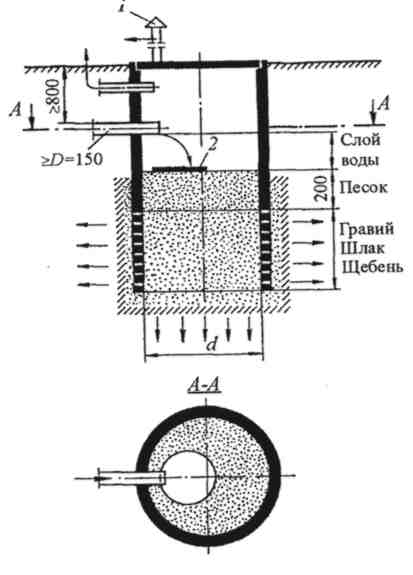

Общие условия выбора системы дренажа: Система дренажа выбирается в зависимости от характера защищаемого...

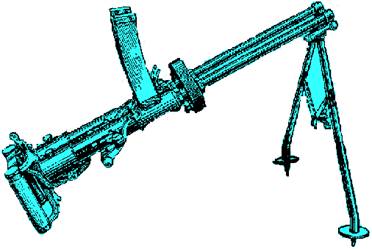

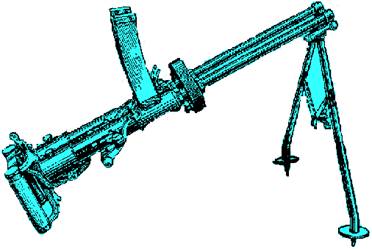

История развития пистолетов-пулеметов: Предпосылкой для возникновения пистолетов-пулеметов послужила давняя тенденция тяготения винтовок...

Общие условия выбора системы дренажа: Система дренажа выбирается в зависимости от характера защищаемого...

История развития пистолетов-пулеметов: Предпосылкой для возникновения пистолетов-пулеметов послужила давняя тенденция тяготения винтовок...

Топ:

Выпускная квалификационная работа: Основная часть ВКР, как правило, состоит из двух-трех глав, каждая из которых, в свою очередь...

История развития методов оптимизации: теорема Куна-Таккера, метод Лагранжа, роль выпуклости в оптимизации...

Интересное:

Наиболее распространенные виды рака: Раковая опухоль — это самостоятельное новообразование, которое может возникнуть и от повышенного давления...

Принципы управления денежными потоками: одним из методов контроля за состоянием денежной наличности является...

Искусственное повышение поверхности территории: Варианты искусственного повышения поверхности территории необходимо выбирать на основе анализа следующих характеристик защищаемой территории...

Дисциплины:

|

из

5.00

|

Заказать работу |

|

|

|

|

1) negotiation; 2) consultation; 3) dispute settlement; 4) with regard to; 5) commercial arbitration; 6) investment disputes; 7) diplomatic protection; 8) arbitration award; 9) on the basis of; 10) provision; 11) exhaust local remedies; 12) resort to; 13) application or (interpretation of a treaty; 14) ad hoc arbitration; 15) arbitration panel; 16) International Centre for the Settlement of Investment Disputes (ICSID); 17) International Chamber of Commerce; 18) United Nations Commission on International Trade Law (UNCITRAL).

Are the following statements true or false?

1. The prohibition of arbitrary and discriminatory measures refers to the prohibition of actions against foreign investors in general or specific groups of foreign investors.

2. Arbitration awards aren't binding on the parties.

3. In the 1960s many developing countries initiated bilateral investment treaties as a way to protect their investments abroad against the growing risks of expropriation and nationalization.

4. Compensation isn't due if a direct expropriation takes place.

5. Bilateral investment treaties don't guarantee to investors the possibility of transferring payments in a freely convertible currency, without delay and at a specified exchange rate.

6. Investment disputes under bilateral investment treaties may involve disputes only between one State and investors of the other State.

7. Disputes between purely private parties are normally resolved through recourse to the courts of the State that has jurisdiction, or to commercial arbitration.

8. Only a few bilateral investment treaties require that the investor exhaust local remedies before resorting to arbitration.

9. The advantage of arbitration is that the dispute is handled in an international legal forum, generally removed from political interference and able to deliver a speedy resolution.

10. Arbitration proceedings are rarely confidential, and awards are never published.

Read the texts and choose the most suitable sentence from the list (A — E) for each gap. There is one extra sentence which you do not need to use. There is an example in the beginning.

A) Under this charter, investment protection was dependent on the goodwill of the host State and the principle of national sovereignty was reaffirmed.

1 — В) On the other hand, there are agreements such as the 1998 FTA between the Caribbean Community and the Dominican Republic or the 2000 US-Vietnam Agreement on Trade Relations that basically contain bilateral investment treaty-like provisions within the agreement.

C) The general aim of these agreements is to create a more favourable investment climate through a combination of investment liberalization and protection measures, with a view to increasing the flow of investment within or between regions.

D) In response, to more effectively attract foreign equity investment, a number of stock exchanges around the worid have adopted audit committees to increase transparency and competence in the management of their listed member companies.

|

|

E) Finally, and most recently, efforts to include investment negotiations proper within the WTO negotiating purview have proven deeply contentious, contributing significantly to the derailment of the WTO's December 2003 ministerial meeting in Cancun.

REGIONAL RULES

The universe of regional instruments on investment or including investment rules does not attain the proportions of the bilateral investment treaty phenomenon, but is still vast, diverse and growing. Such instruments are today creating an intricate web of overlapping commitments. While bilateral investment treaties have a distinct focus on matters of investment protection, regional integration agreements (RIAs) are often geared towards liberalization even though an important (and increasing) number of them also address investment protection issues. According to notifications made to the WTO, over 190 regional trade agreements are currently in force and several dozens are reportedly planned or already under negotiation.

Various recent agreements linking the European Union with third countries also refer to the possible conclusion of bilateral investment treaties between Member States of the European Union and the third countries in question. [ 1 — В ]. At a regional level, only a few instruments are entirely devoted to investment, such as the Framework Agreement on the ASEAN Investment Area and the Andean Community's Decision 291 (adopted in 1991). However, a growing number of regional agreements have included in the last few years a comprehensive set of investment disciplines. The North American Free Trade Agreement (NAFTA), the MERCOSUR Protocols and the Treaty Establishing the Common Market for Eastern and Southern Africa (COMESA) are all examples. (2 ]. The great diversity of regional instruments and the country configurations they bring together have generally meant that the degree of commonality in terms of agreed rules is much less marked in such agreements than in the case of bilateral investment treaties.

MULTILATERAL RULES

To this very day, as can be seen from the fact that investment has failed to stay on the agenda of the World Trade Organization's ongoing Doha Development Agenda negotiations, the history of multilateral rule-making on investment remains a troubled one. The investment chapter of the 1948 Havana Charter was one of the main reasons for the failure of the proposed International Trade Organization (ITO) project. In the General Agreement on Tariffs and Trade (GATT) no further investment-related negotiations would take place, up until the Uruguay Round negotiations launched in the mid-1980s. In the United Nations, immediately after decolonization, developing countries clubbed together and pushed through many (non-binding) resolutions, including the Charter of Economic Rights and Duties. [ 3 ]. The US and other developed countries opposed this approach and sought stronger rules to protect investors and their investments. Developing countries were generally hostile towards stringent investment rules for fear of losing their new-found sovereignty to foreign investors. The attempt to negotiate a UN Code of Conduct on Transnational Corporations was abandoned in the early 1990s after many years of deliberations. Yet throughout this entire period, both the bilateral and, more recently, the regional routes to investment rule-making have been actively pursued, resulting in generally high standards of investment protection and liberalization.

|

|

Several other attempts at crafting a global investment regime would prove stillborn, including the proposed Multilateral Agreement on Investment (MAI) initiative in the OECD in the late 1990s, which represented a major attempt at crafting a multilateral (if far from universal) regime for investment. [4 J. As part of the price to pay for imparting renewed momentum to the stalled Doha Development Agenda, WTO Members agreed in July 2004 that foreign investment would (alongside two other so-called 'Singapore Issues' — trade and competition and transparency in government procurement) be taken off the WTO negotiating table for the duration of the current negotiating round.

Accordingly, in terms of binding multilateral rules, what survives from the multiple initiatives of the past half century are the rules that were agreed in the Uruguay Round of trade negotiations, concluded in 1994. Of these, by far the most important elements are the Agreement on Trade-Related Investment Measures (TRIMs) and the General Agreement on Trade in Services (GATS), followed by the Agreement on Subsidies and Countervailing Measures (ASCM), the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRJPs), and the Understanding on the Settlement of Disputes (DSU), the latter three having a less direct impact on rule-making in the investment field.

|

|

|

Своеобразие русской архитектуры: Основной материал – дерево – быстрота постройки, но недолговечность и необходимость деления...

Индивидуальные очистные сооружения: К классу индивидуальных очистных сооружений относят сооружения, пропускная способность которых...

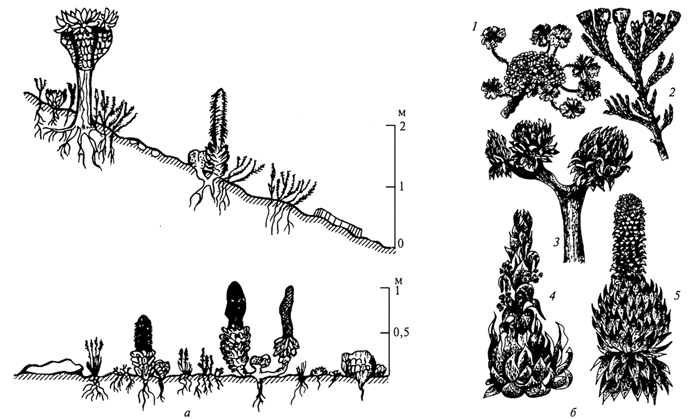

Адаптации растений и животных к жизни в горах: Большое значение для жизни организмов в горах имеют степень расчленения, крутизна и экспозиционные различия склонов...

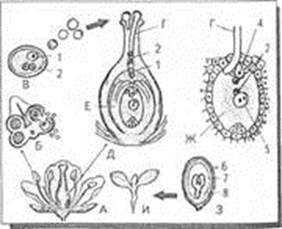

Двойное оплодотворение у цветковых растений: Оплодотворение - это процесс слияния мужской и женской половых клеток с образованием зиготы...

© cyberpedia.su 2017-2024 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!