is an economic abstraction used to analyze a country with no relationship with the rest of the world.

5. Because no two jobs and no two persons are the same, to find a job is not always easy.

6. No economy relies entirely on command.

Exercise 9: Translate the following sentences into Russian, paying special attention to Complex Object.

1. The budget deficit is known to be the excess of government expenditure over government revenue.

2. Markets are said to bring together buyers and sellers of goods and ser vices.

3. The massive influx (зд. включение) of women into the labour force is sometimes assumed to result in unemployment.

4. Alcohol and tobacco are usually believed to be products with a very inelastic demand.

5. An increase in the wage rate is expected to reduce the quantity of labour demanded.

6. A subsidy is known to be money or other resources provided by the government to support a business activity or a person.

7. Demand for imports is expected to rise when domestic income and output rise.

Exercise 10: Translate the sentences into Russian:

1. Taxes of the firm to central government (corporation tax) plus taxes to local government (tax on the property the firm owned) were expected to come to £25,000 that year.

2. Part of the income of households is taxed by the government, which reduces the income share to be allocated to consumption expenditure.

3. Less efficient resource allocation is believed to result from raising the additional taxation revenue necessary to fund government programmes.

4. Aggressive US subsidization of production and exports of farm products was followed by that of other exporting countries, mainly the European Community and Canada, which resulted in competitive subsidization and price discrimination.

5. Levying taxes or borrowing, governments pay for the goods they buy and for the transfer payments they make.

6. In a mixed economy, the government is known to control a considerable share of output through taxation, transfer payments, and such services as defense and the police force.

7. Unemployment benefit systems are said to vary considerably from country to country.

8. The purpose of that book is to show that there are limitations in the economy that no person and no policy can overcome.

9. Both those who provide capital for a new business and those who run the business are known to bear the risk whereas workers of such businesses are not expected to bear any risk.

10. Social security programmes may comprise retirement pensions, invalidity benefits, child benefits paid for every child in a family, housing benefits for low income households, etc.

Exercise 11: Translate the sentences into English:

1. Доля налогов в цене товара не может зависеть от покупательной способности населения.

2. Считается, что дополнительный доход от государства является отрицательным стимулом для поисков работы с более высокой заработной платой.

3. Незначительная доля государственных расходов Японии обусловливается, как известно, чрезвычайно низким уровнем расходов на национальную оборону.

4. Общественные расходы – это, как известно, те расходы, которые финансируются из налогообложения и государственных заимствований.

5. Большой государственный сектор, как полагают, делает экономику неэффективной, снижая количество товаров и услуг, которое может быть произведено и в конечном итоге распределено потребителям.

6. В Великобритании взносы в фонды социального страхования составляют почти треть от общей суммы, которая направляется на социальные расходы.

Text 2: Read and translate the following text:

Economists know state to affect for whom goods are produced mainly through its taxes and transfers, which take income away from some people and give it to others.

Besides these direct effects, the state also affects the allocation of resources indirectly through taxes (and subsidies which economists think to be negative taxes).

When state levies a tax on a good, such as cigarettes, we believe it to reduce the quantity of that good produced; whereas when it subsidizes a good, such as milk, the quantity of that good produced increases as a result.

Economists consider the power to tax to be the power to affect the allocation of the economy's resources, or to distribute what is produced. Through taxing cigarettes the state can reduce the amount of cigarettes smoked so that health of the nation improved.

Taxing income earned from work, the state affects the amount of time people want to work.

Exercise 12: Find definitions for the following terms:

| direct tax, indirect tax, tax burden, tax revenue, income tax, corporation tax, value added tax, sales tax, excise duty, tax rate, taxable income, public goods |

1. A form of indirect tax which is included in the selling price of a product and which is eventually paid by the consumer.

2. An indirect tax which is based on the difference between the value of the output over the value of the input used to produce it.

3. The percentage rate at which a tax is levied on income or expenditure.

4. The money raised by government through imposing taxes.

5. A tax levied by the government on goods and services in order to raise revenue, such as value added tax and excise duty.

6. Goods and services provided by the state for all or most of the population such as education, health, housing, etc.

7. A tax levied by the government on the income or property of households or businesses.

8. A direct tax levied by the government on the income (wages, rent, dividends) received by households.

9. The amount of an individual's income on which a tax is levied.

10. The total amount of taxation paid by the population of a country in the form of income tax, corporation tax, value added tax, etc.

11. A direct tax levied by the government on the profits of businesses.

12. An indirect tax levied by the government on certain goods, typically tobacco, oil, and alcoholic drink.

Text 3: Read and translate the text

FISCAL POLICY

Fiscal policy is an instrument of demand management which is used to influence the level of economic activity in an economy through the control of taxation and government expenditure.

The government can use a number of taxation measures to control aggregate demand or spending: direct taxes on individuals (income tax) and companies (corporation tax) can be increased if spending has to be reduced, for example, to control inflation. Spending can also be reduced by increasing indirect taxes: an increase in the VAT on all products or excise duties on particular products such as petrol and cigarettes will result in lower purchasing power.

The government can change its own expenditure to affect spending levels as well: a cut in purchases of products or capital investment by the government can reduce total spending in the economy.

If the government is to increase spending, it creates a budget deficit, reducing taxation and increasing its expenditure.

A decrease in government spending and an increase in taxes (a withdrawal from the circular flow of national income) reduces aggregate demand to avoid (избегать) inflation. By contrast, an increase in government spending and / or decrease in taxes — an injection (денежное вливание) into the circular flow of national income) stimulates aggregate demand and creates additional jobs to avoid unemployment.

In practice, however, the effectiveness of fiscal policy can be reduced by a number of problems. Taxation rate changes, particularly changes in income tax, take time to make; considerable proportion of government expenditure on, for example, schools, roads, hospitals and defense cannot easily be changed without lengthy political lobbying.

|

|

|

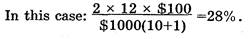

Индивидуальные очистные сооружения: К классу индивидуальных очистных сооружений относят сооружения, пропускная способность которых...

Историки об Елизавете Петровне: Елизавета попала между двумя встречными культурными течениями, воспитывалась среди новых европейских веяний и преданий...

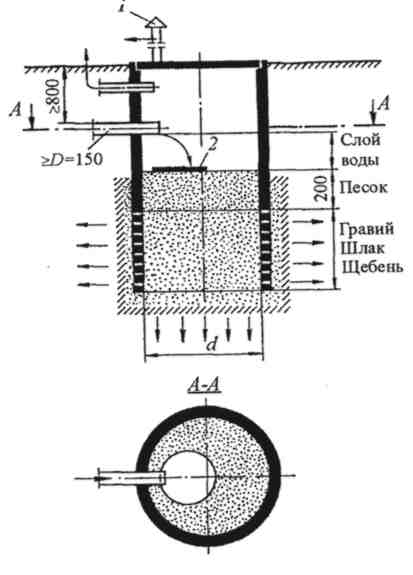

Двойное оплодотворение у цветковых растений: Оплодотворение - это процесс слияния мужской и женской половых клеток с образованием зиготы...

Биохимия спиртового брожения: Основу технологии получения пива составляет спиртовое брожение, - при котором сахар превращается...

© cyberpedia.su 2017-2026 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!