THREE STEPS OF FINANCIAL PLANNING

1. Establishing Organizational Goals and Objectives. Establishing goals and objectives is an important management task. A goal is an end state that the organization wants to achieve. Objectives are specific statements detailing what the organization intends to accomplish within a certain period of time. If goals and objectives are not specific and measurable, they cannot be translated into costs, and financial planning cannot proceed. They must also be realistic. Otherwise, it may be impossible to finance or achieve them.

2. Budgeting for Financial Needs. A budget is a financial statement that projects income and/or expenditures over a specified future period of time. Once planners know what the firm's goals and objectives are for a specific period of time - say, the next calendar year- they can estimate the various costs the firm will incur and the revenues it will receive. By combining these items into a companywide budget, financial planners can determine whether they must seek additional funding from sources outside the firm.

Usually the budgeting process begins with the construction of individual budgets for sales and for each of the various types of expenses: production, human resources, promotion, administration, and so on. Budgeting accuracy is improved when budgets are first constructed for individual departments and for shorter periods of time. These budgets can easily be combined into a com-

panywide cash budget. In addition, departmental budgets can help managers monitor and evaluate financial performance throughout the period covered by the overall cash budget.

Most firms today use one of two approaches to budgeting. In the traditional approach, each new budget is based on the dollar amounts contained in the budget for the preceding year. These amounts are modified to reflect any revised goals, and managers must justify only new expenditures. The problem with this approach is that it leaves room for the manipulation of budget items to protect the (sometimes selfish) interests of the budgeter or his or her department.

This problem is essentially eliminated through zero-base bud geting.

Zero-base budgeting is a budgeting approach in which every expense must be justified in every budget. It can dramatically reduce unnecessary spending. However, some managers feel that zero-base budgeting requires too much time-consuming paperwork.

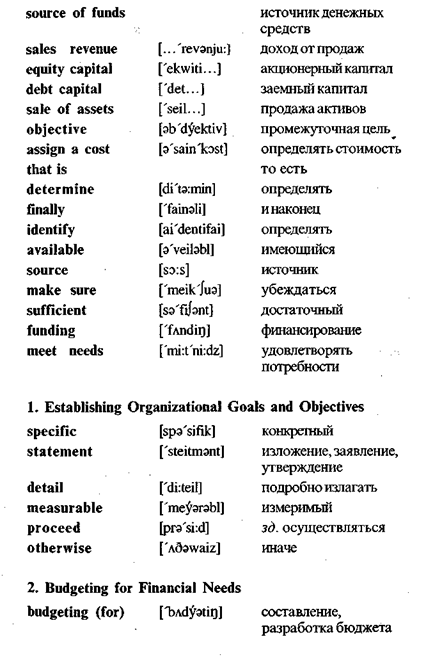

3. Identifying Sources of Funds. The four primary sources of funds are sales revenue, equity capital, debt capital, and the sale of assets. Future sales generally provide the greatest part of a firm's financing.

Sales revenue is the first type of funding.

The second type of funding is equity capital, which is money received from the sale of shares of ownership in the business. Equity capital is used almost exclusively for long-term financing. Thus it might be used to start a business and to fund expansions or mergers. It would not be considered for short-term financing needs.

The third type of funding is debt capital, which is money obtained through loans. Debt capital may be borrowed for either short- or long-term use.

The fourth type of funding is the sale of assets. A firm generally acquires assets because it needs them for its business operations. Therefore, selling assets is a drastic step. However, it may

be a reasonable last resort when neither equity capital nor debt capital can be found. Assets may also be sold when they are no longer needed.

TRADE CREDIT

Wholesalers may provide financial aid to retailers by allowing them thirty to sixty days (or more) in which to pay for merchandise. This delayed payment, which may also be granted by manufacturers, is a form of credit known as trade credit or the open account. More specifically, trade credit is a payment delay that a supplier grants to its customers.

Between 80 and 90 percent of all transactions between businesses involve some trade credit. Typically, the purchased goods are delivered along with a bill (or invoice) that states the credit terms. If the amount is paid on time, no interest is generally charged. In fact, the seller may offer a cash discount to encour-. age prompt payment. The terms of a cash discount are specified on the invoice.

UNSECURED BANK LOANS

Commercial banks offer unsecured short-term loans to their customers at interest rates that vary with each borrower's credit rating. The prime interest rate (sometimes called the preference rate) is the lowest rate charged by a bank for a short-term loan. This lowest rate is generally reserved for large corporations with excellent credit ratings. Organizations with good to high credit ratings may have to pay the prime rate plus 4 percent. Of course, if the banker feels loan repayment may be a problem, the borrower's loan application may be rejected.

Banks generally offer short-term loans through promissory notes. Promissory notes that are written to banks are similar to those discussed in the last section.

COMMERCIAL PAPER

A commercial paper is a short-term promissory note issued by a large corporations. A commercial paper is secured only by the reputation of the issuing firm; no collateral is involved. It is usually issued in large denominations, ranging from $5,000 to $100,000. Corporations issuing commercial papers pay interest rates slightly below those charged by commercial banks. Thus, issuing a commercial paper is cheaper than getting short-term financing from a bank.

Large firms with excellent credit reputations can quickly raise large sums of money. They may issue commercial paper totaling millions of dollars. However, a commercial paper is not without risks. If the issuing corporation later has severe financing problems, it may not be able to repay the promised amounts.

COMMERCIAL DRAFTS

A commercial draft is a written order requiring a customer (the drawee) to pay a specified sum of money to a supplier (the drawer) for goods or services. It is often used when the supplier is insure about the customer's credit standing.

In this case, the draft is similar to an ordinary check with one exception: The draft is filled out by the seller and not the buyer. A sight draft is a commercial draft that is payable on demand -whenever the drawer wishes to collect. A time draft is a commercial draft on which a payment date is specified. Like promissory notes, drafts are negotiable instruments that can be discounted or used as collateral for a loan.

Exercises

I. Translate into Russian.

Source; unsecured financing; promissory note; commercial draft; trade credit; loan; commercial paper; transaction; delayed payment; credit terms; pay interest; interest rate; invoice; amount; prompt payment; written pledge; sum of money; borrower; repayment period; buy on credit; deliver; provide aid; maker; payee; offer loans; credit rating; prime interest rate; questionable credit rating; large denomination; raise large sums of money; drawee; drawer; credit standing; sight draft; time draft; collateral; commercial draft.

II. Find the English equivalents.

Ссуда; давать ссуду; процент; процентная ставка; необеспеченное финансирование; покупать в кредит; условия кредита; счет-фактура; основная сумма; деловая операция; торговый кредит; долговое обязательство; коммерческая бумага; тратта (переводной вексель); условия; обеспечение (за лог); заемщик; трассат (лицо, на которое выставлена трат та); трассант (лицо, выписавшее переводной вексель- тратту); кредитоспособность; тратта (вексель) на предъявителя; срочная тратта.

III. Fill in each blank with a suitable word or word combi nation.

1. Trade credit is a payment... that a supplier grants to its customers.

2. The invoice that's....

3. A promissory note is a written... by a borrower to pay a certain sum of money at a specified date.

. 4. The customer buying on credit is called... and is the party that issues the promissory note.

5. The business selling the merchandise on credit is called....

6. Most promissory notes are... that can be sold when money is needed immediately.

7. The prime interest rate is the lowest rate charged by a bank for... loan.

8. A commercial paper is... issued by a large corporation.

9. A commercial paper is secured only by the... of the issuing. firm.

10. Issuing a commercial paper is... than getting short-term financing from a bank.

11. A commercial draft is a written... requiring a drawee to pay a specified sum of money to the... for goods or services.

12. A sight draft is a commercial draft that is payable on....

13. A... is a commercial draft on which a payment date is specified. 14. Like promissory notes drafts can be used as... for a loan.

IV. Translate into English.

1. Источники необеспеченного краткосрочного финансирования включают торговые кредиты, долговые обязательства, банковские ссуды, краткосрочные долговые обязательства (кредитно-денежные документы) и тратты (переводные векселя).

2. Торговый кредит — это отсрочка платежа, которую поставщик предоставляет своим клиентам.

3. Долговое обязательство — это письменное обязательство заемщика уплатить определенную сумму денег кредитору.

4. В отличие от торгового кредита долговые обязательства требуют, чтобы заемщик платил проценты.

5. Коммерческие банки предоставляют необеспеченные краткосрочные ссуды своим клиентам, которые меняются в зависимости от (with) кредитоспособности каждого заемщика.

6. Коммерческая бумага — это краткосрочное долговое обязательство, выпускаемое крупными корпорациями..

7. Коммерческая бумага не имеет специального (special) обеспечения.

8. Тратта (переводной вексель) — это письменный приказ, требующий, чтобы трассат (лицо, на которое выставле на тратта) уплатил конкретную сумму денег поставщику за товары или услуги.

9. Тратта часто используется, когда поставщик не уверен в кредитоспособности клиента.

V. Answer the questions.

1. What is unsecured financing?

2. What are the sources of unsecured short-term financing?

3. What is a trade credit?

4. What is the difference between a promissory note and trade credit?

5. In what case a loan application may be rejected by a bank?

6. What is a commercial paper secured by?

7. Why issuing a commercial paper is cheaper than getting short-term financing from a bank?

8. What is a commercial draft?

9. Can commercial drafts be used as collaterals for loans?

VI. Make up a written abstract of the above text.

VII. Retell the prepared abstract.

Unit7

Accounting

A BALANCE SHEET

A balance sheet (or statement of financial position), is a summary of a firm's assets, liabilities, and owners' equity ac counts at a particular time, showing the various money amounts that enter into the accounting equation. The balance sheet must demonstrate that the accounting equation does indeed balance. That is, it must show that the firm's assets are equal to its liabilities plus its owners' equity. The balance sheet is prepared at least once a year. Most firms also have balance sheets prepared semi-annually, quarterly, or monthly.

AN INCOME STATEMENT

An income statement is a summary of a firm's revenues and expenses during a specified accounting period. The income statement is sometimes called the statement of income and expenses. It may be prepared monthly, quarterly, semiannually, or annually. An income statement covering the previous year must be included in a corporation's annual report to its stockholders.

THREE STEPS OF FINANCIAL PLANNING

1. Establishing Organizational Goals and Objectives. Establishing goals and objectives is an important management task. A goal is an end state that the organization wants to achieve. Objectives are specific statements detailing what the organization intends to accomplish within a certain period of time. If goals and objectives are not specific and measurable, they cannot be translated into costs, and financial planning cannot proceed. They must also be realistic. Otherwise, it may be impossible to finance or achieve them.

2. Budgeting for Financial Needs. A budget is a financial statement that projects income and/or expenditures over a specified future period of time. Once planners know what the firm's goals and objectives are for a specific period of time - say, the next calendar year- they can estimate the various costs the firm will incur and the revenues it will receive. By combining these items into a companywide budget, financial planners can determine whether they must seek additional funding from sources outside the firm.

Usually the budgeting process begins with the construction of individual budgets for sales and for each of the various types of expenses: production, human resources, promotion, administration, and so on. Budgeting accuracy is improved when budgets are first constructed for individual departments and for shorter periods of time. These budgets can easily be combined into a com-

panywide cash budget. In addition, departmental budgets can help managers monitor and evaluate financial performance throughout the period covered by the overall cash budget.

Most firms today use one of two approaches to budgeting. In the traditional approach, each new budget is based on the dollar amounts contained in the budget for the preceding year. These amounts are modified to reflect any revised goals, and managers must justify only new expenditures. The problem with this approach is that it leaves room for the manipulation of budget items to protect the (sometimes selfish) interests of the budgeter or his or her department.

This problem is essentially eliminated through zero-base bud geting.

Zero-base budgeting is a budgeting approach in which every expense must be justified in every budget. It can dramatically reduce unnecessary spending. However, some managers feel that zero-base budgeting requires too much time-consuming paperwork.

3. Identifying Sources of Funds. The four primary sources of funds are sales revenue, equity capital, debt capital, and the sale of assets. Future sales generally provide the greatest part of a firm's financing.

Sales revenue is the first type of funding.

The second type of funding is equity capital, which is money received from the sale of shares of ownership in the business. Equity capital is used almost exclusively for long-term financing. Thus it might be used to start a business and to fund expansions or mergers. It would not be considered for short-term financing needs.

The third type of funding is debt capital, which is money obtained through loans. Debt capital may be borrowed for either short- or long-term use.

The fourth type of funding is the sale of assets. A firm generally acquires assets because it needs them for its business operations. Therefore, selling assets is a drastic step. However, it may

be a reasonable last resort when neither equity capital nor debt capital can be found. Assets may also be sold when they are no longer needed.