Семя – орган полового размножения и расселения растений: наружи у семян имеется плотный покров – кожура...

Биохимия спиртового брожения: Основу технологии получения пива составляет спиртовое брожение, - при котором сахар превращается...

Семя – орган полового размножения и расселения растений: наружи у семян имеется плотный покров – кожура...

Биохимия спиртового брожения: Основу технологии получения пива составляет спиртовое брожение, - при котором сахар превращается...

Топ:

Характеристика АТП и сварочно-жестяницкого участка: Транспорт в настоящее время является одной из важнейших отраслей народного...

Генеалогическое древо Султанов Османской империи: Османские правители, вначале, будучи еще бейлербеями Анатолии, женились на дочерях византийских императоров...

Проблема типологии научных революций: Глобальные научные революции и типы научной рациональности...

Интересное:

Инженерная защита территорий, зданий и сооружений от опасных геологических процессов: Изучение оползневых явлений, оценка устойчивости склонов и проектирование противооползневых сооружений — актуальнейшие задачи, стоящие перед отечественными...

Влияние предпринимательской среды на эффективное функционирование предприятия: Предпринимательская среда – это совокупность внешних и внутренних факторов, оказывающих влияние на функционирование фирмы...

Отражение на счетах бухгалтерского учета процесса приобретения: Процесс заготовления представляет систему экономических событий, включающих приобретение организацией у поставщиков сырья...

Дисциплины:

|

из

5.00

|

Заказать работу |

|

|

|

|

Study and Learn the Words:

| English | English equivalents | Romanian | Russian |

| collateral (n) | pledge | ||

| commercial paper | securities such as: drafts, promissory notes | capital circulant sau de rulaj | легкореализуемые ценные бумаги |

| reluctant (adj) | unwilling | ||

| prospects of repayment | possibility of repayment | perspectivă de plată, posibilitatea efectuării plăţii | перспективы оплаты |

| to back up | to help, to support | a susţine | поддерживать, финансировать |

| to pledge collateral | to leave smth as security for the loan | a amaneta, a zălogi | закладывать |

| draft (n) | bill of exchange | cambie | вексель |

| invoice (n) | a document listing the goods and services and the price for them | factură | фактура |

| at maturity | when the time falls due | la scadenţă | наступление срока |

| drawer (n) | the person who makes out the draft | tragator | трассант |

| drawee (n) | a person who is requested to pay the draft | tras | трассат |

| to discount a draft | to calculate the real value of the draft according to the formula: Actual value = Face value - Discount | a sconta o cambie | вычитать вексель |

Unsecured financing is financing that is not backed by collateral. A company seeking unsecured short-term capital has several options; they include trade credit, promissory notes, bank loans, commercial papers and commercial drafts.

Trade Credit We knowthat wholesalers might provide financial aid to retailers by allowing them thirty to sixty days (or more in which to pay for merchandise. This delayed payment, which may also be granted by manufacturers, is a form of credit known as trade credit. More specifically, trade credit is a payment delay that a supplier grants to its customers. Between 80 and 90 percent of all transactions between businesses involve some trade credit. Typically, the purchased goods are delivered along with a bill (or invoice) that states the credit terms.

Promissory Notes Issued to Suppliers A promissory note is a written pledge by a borrower to pay a certain sum of money to a creditor at specified future date. Suppliers that are uneasy about extending trade credit may be less reluctant to offer credit to customers that sign promissory notes. Unlike trade credit, however, promissory notes usually provide that the borrower pay interest.

Unsecured Bank Loans Commercial banks offer unsecured short-term loans to their customers at interest rates that vary with each borrower’s credit rating. The prime interest rate (sometimes called the reference rate) is the lowest rate charged by a bank for a short-term loan. This lowest rate is generally reserved for large corporations with excellent credit ratings.

Banks generally offer loans through promissory notes, a line of credit, or a revolving credit agreement. Most promissory notes specify repayment periods of 60 to 180 days.

|

|

The line of credit – in essence, is a prearranged short-term loan. A bank that offers a line of credit may require that a compensating balance be kept on deposit at the bank. This balance may be as much as 20% of the line-of-credit amount. The bank may also require that every commercial borrower clean up (pay off completely) its line of credit at least once each year and not use it again for a period of 30 to 60 days. This second requirement ensures that the line of credit is used only to meet short-term needs and that it doesn’t gradually become a source of long-term financing.

Even with a line of credit, a firm may not be able to borrow on short notice if the bank does not have sufficient funds available. For this reason, some firms prefer a revolving credit agreement, which is a guaranteed line of credit. Under this type of agreement, the bank guarantees that the money will be available when the borrower needs it. In return for the guarantee, the bank charges a commitment fee ranging from 0.25 to 1.0 percent of the unused portion of the revolving credit. The usual interest is charged for the portion that is borrowed.

Commercial Paper is short-term promissory notes issued by large corporations. Commercial paper is secured only by the reputation of the issuing firm; no collateral is involved. It is usually issued in large denominations, ranging from $5,000 to $100,000. Corporations issuing commercial paper pay interest rates slightly below those charged by commercial banks. Thus, issuing commercial paper is cheaper than getting short-term financing from a bank.

Commercial Drafts A commercial draft is a written order requiring a customer (the drawee) to pay a specified sum of money to a supplier (the drawer) for goods or services. It is often used when the supplier is unsure about the customer's credit standing. The draft would be completed as follows:

1. The draft form is filled out by the drawer. The draft contains the purchase price, interest rate, if any and maturity date.

2. The draft is sent by the drawer to the drawee.

3. If the information contained in the draft is correct and the merchandise has been received, the drawee marks the draft "Accepted" and signs it.

4. The customer returns the draft to the drawer. Now the drawer may (a) hold the draft until maturity, (b) discount the draft at its bank (c) use the draft as collateral for a loan.

In this case, the draft is similar to an ordinary check with one exception: The draft is filled out by the seller and not the buyer. A sight draft is a commercial draft that is payable on demand—whenever the drawer wishes to collect. A time draft is a commercial draft on which a payment date is specified. Like promissory notes, drafts are negotiable instruments that may be discounted or used as collateral for a loan. They are legally enforceable.

I. COMPREHENSION

A) Answer the following questions:

1. Short-term financing is easier to obtain. Why?

2. When do most lenders require collateral for short-term financing?

4. Define the word: “trade credit”. What document states the credit terms?

6. Define the word: “promissory note”.

7. What are the two advantages of a promissory note?

8. Define the word: “unsecured bank loans”.

9. Explain what the line of credit is. Give examples.

10. What are the revolving credit agreement, commercial papers and commercial drafts?

|

|

11. What collateral can be used for short-term financing?

B) True or False?

1. The shorter repayment period means there is risk of nonpayment.

2. Unsecured financing is financing that is not backed by collateral.

3. Between 70 and 100% of all transactions between businesses involve trade credit.

4. Suppliers that are uneasy about extending credit may be more reluctant to offer credit to customers that sign promissory notes.

5. Commercial paper is a short-term promissory note issued by sole proprietorships.

6. The customer returns the draft to the drawer. Now the drawer may: (a) hold the draft until maturity (b) discount the draft at its bank or (c) use the draft as collateral for a loan.

7. Most promissory notes specify repayment periods of 60 to 180 days.

8. The purchased goods are delivered along with a contract that states the credit terms.

9. The draft is filled out by the buyer and not the seller.

II. FOCUS ON GRAMMAR

Insert prepositions:

Typically, the purchased goods are delivered (1)………. (2) …….. a bill that states the credit terms. The terms (3) ……… a cash discount are specified (4) ………. the invoice. The customer buying (5) ……….. credit is called the maker. Commercial banks offer unsecured short-term loans (6) ……….. their customers (7) ……… interest rates that vary (8) ….. each borrower’s credit rating. The draft is filled (9) ……… by the seller and not by the buyer. They arise primarily (10) …… trade credit and are usually due (11) ….. less than 60 days. In addition, (12) …….. the interest (13) ……. the loan, the borrower must also pay (15) ….. storage (16) …. a warehouse.

III. VOCABULARY PRACTICE

A) Finish the sentences:

1. Commercial paper is secured only by …..……………………

2. A sight draft is ………………….……………………………..

3. Even with a line of credit ………………………………………

4. Organizations with good to high ratings may ……………………

5. Most lenders do ………………………………………………….

B) Supply:

Synonyms Аntonyms

1. supplier – 6. short-term loan -

2. questionable – 7. secured loans -

3. interest – 8. borrower -

4. drawer – 9. favourable -

5. collateral - 10. partial -

C) Match the words with their definitions:

Unsecured financing, trade credit, promissory note, prime interest rate, revolving credit agreement, commercial paper, commercial draft.

1. A guaranteed line of credit.

2. A written order requiring the customer to pay a specified sum of money to the supplier.

3. Short-term promissory notes issued by large corporations.

4. The lowest rate charged by a bank for a short-term loan.

5. Financing that is not backed by collateral.

6. A written pledge by a borrower to pay a certain sum of money to a creditor at a specified future date.

7. A payment delay that a supplier grants to its customers.

IV. DISCUSSION

1. Have you ever bought goods on credit? When do people decide to buy goods in this way? What shops offer such services? What is the usual interest rate charged by them?

2. List the advantages and disadvantages of buying a computer on credit? The first one has been done for you:

| Advantages | Disadvantages |

| 1. You do not pay the total sum of money immediately | 1. Interst is $10 paid dayly |

3. Are commercial drafts largely used in our country? Make an investigation and be ready to speak on it.

5.3 Sources of Secured Short-Term Financing

Learning objectives:

|

|

|

История развития пистолетов-пулеметов: Предпосылкой для возникновения пистолетов-пулеметов послужила давняя тенденция тяготения винтовок...

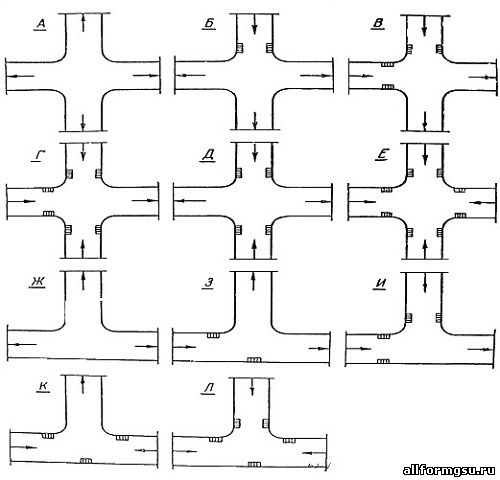

Организация стока поверхностных вод: Наибольшее количество влаги на земном шаре испаряется с поверхности морей и океанов (88‰)...

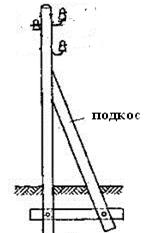

Опора деревянной одностоечной и способы укрепление угловых опор: Опоры ВЛ - конструкции, предназначенные для поддерживания проводов на необходимой высоте над землей, водой...

История создания датчика движения: Первый прибор для обнаружения движения был изобретен немецким физиком Генрихом Герцем...

© cyberpedia.su 2017-2024 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!