Семя – орган полового размножения и расселения растений: наружи у семян имеется плотный покров – кожура...

История создания датчика движения: Первый прибор для обнаружения движения был изобретен немецким физиком Генрихом Герцем...

Семя – орган полового размножения и расселения растений: наружи у семян имеется плотный покров – кожура...

История создания датчика движения: Первый прибор для обнаружения движения был изобретен немецким физиком Генрихом Герцем...

Топ:

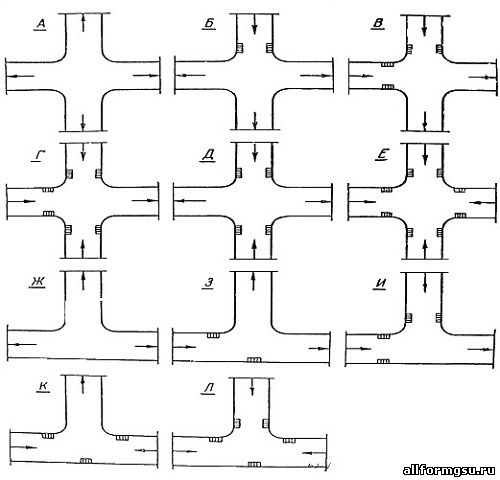

Определение места расположения распределительного центра: Фирма реализует продукцию на рынках сбыта и имеет постоянных поставщиков в разных регионах. Увеличение объема продаж...

Процедура выполнения команд. Рабочий цикл процессора: Функционирование процессора в основном состоит из повторяющихся рабочих циклов, каждый из которых соответствует...

Характеристика АТП и сварочно-жестяницкого участка: Транспорт в настоящее время является одной из важнейших отраслей народного хозяйства...

Интересное:

Инженерная защита территорий, зданий и сооружений от опасных геологических процессов: Изучение оползневых явлений, оценка устойчивости склонов и проектирование противооползневых сооружений — актуальнейшие задачи, стоящие перед отечественными...

Принципы управления денежными потоками: одним из методов контроля за состоянием денежной наличности является...

Аура как энергетическое поле: многослойную ауру человека можно представить себе подобным...

Дисциплины:

|

из

5.00

|

Заказать работу |

|

|

|

|

The National Bureau of Economic Research (NBER) is noted for its pioneering and comprehensive statistical studies of business cycles. In 1938 the NBER published its first list of business cycle indicators, as compiled by Wesley C. Mitchell, Arthur F. Burns, Geoffrey Moore, and Julius Shiskin. The list has been expanded several times with the most well-known series being the list of twelve leading indicators. The 1985 list is shown in Table 5-1 together with the median number of months by which the indicators have historically led the economy at peaks and troughs of business cycles.

See Figure 5-3 for the composite indexes of the twelve leading indicators, four coincident, and six lagging indicators during the period 1948 to 1985.

By closely watching the movements of the twelve leading indicators and their composite index, investors gain some perspective on what the economy will do in the next year or so. However, as shown in Figure 5-3, the composite index of the twelve leading indicators sometimes hesitates or pauses temporarily and may even decline for a month or two before resuming its upward movement. Investors should not jump to conclusions whenever the composite index of leading indicators turns downward. Rather, they should examine the individual leading indicators that have brought down the composite index. Some leading indicators portray basic economic processes, such as future production and, therefore, are more important than other leading indicators. Generally, if the composite index of leading indicators has been rising and then changes direction with three consecutive monthly declines, there is reason to expect that a business slowdown or recession will soon occur. In addition, one should examine the coincidental indicators and their underlying strength. A relatively strong upward momentum can suggest that the pause or decline of the composite index of twelve leading indicators may more likely be just temporary. Sometimes some leading indicators point to a change, while others do not. To deal with that, a diffusion index can be constructed.

TABLE 5-1 Leading Indicators of Economic Activity, 1985

Median Lead (in months)

Peak Trough

1. Average weekly hours of production of nonsupervisory

workers, manufacturing 11 1

2. Average weekly initial claims for unemployment

insurance, state programs 12 0

3. Manufacturers' new orders in 1972 dollars,

consumer goods and materials industries 11 1

4. Vendor performance, percent of companies receiving

slower deliveries 6 4

|

|

5. Index of net business formation 13 1

6. Contracts and orders for plant and equipment

in 1972 dollars 8 1

7. Index of new private housing units authorized

by local building permits 13 2

8. Change in manufacturing and trade inventories on

hand and on order in 1972 dollars, smoothed 11 1

9. Change in sensitive materials prices, smoothed 9.5 3.5

10. Index of stock prices, 500 common stock 9.5 4

11. Money supply (M2) in 1972 dollars 16 3

12. Change in business and consumer credit outstanding 11 2

Options and Warrants

OPTIONS

Options are contracts giving the holder the right to buy or sell a stated number of shares of a given security at a fixed price within a specified period of time. There are two basic types of options: calls and puts.

A call option is a contract giving the holder the right to purchase (call) 100 shares of a given security at a specified price (called the exercise price or striking price) within a specific period of time. The holder (buyer) of the call option pays a price called a premium.

A put option, on the other hand, is an option to sell. The holder has the right to sell to the writer (seller) of the option 100 shares of a given security at a specified price within a specific period of time. The holder or buyer of a put option pays a premium to the seller or writer of the option.

Some believe that options are very speculative and that investors should stay away from them. On the other hand, there are those who believe that the options market is the place to make quick and big money. Neither statement is true. Options, like stocks and bonds, are investment vehicles. One may make conservative use of the vehicle or one may speculate with them. Actually, if an investor has some basic understanding of the options market and options strategies, he or she can improve the chances of success in investment by using both options and stocks at the same time. In Wall Street there is a famous proverb: «To err is human, to hedge is divine.» To hedge means to take counterbalancing action to protect possible losses. Options are the most flexible investment one can use to hedge a commitment.

THE OPTIONS MARKET

Over – the – Counter Market

Prior to the introduction of the Chicago Board Options Exchange, transactions in put and call options in the United States were all carried out in the over-the-counter market. About two dozen dealers and brokers were active in the market, and they were members of the Put and Call Dealers Association. These dealers and brokers usually served as middlemen between would-be buyers and sellers of options. They rarely took the position as the maker of options themselves.

|

|

Each call or put contract was individually negotiated between the buyer and the seller as to exercise price, maturity date, and amount of premium. There, was no standardization either in exercise price or on dates of maturity. One call contract could be slightly different from another, even though the underlying stock was the same. Consequently, the resale of an option was both expensive (the difference between buying and selling price was substantial) and time consuming. Many times the maker (writer) and holder of options would have to sit out the duration of the contract, even though their option contracts were in bearer form and transferable.

|

|

|

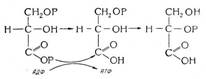

Биохимия спиртового брожения: Основу технологии получения пива составляет спиртовое брожение, - при котором сахар превращается...

Организация стока поверхностных вод: Наибольшее количество влаги на земном шаре испаряется с поверхности морей и океанов (88‰)...

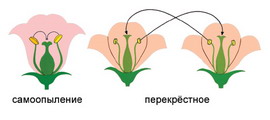

Семя – орган полового размножения и расселения растений: наружи у семян имеется плотный покров – кожура...

Своеобразие русской архитектуры: Основной материал – дерево – быстрота постройки, но недолговечность и необходимость деления...

© cyberpedia.su 2017-2024 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!