Общие условия выбора системы дренажа: Система дренажа выбирается в зависимости от характера защищаемого...

Индивидуальные очистные сооружения: К классу индивидуальных очистных сооружений относят сооружения, пропускная способность которых...

Общие условия выбора системы дренажа: Система дренажа выбирается в зависимости от характера защищаемого...

Индивидуальные очистные сооружения: К классу индивидуальных очистных сооружений относят сооружения, пропускная способность которых...

Топ:

Методика измерений сопротивления растеканию тока анодного заземления: Анодный заземлитель (анод) – проводник, погруженный в электролитическую среду (грунт, раствор электролита) и подключенный к положительному...

Определение места расположения распределительного центра: Фирма реализует продукцию на рынках сбыта и имеет постоянных поставщиков в разных регионах. Увеличение объема продаж...

Характеристика АТП и сварочно-жестяницкого участка: Транспорт в настоящее время является одной из важнейших отраслей народного...

Интересное:

Подходы к решению темы фильма: Существует три основных типа исторического фильма, имеющих между собой много общего...

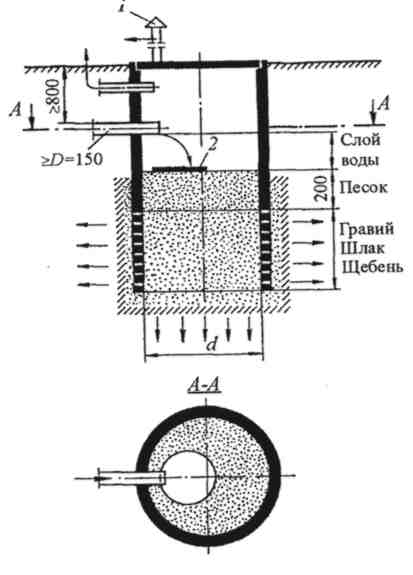

Мероприятия для защиты от морозного пучения грунтов: Инженерная защита от морозного (криогенного) пучения грунтов необходима для легких малоэтажных зданий и других сооружений...

Уполаживание и террасирование склонов: Если глубина оврага более 5 м необходимо устройство берм. Варианты использования оврагов для градостроительных целей...

Дисциплины:

|

из

5.00

|

Заказать работу |

|

|

|

|

1. The more shares an individual investor buys the greater his ownership stake in the company.

2. To have the opportunity to make decisions about the everyday work of the company it is enough for a shareholder to own one share.

3. A shareholder is always given a legal right for a part of company’s profit even in case of liquidation.

4. Shareholders are legally responsible for the debts of a company to the extent of the nominal value of their shares.

5. There is only one way for the company to collect money that is needed, namely, by means of borrowing.

Reading 2

Stock Markets

A stock market is the market that people use to trade (buy and sell) shares, which are like small pieces of the company that a person can own. To some it is a puzzle. To others it is a source of profit and endless fascination. The stock market is the financial nerve center of any country. It reflects any changes in the economy. It is sensitive to interest rates, inflation and political events. Really, it has its fingers on the pulse of the entire world.

Taken in its broadest sense, the stock market is also a control center. It is the market place where businesses and governments come to raise money so that they can continue and expand their operations. The stock market is also a place of individual opportunity.

Securities markets can be divided into international, regional and national (domestic) according to the territory they cover.

According to the number of transfers securities markets can be primary (which issue new securities) and secondary (where previously issued securities are bought and sold).

Besides, there is a bull market and a bear market. The terms bull market and bear market describe upward and downward market trends respectively. A bull market is when any asset class runs up in value over an extended period of time. Confidence is high that prices of the asset will continue to rise. A bear market is when the price of an asset class declines pretty substantially over time. The terms are widely used when talking about the major indices in the stock market, such as, Dow Jones Industrial Average, the S&P500 (Standard and Poor’s 500 stock index) or the NASDAQ (National Association of Securities Dealers Automated Quotation).

The phrase “the stock market” is often used to refer to the biggest and most important stock market in the world. In the United States, the New York Stock Exchange (NYSE) is the world’s largest stock exchange, located in New York City. It began with 24 stockbrokers trading company paper for investors, organizing what was a chaotic method prior to the NYSE establishment. The 1792 “Buttonwood Agreement” formally created the NYSE, making it one of the oldest financial markets of any kind in the world. The NYSE acquired the American Stock Exchange, the AMEX, in 2008 to create an even larger organization. The other prominent component of the American stock market, the NASDAQ, contrasts with the NYSE in that there is no face-to-face auction at a special exchange. The NASDAQ trades electronically, the first exchange to do so when it opened in 1971. The NYSE had a predecessor in Europe, the London Stock Exchange, which was established in 1698 to help seafarers and local merchants create a method of trading stocks and commodities at a fair market price. Today, nearly every major international mercantile hub has a stock exchange with trillions of dollars of stocks traded daily.

|

|

Stock markets have developed to make the buying and selling of securities easier. The stock markets (or securities exchanges) consist of individual investors, brokers, and intermediaries who deal in the purchase and sale of securities. Securities exchanges do not buy or sell stocks, they simply provide the location and services for the brokers who buy and sell securities, they help to ensure that the price of a deal is fair. To trade on the exchange, a “seat” must be purchased. A seat is a membership. The members represent stockbrokers. The system of stock exchange is when a stockbroker calls in order to sell, the member representing this broker looks for a buyer at the price requested. And when a broker calls in order to buy, the exchange member looks for a seller at the price offered.

Discussion

Organize the following headings in the order according to the text:

1. The process of trading on the exchange.

2. Components of American stock market.

3. A nerve center of the country.

4. Types of stock markets.

5. The oldest stock exchange in the world.

Reading 3

|

|

|

Наброски и зарисовки растений, плодов, цветов: Освоить конструктивное построение структуры дерева через зарисовки отдельных деревьев, группы деревьев...

Биохимия спиртового брожения: Основу технологии получения пива составляет спиртовое брожение, - при котором сахар превращается...

Таксономические единицы (категории) растений: Каждая система классификации состоит из определённых соподчиненных друг другу...

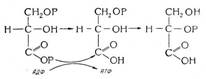

Состав сооружений: решетки и песколовки: Решетки – это первое устройство в схеме очистных сооружений. Они представляют...

© cyberpedia.su 2017-2024 - Не является автором материалов. Исключительное право сохранено за автором текста.

Если вы не хотите, чтобы данный материал был у нас на сайте, перейдите по ссылке: Нарушение авторских прав. Мы поможем в написании вашей работы!